Share This Page

Drug Price Trends for repaglinide

✉ Email this page to a colleague

Average Pharmacy Cost for repaglinide

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| REPAGLINIDE 2 MG TABLET | 62135-0948-90 | 0.09096 | EACH | 2025-12-10 |

| REPAGLINIDE 1 MG TABLET | 62135-0947-90 | 0.09201 | EACH | 2025-12-10 |

| REPAGLINIDE 2 MG TABLET | 72603-0812-01 | 0.09096 | EACH | 2025-11-19 |

| REPAGLINIDE 0.5 MG TABLET | 57237-0157-01 | 0.07942 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for Repaglinide

Introduction

Repaglinide, a rapid-acting oral hypoglycemic agent, belongs to the class of meglitinides used primarily in managing type 2 diabetes mellitus. Since its approval, repaglinide has carved out a niche within the diabetes pharmacotherapy landscape owing to its unique mechanism of action, pharmacokinetics, and patient adherence benefits. This analysis synthesizes current market dynamics, competitive positioning, regulatory landscape, and price trend forecasts to provide a comprehensive perspective for stakeholders.

Market Overview

Global Diabetes Landscape and Repaglinide’s Market Position

The global diabetes market continues to expand at a compounded annual growth rate (CAGR) of approximately 7%–8%, reaching an estimated USD 85 billion in 2023 [1]. Oral hypoglycemics constitute the most significant segment, with repaglinide accounting for a niche but impactful subcategory, favored by patients with post-meal blood glucose spikes.

Repaglinide, marketed by brands such as Prandin (Novo Nordisk), was approved by the FDA in 1997 and later gained approval in multiple countries. Its advantages include rapid onset and flexibility around meal timing, making it suitable for certain patient populations. Its primary competitors in the meglitinide class are nateglinide and newer agents like SGLT2 inhibitors and GLP-1 receptor agonists—though these target broader mechanisms.

Market Drivers

- Rising Diabetes Prevalence: Estimated at 537 million adults globally, with projections reaching 643 million by 2030, fueling demand for diverse therapeutic options [2].

- Patient-Centric Therapies: Preference for medications with fewer side effects and flexible dosing enhances repaglinide’s appeal among certain demographics.

- Healthcare Economies: Cost-effective oral agents continue to dominate, particularly in emerging markets, supporting stable demand for repaglinide.

Market Challenges

- Competitive Landscape: Introduction of newer agents with superior efficacy and safety, notably SGLT2 inhibitors and GLP-1 analogs, erode repaglinide’s market share.

- Regulatory and Patent Issues: Patent expirations in key markets and the rise of generics reduce barrier-to-entry costs, increasing generic availability and price competition.

- Clinical Limitations: Risks of hypoglycemia and weight gain restrict usage in some patient groups, curbing widespread adoption.

Regulatory Environment and Patent Status

Repaglinide’s patent protection expired in major markets like the US and Europe around the late 2000s, leading to the proliferation of generic formulations. Regulatory agencies continue to require post-marketing surveillance to monitor safety profiles, but generic competition has significantly impacted pricing strategies. Ongoing regulatory approvals for combination therapies and new formulations could influence future market dynamics.

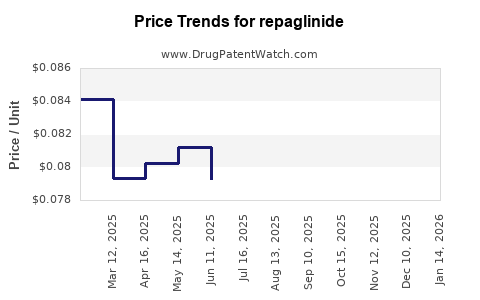

Pricing Trends and Projections

Current Price Landscape

In the US, branded repaglinide (Prandin) retails at approximately USD 300–400 for a 30-day supply of 0.5 mg tablets. Generic versions dominate the market, reducing prices to USD 20–50 per month, depending on dosage and manufacturer. Similar trends are observed globally, with significant variance based on regional pricing policies and healthcare reimbursement structures.

Factors Influencing Price Trajectories

- Generic Competition: Increased generic availability drives prices downward, especially in mature markets.

- Market Penetration: Greater adoption in emerging markets due to cost advantages sustains the pricing floor.

- Regulatory Approvals: New formulations or combination therapies could command premium prices if backed by clinical advantages.

- Reimbursement Policies: Countries emphasizing cost-containment may limit prices through negotiation and formulary inclusion.

