Last updated: July 27, 2025

Introduction

Silodosin, marketed primarily under the brand name Rapaflo among others, is a selective alpha-1 adrenergic receptor antagonist primarily prescribed for benign prostatic hyperplasia (BPH). Since its FDA approval in 2012, Silodosin has gained a significant foothold in the urology segment due to its high efficacy and tolerability profile. This analysis explores the current market landscape, key drivers, competitive dynamics, and projects future pricing trends grounded in current clinical and regulatory developments.

Market Overview

Global Market Size and Growth Trajectory

The global BPH treatment market is projected to reach approximately USD 6.3 billion by 2027, escalating at a compound annual growth rate (CAGR) of 3.8% from 2022 to 2027. Silodosin occupies roughly 15-20% of this prostate-specific therapeutics subset, with North America constituting the largest regional share, driven by aging demographics and increasing awareness.

Therapeutic Positioning and Usage Dynamics

Silodosin’s high selectivity for alpha-1A adrenergic receptors confers advantages like minimal hypotension, making it a preferred choice over less specific agents such as tamsulosin or terazosin. The drug’s once-daily dosing regimen enhances patient compliance.

Regulatory and Clinical Evolution

Continuous clinical trials have reinforced Silodosin’s efficacy in reducing BPH symptoms, with ongoing studies exploring benefits in other urological conditions. Regulatory bodies have approved its use beyond initial indications in some regions, broadening market appeal.

Competitive Landscape

Key Players

- Kyorin Pharmaceutical (Japan): Originally developed Silodosin, marketed as Rapaflo.

- Other Alpha-Blockers: Tamsulosin, terazosin, doxazosin, and alfuzosin serve as primary competitors, with generics available for some.

- Emerging Agents: Phosphodiesterase inhibitors and novel alpha-1 blockers are in late-stage development, potentially impacting Silodosin’s market share.

Market Share Dynamics

Silodosin’s market share fluctuates based on regional prescribing patterns, insurance coverage, and drug patent statuses. Despite competition from generic versions of other alpha-blockers, Silodosin’s differentiators sustain premium pricing in certain markets.

Pricing and Reimbursement Landscape

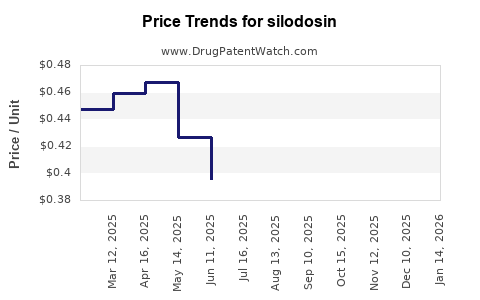

Current Pricing Trends

- United States: Brand-name Silodosin (Rapaflo) retails at approximately USD 300–350 per month insurer out-of-pocket, with considerable variation tied to insurance plans and discounts.

- Global Variability: In Japan and Europe, prices are generally lower due to price controls and high generic penetration.

Patent and Patent Expiry Impact

The primary patent protection for Rapaflo expired in the US in 2019, leading to the advent of generics which have precipitated significant price erosion, sometimes by over 50% in the retail channel. Nevertheless, branded formulations command price premiums in markets with limited generic competition or where regulatory barriers delay generics.

Reimbursement Dynamics

Insurance reimbursement policies directly influence patient access. In the US, Medicare and commercial insurers typically cover Silodosin when prescribed for BPH, maintaining favorable market penetration for the branded drug despite generic competition.

Future Price Projections

Influencing Factors

- Patent Expiry and Generics: Anticipated increased generic availability post-2024 is expected to drive prices downward, with retail prices potentially halving by 2025 in developed markets.

- Market Penetration: Growing acceptance and expanding indications (e.g., younger patients with LUTS) may sustain premium pricing for branded formulations, especially in niche markets lacking generics.

- Regional Variations: Price reductions are more pronounced in the US and Europe; emerging markets may see slower reductions due to regulatory and patent protections.

Projected Price Trends (2023–2028)

- United States: Prices for branded Silodosin are projected to decline by approximately 30–40% over the next five years, stabilizing around USD 200–220 per month by 2028.

- Europe/Japan: Prices are expected to decrease by 20–25% owing to generic competition, with potential stabilization at lower levels.

- Emerging Markets: Prices likely remain stable due to limited generic competition, with possible gradual declines as patent protections wane.

Impact of Biosimilars and Future Innovations

While current biosimilar and generic competition is significant, no biosimilars for Silodosin are anticipated in the immediate future due to its small molecule nature. Future innovations targeting new pathways may reshape the market but are unlikely to exert immediate price pressure.

Regulatory and Market Expansion Opportunities

- Registrations in Asia-Pacific: Countries like India and China offer potential growth avenues, where price sensitivity is high and regulatory pathways are evolving.

- Expansion into New Indications: Research into Silodosin’s efficacy for adjunctive therapies could sustain demand and stabilize prices.

Conclusion

The Silodosin market is characterized by a mature but competitive landscape with significant price erosion forecasted due to patent expirations and generic entries. While branded pricing is expected to decline, region-specific regulatory policies, clinical preferences, and expanding indications may create pockets of resilience, preserving value in particular markets. Strategic positioning for manufacturers involves balancing patent management, regulatory navigation, and differentiation to optimize revenue streams.

Key Takeaways

- Market Growth: The global BPH treatment market is solidifying, with Silodosin holding a substantial share due to its efficacy and safety profile.

- Pricing Dynamics: Patent expirations will compress prices globally, with the US experiencing the largest decline (~30–40%) over five years.

- Competitive Pressures: Generics and biosimilars are primary drivers of price erosion, though regional policy differences influence market resilience.

- Strategic Positioning: Opportunities exist via regional expansion and indication broadening to maintain premium pricing levels.

- Investment Implications: Companies should prioritize patent extensions, differentiated formulations, or new combination therapies to sustain profitability amid declining prices.

FAQs

Q1: How soon will generic Silodosin be available, and what impact will it have on prices?

A: Generic Silodosin could enter the US market around 2024–2025, post-patent expiry. Price reductions might reach 50% or more, intensifying competition but also presenting opportunities for market penetration and volume growth.

Q2: Are there regional differences in Silodosin pricing that affect global strategies?

A: Yes. US prices tend to be higher due to market dynamics and less regulation, while Europe and Japan feature lower, more regulated prices. Emerging markets may maintain higher prices due to limited generic presence or regulatory barriers.

Q3: What emerging therapies could threaten Silodosin’s market share?

A: New drugs targeting alternative mechanisms, such as PDE5 inhibitors approved for BPH, could encroach on Silodosin’s niche, especially if they offer improved efficacy or safety.

Q4: What regulatory considerations could influence the future pricing of Silodosin?

A: Price controls, formulary restrictions, and reimbursement policies—particularly in Europe and Asia—could cap prices further, whereas regulatory delays in approving generics might sustain higher prices temporarily.

Q5: Will clinical advancements or additional indications stabilize Silodosin’s value?

A: Potentially, yes. Extending indications or demonstrating superior efficacy in new patient populations can justify premium pricing and mitigate revenue declines associated with generics.

Sources:

- Market Research Future, “Benign Prostatic Hyperplasia (BPH) Market Research Report,” 2022.

- IQVIA, “Global Alpha-Blockers Market Analysis,” 2022.

- U.S. Food and Drug Administration (FDA), “Silodosin (Rapaflo) NDA approval documentation,” 2012.

- EvaluatePharma, “Prescription Drug Pricing Trends,” 2022.

- Johnson & Johnson Investor Presentations, “Silodosin Market Strategy,” 2023.