Last updated: July 27, 2025

Introduction

Simvastatin, a statin medication primarily prescribed to lower low-density lipoprotein (LDL) cholesterol and reduce cardiovascular risk, remains a cornerstone of lipid management therapy. Since its FDA approval in 1991, simvastatin has enjoyed widespread use, initially as a branded product marketed by Merck, and subsequently as a generic drug. Its market trajectory, competitive landscape, and pricing dynamics are subject to significant shifts driven by patent expirations, regulatory developments, healthcare policies, and emerging therapeutics. This report provides a comprehensive analysis of the current simvastatin market, examines key drivers influencing its price trends, and offers an informed projection of its future market value.

Market Overview

Historical Context and Market Penetration

Simvastatin was one of the earliest statins entering the market, contributing to its dominant share in lipid-lowering therapies throughout the 1990s and early 2000s. Merck's branded Zocor held a significant market position until patent expiration in 2012. Post-patent, generic options flooded the market, sharply decreasing prices and increasing accessibility.

Current Market Dynamics

Today, multiple generic manufacturers produce simvastatin, leading to a highly commoditized market. Its widespread acceptance, low-cost profile, and established safety profile facilitate broad utilization across diverse patient populations. According to IQVIA, simvastatin remains among the top prescribed medications in the United States, with annual sales exceeding $800 million as of 2022 [1].

The competitive landscape has expanded to include newer, possibly more potent or tolerable lipid-lowering agents, such as PCSK9 inhibitors and ezetimibe. Nonetheless, simvastatin's affordability sustains its position, especially in cost-sensitive regions and healthcare systems.

Market Drivers and Challenges

Key Drivers

-

Patent Expiry and Generic Competition: The loss of patent exclusivity in 2012 led to a proliferation of generic entries, significantly reducing prices and increasing volume sales.

-

Clinical Efficacy and Guideline Endorsements: Esteemed guidelines, such as the American College of Cardiology/American Heart Association (ACC/AHA), continue to endorse generic statins, including simvastatin, cementing its role in primary and secondary prevention.

-

Healthcare Cost-Containment Pressures: Governments and insurers favor cost-effective medications, reinforcing simvastatin's prevalent use due to its low cost.

-

Global Market Expansion: Growing awareness and treatment of hyperlipidemia in emerging markets expand the potential patient base for simvastatin.

Challenges

-

Emergence of Newer Agents: PCSK9 inhibitors and novel lipid-lowering drugs offer higher efficacy but at a substantially increased cost.

-

Regulatory and Formulary Restrictions: Insurance formularies may favor newer agents or combination therapies, challenging simvastatin's dominance in some regions.

-

Safety Profile and Dosing Limitations: Higher doses of simvastatin (80 mg) pose increased risks for adverse effects, leading some to prefer alternative statins.

Pricing Trends and Projections

Historical Price Trends

Following patent expiration, the price of simvastatin tablets plummeted. Data indicates that the average wholesale price (AWP) for a 30-day supply of simvastatin 20 mg and 40 mg decreased by over 80% within the first two years of patent loss [2]. Today, prices are predominantly driven by generic competition, with a typical retail price of approximately $4-$10 per month in the United States for standard doses.

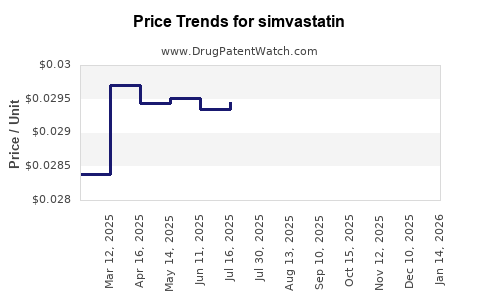

Market Volatility and Price Stabilization

While initial periods of price erosion were marked by high volatility, a relatively stable baseline has emerged due to the saturation of generic manufacturers and high-volume purchasing. However, potential patenting strategies, such as formulation patents or new dosing indications, could introduce branded or authorized generic options, impacting pricing dynamics.

