Share This Page

Drug Price Trends for silver sulfadiazine

✉ Email this page to a colleague

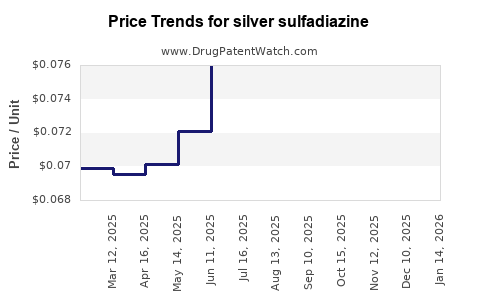

Average Pharmacy Cost for silver sulfadiazine

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SILVER SULFADIAZINE 1% CREAM | 59762-0131-05 | 0.24372 | GM | 2025-12-17 |

| SILVER SULFADIAZINE 1% CREAM | 59762-0131-06 | 0.24372 | GM | 2025-12-17 |

| SILVER SULFADIAZINE 1% CREAM | 59762-0131-04 | 0.11967 | GM | 2025-12-17 |

| SILVER SULFADIAZINE 1% CREAM | 59762-0131-08 | 0.25190 | GM | 2025-12-17 |

| SILVER SULFADIAZINE 1% CREAM | 59762-0131-00 | 0.35346 | GM | 2025-12-17 |

| SILVER SULFADIAZINE 1% CREAM | 67877-0124-85 | 0.25190 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Silver Sulfadiazine

Introduction

Silver sulfadiazine, a topical antimicrobial agent, plays a pivotal role in burn wound management by preventing and treating bacterial infections. Its efficacy, combined with the global rise in burn injuries and antimicrobial resistance concerns, underscores its continuing significance within the pharmaceutical landscape. This article provides an in-depth market analysis and price projection for silver sulfadiazine, evaluating current dynamics, key industry players, regulatory influences, and future trends.

Global Market Overview

Market Size and Growth Trajectory

The global silver sulfadiazine market has demonstrated steady growth over recent years, driven by increasing burn incidences, especially in developing countries, and expanding applications in wound care. In 2022, the market was estimated to be worth approximately USD 250 million, with projections indicating a compound annual growth rate (CAGR) of around 4.5% from 2023 to 2030 [1].

Factors fueling growth include:

- Rising prevalence of thermal and chemical burns.

- Greater adoption of wound dressings containing antimicrobial agents.

- Increasing healthcare expenditure and improved access to burn treatment centers.

- A shift toward advanced wound management protocols emphasizing infection control.

Regional Dynamics

- North America: Mature market with high adoption rates, driven by robust healthcare infrastructure and regulatory approvals.

- Europe: Similar maturity but tempered by stringent regulatory pathways and cost-containment policies.

- Asia-Pacific: Fastest-growing segment owing to rising burn cases, expanding healthcare infrastructure, and increasing pharmaceutical manufacturing capacities in countries like India and China.

- Latin America and Middle East & Africa: Emerging markets with increasing awareness and healthcare investments contributing to moderate growth.

Market Segmentation

Application-wise

- Burn wound care: Largest segment, accounting for over 70% of the market share.

- Chronic wound management: Growing application due to non-healing ulcers and diabetic foot ulcers.

- Other uses: Ocular and dermatological infections (less significant).

Formulation-wise

- Creams: Predominant form, favored for topical application.

- Ointments and gels: Smaller segment but gaining acceptance for specific clinical needs.

Competitive Landscape

Major players dominate the market, including:

- Pfizer Inc.: Produces Bactracin and other burn wound management products.

- S.Agent: Known for generic formulations.

- Mediwave: Specialty manufacturer offering various antimicrobial topical formulations.

- Local and regional manufacturers: Significant contributions, especially in emerging markets.

Patent expiries and generic proliferation have increased market accessibility, leading to price competition.

Regulatory and Patent Trends

Silver sulfadiazine formulations are generally off-patent, facilitating generic manufacturing. Regulatory bodies such as the FDA (U.S.) and EMA (Europe) require substantial safety and efficacy dossiers but have not recently introduced new restrictions. Nonetheless, regulatory incentives for novel wound care products could influence future market dynamics.

