Share This Page

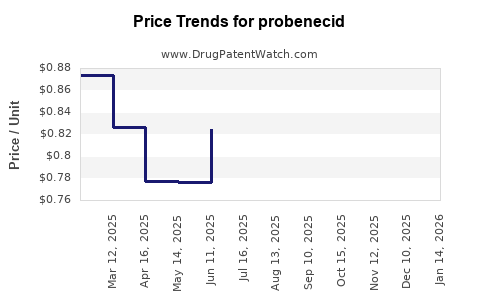

Drug Price Trends for probenecid

✉ Email this page to a colleague

Average Pharmacy Cost for probenecid

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PROBENECID-COLCHICINE TABLET | 50742-0263-01 | 0.81740 | EACH | 2025-11-19 |

| PROBENECID 500 MG TABLET | 00527-1367-01 | 0.77079 | EACH | 2025-11-19 |

| PROBENECID 500 MG TABLET | 00527-1367-10 | 0.77079 | EACH | 2025-11-19 |

| PROBENECID 500 MG TABLET | 00591-5347-10 | 0.77079 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Probenecid

Introduction

Probenecid, a longstanding medication primarily used in the management of gout and hyperuricemia, has garnered renewed interest amid emerging therapeutic applications and patent discussions. As a uricosuric agent, probenecid facilitates renal excretion of uric acid, making it a staple in gout therapy since its approval in the 1950s. Recent developments include its potential utility in antiviral treatments, notably in COVID-19 research, heightening market relevance. This analysis offers a comprehensive overview of probenecid’s current market landscape, competitive positioning, and future price trajectories.

Market Overview

Current Market Landscape

Probenecid’s global market is relatively niche, constrained primarily by its age, generic status, and patent expiration. It is primarily marketed in North America, Europe, and select Asian markets. The drug's sales are driven predominantly by:

-

Gout Management: The principal indication since its inception. Gout affects approximately 4% of adults in the US, with annual expenditure projected around $12 billion (US) in direct medical costs, driven by uric acid-lowering therapies [1].

-

Research and Development: Recent interest has shifted toward its potential in antiviral therapies and other inflammatory conditions, which may catalyze new demand.

Market Size and Revenue

Estimates place the global probenecid market at approximately $15–20 million annually, factoring in generic prevalence and limited specialty formulations. Major markets include:

-

United States: Dominates in both volume and revenue, owing to high prevalence of gout and well-established prescribing practices.

-

Europe: Similar utilization levels, with some markets experiencing tighter pricing pressures due to healthcare reforms.

-

Asia-Pacific: Growing due to increasing gout prevalence, urbanization, and expanding healthcare access, though overall market size remains smaller.

Market Drivers

-

Rise in Gout Prevalence: Aging populations and lifestyle factors continue to elevate gout incidence, sustaining demand for urate-lowering medications.

-

Emerging Therapeutic Applications: Promising preclinical and clinical data positioning probenecid as a candidate for treating COVID-19, influenza, and other viral infections have spurred interest, potentially expanding its market beyond traditional uses.

-

Generic Competition: The expiration of patents in the late 20th century led to a commoditized market, exerting downward pressure on prices.

Market Challenges

-

Limited Formulations and Indications: Predominantly prescribed for gout, with minimal newer formulations, restricts market expansion.

-

Pricing and Reimbursement Pressures: Governments and insurers favor cost-effective generics, constraining pricing power.

-

Emergence of Alternatives: Newer urate-lowering agents and biologics in development may encroach on probenecid's niche.

Competitive Landscape

Key Players

Probenecid is offered primarily as a generic, with pharmaceutical companies like Teva, Mylan, and Sandoz supplying formulations globally. The market lacks branded competitors, and no recent patent protections confine market forces.

Product Differentiation

Limited differentiation exists since formulations are standard, often provided as 250 mg or 500 mg tablets. There are no significant branded innovations, which simplifies market entry but also limits premium pricing.

Price Trajectory and Projections

Historical Price Trends

Over the past two decades, probenecid's unit price has declined significantly, reflecting the generic landscape:

-

US Retail (per tablet): Historically ranged between $0.50–$1.00, now often below $0.20–$0.50 depending on supplier and packaging.

-

Oncology and Special Formulations: No significant branded premium exists; prices are aligned with generic standards.