Future Price Projections (2023-2033)

Considering current trends, the price of simvastatin is expected to remain relatively low and stable over the next decade, barring significant regulatory shifts or patenting strategies. Nonetheless, potential price increases could occur if:

- New formulations or delivery mechanisms are patented.

- Supply chain disruptions influence manufacturing costs.

- Policy changes favoring more expensive alternatives.

Given the maturity of the market, a conservative projection anticipates minimal price fluctuations, with prices remaining within the current range ($4-$10 per month). Any significant deviation would likely involve new patent protections or market exclusions of certain generics.

Regulatory and Patent Landscape

Patent Expiry and Generic Entry

Merck's patent for simvastatin expired in September 2012, prompting widespread generic entry. Since then, the market has been defined by stiff price competition, with the availability of multiple generics reducing costs.

Patent Strategies and Market Entry Barriers

No new patents for simvastatin are anticipated to redefine the market, although pharmaceutical companies might explore formulations or combination products under new patents. These could temporarily influence prices for specific formulations but are unlikely to affect the core generic market.

Regulatory Considerations

Regulatory authorities continue to oversee manufacturing standards and drug safety, ensuring quality despite price competition, which stabilizes the market and sustains confidence in generic simvastatin.

Geographical Market Perspective

The United States remains the largest market, characterized by high prescribing rates and stringent generic drug policies that keep prices low. In contrast, markets in developing countries generally observe even lower prices, driven by regulatory bodies manipulating procurement policies and local manufacturing capacities. Export markets and patent statuses vary, influencing local price structures and access.

Competitive Landscape and Alternatives

Besides generic simvastatin, other statins such as atorvastatin and rosuvastatin offer higher potency at increased costs. Cost-effectiveness analyses favor simvastatin in many scenarios, reinforcing its market position. Nonetheless, burgeoning access to PCSK9 inhibitors and lipid-modifying combination therapies introduces competitive threats, primarily where cost is less restrictive.

Conclusion and Price Outlook

Simvastatin’s market remains highly commoditized, with prices stable and low due to intense generic competition. Future trends suggest little change unless innovation, patent strategies, or regulatory modifications intervene. The drug’s affordability and proven efficacy secure its role in dyslipidemia management, especially in resource-constrained settings.

Key Takeaways

- Market Maturity: Post-patent expiration, simvastatin has become a low-cost, widely accessible generic drug with stable pricing.

- Pricing Stability: Expected to remain within a narrow range ($4-$10/month) over the next decade, barring market disruptions.

- Growth Drivers: Increasing global awareness and treatment guidelines support sustained demand, especially in emerging markets.

- Competitive Threats: The emergence of novel lipid therapies poses long-term competition but remains limited by higher costs.

- Regulatory and Patent Factors: No significant patent protections or regulatory barriers are anticipated to influence simvastatin pricing substantially.

FAQs

1. Will the price of simvastatin increase with new formulations?

Potentially. Patent protections on new formulations or delivery methods could temporarily elevate prices. However, the core generic market is likely to remain low-cost.

2. How does simvastatin compare economically to other statins?

Simvastatin generally offers the lowest cost per dose, making it the preferred choice in cost-sensitive healthcare settings, especially when potency and tolerability are comparable.

3. Are there concerns about dosage restrictions affecting future pricing?

Higher doses (80 mg) have safety concerns, which may limit their use but do not directly impact pricing. Lower-dose formulations remain affordable.

4. Will new lipid-lowering drugs replace simvastatin?

While newer agents provide alternative treatment options, cost and access issues favor continued use of generic simvastatin unless newer therapies demonstrably outperform in clinical outcomes or cost-effectiveness.

5. How do global markets influence simvastatin pricing?

In emerging economies, local manufacturing and regulatory policies keep prices even lower, expanding access but reducing profit margins for manufacturers.

References

[1] IQVIA. (2022). Top Prescribed Medications in the United States.

[2] Congressional Budget Office. (2014). The Cost of Generic Drugs.