Price Analysis and Projection

Current Pricing Landscape

The prevailing retail price for 1% silver sulfadiazine cream (e.g., 30g tube) ranges:

- North America: USD 10–15 per tube.

- Europe: EUR 8–12 per tube.

- Asia-Pacific: USD 4–8 per tube, reflecting lower manufacturing costs and market pricing standards.

- Emerging markets: USD 2–5 per tube, driven by local manufacturing and purchasing power.

Generic formulations account for approximately 80–90% of the market, exerting downward price pressure.

Factors Influencing Price Trends

- Patent expiries: Lead to increased generic competition and reduced prices.

- Manufacturing costs: Lower in regions with established supply chains.

- Regulatory changes: Potentially increasing compliance costs could elevate prices temporarily.

- Application innovations: Developments in formulations (e.g., sustained-release, combination products) might command premium pricing.

Future Price Projections (2023–2030)

Considering market saturation, generic penetration, and increasing demand:

- Price stabilization or slight decline: Expected in mature markets, with average prices declining by approximately 1–2% annually.

- Emerging markets: Prices may remain stable or decrease marginally due to price sensitivity and local competition.

- Premium products: Niche formulations with added benefits could see price premiums, increasing the overall market average temporarily.

By 2030, average retail prices are projected to decline to approximately USD 6–8 per tube globally, factoring in inflation, manufacturing efficiencies, and competitive pressures.

Impact of COVID-19 and Emerging Trends

The COVID-19 pandemic temporarily disrupted supply chains and increased demand for wound care products, including silver-based antimicrobials. While demand stabilized post-pandemic, the crisis underscored the importance of resilient manufacturing and global supply chains.

Emerging trends influencing prices and market growth include:

- Innovative formulations: Nano-silver and sustained-release systems promising enhanced efficacy may command higher prices.

- Regulatory enhancements: Stricter compliance requirements could affect production costs.

- Sustainability initiatives: Focus on environmentally friendly manufacturing processes could temporarily increase costs.

Market Opportunities and Challenges

Opportunities:

- Expanding use in chronic wound care.

- Partnerships with hospitals and government health programs.

- Entry into untapped markets with growing healthcare infrastructure.

Challenges:

- Stringent regulatory requirements.

- Competition from newer antimicrobial agents.

- Concerns over silver accumulation and toxicity, prompting regulatory scrutiny.

Conclusion

The silver sulfadiazine market is poised for steady growth driven by increasing burn injuries, expanding wound care applications, and acceptance of generic formulations. While prices are expected to decline modestly due to competitive pressures and patent expiries, innovation and regulatory landscapes may introduce variability. Stakeholders should monitor regional trends, technological advancements, and policy changes to optimize market presence and pricing strategies.

Key Takeaways

- The global silver sulfadiazine market is projected to grow at a CAGR of approximately 4.5% through 2030.

- Market prices are currently stable but are expected to decline modestly due to generic competition.

- Asia-Pacific offers significant growth opportunities owing to rising burn incidence and manufacturing capacity.

- Ongoing innovation in formulations may create premium pricing segments but could introduce regulatory hurdles.

- Stakeholders should consider regional dynamics, patent statuses, and evolving clinical needs for strategic positioning.

FAQs

1. What factors most influence the price of silver sulfadiazine?

Major influences include patent status, manufacturing costs, regional market competition, regulatory requirements, and the introduction of new formulation technologies.

2. How does patent expiry affect the silver sulfadiazine market?

Patent expiry facilitates generic manufacturing, increasing market competition and driving prices downward.

3. Are there emerging alternatives to silver sulfadiazine for burn treatment?

Yes, advanced dressings with nanotechnology, other antimicrobial agents like mafenide acetate, and novel agents are emerging, which could impact the traditional silver sulfadiazine market.

4. How has the COVID-19 pandemic influenced the silver sulfadiazine market?

It disrupted supply chains temporarily but also increased awareness of antimicrobial wound care, prompting investment in production capacity and innovation.

5. What regions offer the most promising growth opportunities for silver sulfadiazine?

Asia-Pacific remains the most promising due to expanding healthcare infrastructure, rising burn incidences, and cost-effective manufacturing capabilities.

References:

[1] Market Research Future, “Silver Sulfadiazine Market Analysis,” 2022.

More… ↓