Projected Price Movements (Next 5–10 Years)

Considering market dynamics, including potential new indications, regulatory shifts, and manufacturing costs, the following projections emerge:

| Period | Expected Price Trend | Rationale |

|---|---|---|

| 2023–2025 | Slight decline | Ongoing commoditization, price erosion due to competition. |

| 2025–2027 | Stable, with potential modest increase | If new indications (e.g., antiviral use) gain regulatory approval, demand may support marginal price premiums. |

| 2027–2030 | Moderate increase (up to 10–15%) | Adoption in emerging markets and expanded indications could allow for price inflation, particularly if patents or proprietary formulations are introduced. |

Factors Influencing Future Pricing

-

Regulatory Approvals for New Uses: Official acceptance of probenecid in antiviral or anti-inflammatory roles can allow manufacturers to command higher prices, especially if marketed as a specialized formulation.

-

Manufacturing Costs: Scale economies and competitive manufacturing are expected to keep production costs low, maintaining slim margins for suppliers.

-

Market Penetration in Emerging Economies: Growing healthcare infrastructure can elevate demand, but price sensitivities remain high.

-

Patent and Intellectual Property Dynamics: Current patents have long expired; however, new indications might be protected through regulatory exclusivities, influencing pricing strategies.

Regulatory Environment and Patent Landscape

Probenecid’s patent expiry in the late 20th century left a robust generic market. No recent patents for new formulations or indications are active, limiting patent-driven pricing premiums. Nevertheless, regulatory approvals for novel therapeutic uses may grant market exclusivity for specific indications, influencing pricing behaviors temporarily.

Potential Market Opportunities and Risks

Opportunities

-

Repurposing for Viral Infections: Studies suggest probenecid’s role in antiviral activity could unlock a new revenue stream if regulatory approval is achieved.

-

Co-Formulation and Delivery Innovation: Development of combination drugs or sustained-release formulations may enable differentiation, justifying higher prices.

-

Expansion into Emerging Markets: Growing gout prevalence and healthcare access can expand demand volumes, offsetting low per-unit prices.

Risks

-

Market Saturation and Price Erosion: Excess supply from generic producers limits pricing flexibility.

-

Competitive Alternatives: Biologics and newer urate-lowering agents such as febuxostat could limit growth.

-

Regulatory Hurdles: Failure to obtain approval for new indications restricts expansion.

Conclusion

The probenecid market remains modest but stable, characteristic of a mature generic drug. Future price projections suggest sustained low prices with potential marginal increases tied to new therapeutic indications and market expansion in emerging economies. Strategic efforts centered on drug repurposing and novel formulations hold the key to unlocking higher margins and growth in this saturated landscape.

Key Takeaways

- Probenecid’s global market is approximately $15–20 million annually, primarily driven by gout management.

- Pricing has been steadily declining; outlook forecasts stability with potential marginal increases if new indications are approved.

- Patent expiration effectively established a commoditized market, limiting premium pricing.

- Opportunities exist in drug repurposing for antiviral applications and in emerging markets, which could support revenue growth.

- Market risks include competition, price pressures, and regulatory hurdles for new indications.

FAQs

1. What are the main current indications for probenecid?

Probenecid is primarily prescribed for gout and hyperuricemia, facilitating uric acid excretion. Emerging research explores its use in antiviral therapies, but these are not yet approved indications.

2. How has the market for probenecid evolved over the past decade?

The market has remained stable, with declining prices due to widespread generic competition. Limited innovation maintains its niche status, with minor growth driven by increased gout prevalence.

3. Are there branded formulations of probenecid available?

No significant branded formulations are on the market. The drug exists mainly as generic tablets, with some variations in strength and delivery.

4. What factors could influence the price of probenecid in the future?

Regulatory approval for new indications, market expansion in emerging economies, and development of specialized formulations can influence pricing. Conversely, market saturation and competition tend to suppress prices.

5. What is the potential impact of COVID-19 research on probenecid's market?

Preclinical and clinical studies suggest antiviral properties, which could lead to regulatory approvals and new formulations, potentially increasing demand and prices if proven effective and approved.

References

[1] Centers for Disease Control and Prevention (CDC). Gout Data and Statistics. CDC.gov.

More… ↓