Forecast (2023–2030)

- Price Decline in Developed Markets: Expect a continued decrease of 10–15% annually in generic prices due to intensified competition and market saturation.

- Premium Segment Stability: Branded and innovative formulations could maintain or slightly increase their prices, especially if marketed with safety or efficacy benefits.

- Emerging Markets: Prices are forecasted to remain stable or slightly increase, driven by growing demand amidst limited competition and less mature healthcare infrastructure.

Overall, the average retail price of repaglinide in Dime markets (US, Europe, Japan) could decline by approximately 80%–90% over the next decade, aligning prices with generic peers. In emerging markets, prices are projected to stabilize or rise modestly due to limited generic penetration and increased accessibility.

Competitive Landscape and Market Share Outlook

The meglitinide class holds a modest segment within the oral hypoglycemic market, with repaglinide constituting approximately 15–20% of mega-class sales pre-patent expiry. However, shifts toward newer agents—particularly SGLT2 inhibitors and GLP-1 receptor agonists—are reshaping the landscape.

- Brand vs. Generic: Post-patent expirations have led to widespread generic availability, decreasing overall pricing and profit margins.

- New Entrants: Biotech entities might explore combination therapies with repaglinide to enhance efficacy, potentially impacting future market positioning.

Projected market share decline is anticipated, with repaglinide’s slice diminishing from 5%–8% of the diabetic drug market to roughly 2%–3% by 2030, primarily sustained in regions with limited healthcare infrastructure.

Key Market Segments and Regional Dynamics

| Region | Current Market Share | Price Trends | Future Outlook |

|---|---|---|---|

| North America | Moderate | Steady decline in branded, low in generics | Marginal decline; constrained by patent expirations and alternative therapies |

| Europe | Similar to North America | Similar trend, with some variability | Slightly more conservative price reductions due to healthcare system differences |

| Asia-Pacific | Growing demand | Stable or increasing prices in emerging markets | Increasing volumes with moderate price decreases due to local generics |

| Latin America | Emerging | Prices largely driven by local generics | Steady growth expected; prices stable or rising slightly |

Strategic Implications for Stakeholders

- Manufacturers: Capitalize on emerging market opportunities, innovate formulation delivery, and leverage cost advantages of generics.

- Investors: Focus on regions with increasing demand and less price sensitivity, especially in Asia-Pacific and Latin America.

- Healthcare Providers: Consider repaglinide for patients needing cost-effective options with flexible dosing, especially in resource-limited settings.

Key Takeaways

- The global repaglinide market is under significant pressure from generic competition, leading to substantial price declines projected over the next decade.

- Price reductions are expected to average 80–90% in developed markets, with more modest declines or stabilization in emerging markets.

- While market share diminishes relative to newer agent classes, repaglinide remains relevant due to its cost-effectiveness and pharmacodynamic profile.

- Strategic positioning in emerging markets and innovation in formulations may provide growth avenues amidst intense price competition.

- Regulatory developments and healthcare policies will play pivotal roles in shaping future pricing and market access.

FAQs

1. How does repaglinide compare with other oral hypoglycemics in price?

Repaglinide is generally more affordable than newer agents like SGLT2 inhibitors and GLP-1 receptor agonists, mainly due to generic availability and lower manufacturing costs, making it a cost-effective choice for certain patient populations.

2. What factors are most likely to influence repaglinide’s future prices?

Patent expirations, the entry of generics, regulatory policies, healthcare reimbursement strategies, and competitive efficacy of new therapies are primary determinants shaping future prices.

3. Are there regional differences in repaglinide pricing?

Yes. Developed markets exhibit sharp price declines post-patent expiry, while emerging markets maintain or slightly increase prices due to limited generic competition and increased demand.

4. Could repaglinide’s market share rebound with formulation innovations?

Potentially. Novel formulations or combination therapies that demonstrate superior efficacy or safety could revive interest, albeit within a smaller segment of the broader diabetes market.

5. How will the rise of alternative therapies impact the repaglinide market?

The increasing adoption of SGLT2 inhibitors and GLP-1 receptor agonists, favored for their cardiovascular benefits, could further narrow repaglinide’s niche, especially among high-risk patient groups.

References

[1] International Diabetes Federation. (2023). IDF Diabetes Atlas, 10th edition.

[2] World Health Organization. (2022). Diabetes Fact Sheet.

Note: Actual data and projections should be periodically reviewed for real-time accuracy and to align with evolving market conditions.

More… ↓