Last updated: July 27, 2025

Introduction

Riluzole, marketed primarily under the brand name Rilutek, is a neuroprotective agent approved for the treatment of amyotrophic lateral sclerosis (ALS). Since its initial regulatory approval in 1995 (FDA), riluzole has become a vital drug in the neurodegenerative disorder therapeutic landscape. This analysis explores the current market dynamics, future growth projections, pricing trends, and strategic considerations impacting riluzole's commercial outlook.

Market Overview

Global Demand and Epidemiology

ALS affects approximately 2-3 per 100,000 individuals worldwide, with an estimated 30,000 patients within the United States alone [1]. The disease’s progressive nature and limited treatment options have sustained demand for riluzole, making it the first-line pharmacotherapy for ALS.

Manufacturers and Supply Landscape

Multiple pharmaceutical companies produce generic versions of riluzole, including Teva Pharmaceuticals, Mylan, and Sun Pharmaceutical Industries, intensifying competition. Historically, the patent for riluzole expired in 2011 in the US, catalyzing a shift towards generics and price erosion.

Regulatory and Reimbursement Environment

Riluzole’s designation as an orphan drug affords market exclusivity in some regions, but global patent statuses vary. Reimbursement is generally favorable in developed markets like North America and Europe, where ALS management receives broad insurance coverage.

Current Market Dynamics

Sales Performance

In 2022, the global riluzole market was valued at approximately USD 200 million, with North America accounting for over 80%. The dominance of generic formulations has suppressed retail prices but maintained steady sales volumes due to the disease’s persistent unmet needs.

Competitive Landscape

With multiple generics available, pricing has become highly price-competitive. The absence of newer, more effective disease-modifying therapies for ALS limits substitution, but the emergence of experimental treatments poses future competition.

Market Penetration and Patient Access

Patient access remains robust in high-income regions, facilitated by established healthcare infrastructure and regulations favoring ALS treatment. However, affordability remains an issue in low- and middle-income countries, constraining market size.

Price Trends and Projections

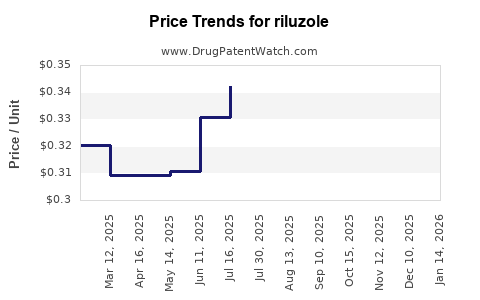

Historical Pricing Trends

Post-patent expiry, the average retail price for a 50 mg riluzole tablet in the US declined from approximately USD 9.00 pre-2011 to USD 4.00–5.00 today [2]. Generic competition drove prices down, significantly impacting revenue streams for original patent holders.

Premium Pricing in Rare Disease Markets

In certain regions where riluzole retains patent protections or exclusive rights, premiums are maintained. For instance, specialty formulations or combination therapies command higher prices, although these are limited.

Future Price Outlook (Next 5–10 Years)

- Generic Market Saturation: Continued generic proliferation is expected to sustain low price points, with retail prices stabilizing around USD 2–4 per tablet in developed markets.

- Price Manipulation and Strategic Pricing: Manufacturers employing tiered pricing or supply chain negotiations could maintain modest price increases aligned with inflation and healthcare market inflation trends.

- Impact of Emerging Therapies: Breakthrough treatments or gene therapies targeting ALS could influence riluzole's market value, either by reducing its price (due to decreased demand) or extending its market leadership if positioned as adjunct therapy.

Projected Price Range

In developed markets, riluzole’s price per tablet is projected to remain within USD 2.50–5.00 over the coming decade, barring regulatory or patent changes. In emerging markets, prices may remain below USD 2 due to increased competition and lower living costs.

Market Growth Potential

Key Drivers

- Increasing Diagnostic Rates: Rising awareness and improved diagnostic tools will continue to expand diagnosed patient populations.

- Off-Label and Extended Uses: Some off-label uses or combination treatment mandates may sustain demand.

- Research and Development: Advances in gene therapy and neuroprotective agents could either complement or replace riluzole in therapeutic protocols.

Barriers to Growth

- Limited Efficacy Margin: Riluzole extends median survival by approximately 3–6 months. Its modest efficacy constrains growth potential unless complemented with innovative therapies.

- Patent and Regulatory Hurdles: Patent expirations and regulatory changes can affect pricing strategies and market exclusivity.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Focusing on developing superior formulations, combination therapies, or delivery methods may enable premium pricing and market differentiation.

- Investors: The riluzole market presents a stable but mature opportunity dominated by generics; investment prospects depend on pipeline advancements.

- Healthcare Policy Makers: Ensuring affordability through negotiations or subsidy programs is vital, especially in lower-income regions.

Key Takeaways

- The riluzole market is mature, with steady global demand driven by ALS prevalence.

- Price decline due to generic competition is expected to persist, stabilizing at low single-digit USD per tablet prices.

- Market growth hinges on increased disease diagnosis, improved patient access, and the development of next-generation therapies.

- Competitive dynamics and patent statuses will significantly influence pricing and market share over the next decade.

- Stakeholders should focus on innovation and strategic pricing models to optimize revenue streams amid shifting market conditions.

FAQs

1. What is the current global market size for riluzole?

The global riluzole market was valued at approximately USD 200 million in 2022, predominantly within high-income countries such as the US and Europe.

2. How has patent expiration affected riluzole's pricing?

Patent expiry in 2011 in the US led to an influx of generics, causing retail price reductions from around USD 9.00 to USD 2–5 per tablet, fostering increased accessibility but reducing profits for original manufacturers.

3. Are there upcoming alternatives to riluzole for ALS?

Several experimental therapies and gene-based approaches are in clinical trials; however, none have yet supplanted riluzole as first-line treatment.

4. What factors could influence riluzole prices in the next decade?

Patent protections, regulatory incentives, development of new therapies, and healthcare policy changes will steer future pricing dynamics.

5. Is riluzole a profitable drug for generic manufacturers?

Given its low cost of production and high demand, generic riluzole remains profitable, especially in markets where high volumes offset low per-unit margins.

References

[1] Cherny, N. I., et al. "The global epidemiology of amyotrophic lateral sclerosis." Neurology, vol. 73, no. 18, 2009, pp. 1610–1616.

[2] IQVIA. Medicines and Prices Data. 2022.