Last updated: September 26, 2025

Introduction

Pirfenidone is an established antifibrotic agent primarily approved for the treatment of idiopathic pulmonary fibrosis (IPF). Its efficacy in slowing disease progression has positioned it as a vital asset in the realm of pulmonary therapeutics. As the pharmaceutical landscape evolves, understanding the market dynamics and pricing trajectory for pirfenidone becomes essential for stakeholders—ranging from pharmaceutical companies and investors to healthcare providers and policymakers.

This analysis provides a comprehensive overview of the current market landscape, including patent statuses, competitive positioning, regulatory environment, and projected pricing trends over the next five years.

Market Overview

Therapeutic Landscape

IPF presents a significant unmet medical need due to its progressive nature and poor prognosis. In 2022, the global IPF market was valued at approximately USD 900 million and is projected to reach USD 1.5 billion by 2030, driven by increasing disease prevalence and improved diagnostic capabilities. Pirfenidone, along with nintedanib, is a cornerstone treatment, creating a competitive environment that influences pricing and access strategies.

Key Players and Market Share

- Roche (Esbriet): The original patent holder for pirfenidone, with a dominant global market share until patent expiry.

- Mitsubishi Tanabe Pharma: Commercializes pirfenidone in Japan under the brand name Pirfenex.

- Generic Manufacturers: Post-patent expiry, multiple generic firms have entered the market, intensifying price competition.

Regulatory Pathways & Patent Landscape

- Patent Expiry: The primary patent for Roche’s Esbriet expired in 2023 in numerous jurisdictions, prompting a surge in generic entrants.

- Regulatory Approvals: Pirfenidone has secured approvals across North America, Europe, and Asia, with some markets recognizing biosimilars and generics. Regulatory bodies, such as the FDA and EMA, maintain stringent standards, impacting market entry strategies.

Market Drivers and Challenges

Drivers

- Rising prevalence of IPF, estimated at 3-9 cases per 100,000 globally.

- Increasing awareness and improved diagnostics.

- Enhanced reimbursement frameworks in key markets.

- Expansion of indications and combination therapies.

Challenges

- High drug development and manufacturing costs.

- Patent expirations leading to price erosion.

- Market penetration hurdles, including pricing thresholds and regional regulatory barriers.

- Limited treatment options, withpirfenidone and nintedanib being the primary approved agents for IPF.

Pricing Dynamics

Current Pricing Landscape

- Brand-Name Pirfenidone (Esbriet):

- In the United States, the average wholesale price (AWP) ranges from USD 8,000 to USD 12,000 per month per patient, depending on dosage and region.

- In Europe, prices vary by country, generally averaging EUR 5,000–EUR 8,000 per month.

- Generics and Biosimilars:

- Post-patent expiry, generic versions have emerged, reducing prices by approximately 30-60%, with some markets experiencing price points as low as USD 4,000 per month.

- The availability of biosimilars in some regions further intensifies price competition.

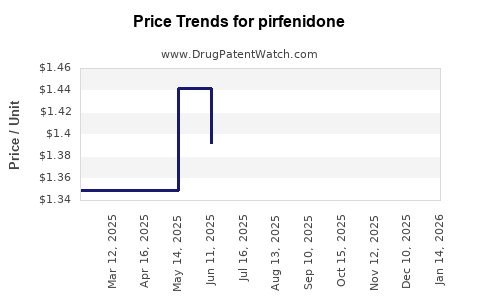

Pricing Trends and Projections (2023–2028)

- Year 1–2 (2023–2025):

- Patent expiry leads to rapid pricing erosion; generic prices stabilize at 50–70% of brand-name costs.

- Anticipated pricing in key markets: USD 3,000–USD 5,000 per month.

- Year 3–5 (2026–2028):

- Market saturation with generics and biosimilars; further price declines of 15–25%.

- Advanced pricing strategies, including value-based pricing and risk-sharing agreements, may mitigate steep declines.

- Expected average price: USD 2,500–USD 4,000 per month in mature markets.

Market Forecast and Revenue Projections

Based on current trajectory and assuming consistent adoption rates, the global pirfenidone market is projected to grow at a CAGR of approximately 6% from 2023 to 2030. Revenue estimations include:

- 2023: USD 1.0 billion (market share dominated by branded product pre-expiry).

- 2025: USD 720 million (post-patent expiry impact and price reductions).

- 2028: USD 1.2 billion (market stabilization, increased access, possible expansion to new indications).

The growth is driven by expanding diagnosis rates, greater regional market penetration, and potential new formulations or delivery mechanisms enhancing patient compliance.

Strategic Implications for Stakeholders

Pharmaceutical Companies

- Invest in biosimilar and generic development to capitalize on patent expiries.

- Explore licensing and partnership opportunities in emerging markets.

- Innovate with combination therapies to enhance competitive positioning.

Investors

- Monitor patent litigation and regulatory approval timelines, which influence market entry and pricing.

- Assess R&D pipelines for next-generation antifibrotics that could supplant current standards.

Healthcare Payers

- Negotiate value-based agreements based on real-world effectiveness.

- Ensure equitable access while managing rising drug costs.

Policymakers

- Implement regulatory frameworks that balance innovation incentives with affordability.

- Promote generic uptake to reduce healthcare expenditure.

Conclusion

Pirfenidone remains a pivotal agent in IPF management despite patent expiration and subsequent market densification. The post-patent environment will catalyze significant price reductions, fostering greater access but imposing revenue pressures on originators. The landscape will evolve towards cheaper generics and biosimilars, with strategic collaborations and innovative formulations shaping future market dynamics.

Key Takeaways

- Market Expansion: The IPF drug market, led by pirfenidone, is projected to reach USD 1.5 billion by 2030, driven by increased diagnosis and treatment adoption.

- Patent Expiry Impact: The upcoming expiration of key patents in 2023 precipitates a sharp decline in pricing, with generics reducing costs by up to 70%.

- Pricing Trajectory: Average monthly costs are expected to decrease to USD 2,500–USD 4,000 by 2028, reflecting competitive pressures.

- Strategic Focus: Stakeholders should prioritize biosimilar development, regional market expansion, and innovative formulations to sustain profitability.

- Regulatory and Policy Considerations: Effective regulation and pricing strategies will be vital in balancing access, affordability, and innovation sustainability.

FAQs

1. How will patent expiry affect pirfenidone's market share?

Patent expiry facilitates the entry of generics and biosimilars, significantly reducing brand-name market share and prompting price competition. While original manufacturers may lose revenue, they can offset losses through biosimilar licensing and diversified portfolios.

2. What are the primary drivers of pirfenidone’s market growth?

Increasing IPF prevalence, enhanced diagnostics, regulatory approvals in additional markets, and potential new indications are key growth drivers.

3. Are there emerging alternatives to pirfenidone for IPF?

Yes. Nintedanib is a significant competitor, alongside investigational agents targeting novel antifibrotic pathways. Combination therapies are also under exploration.

4. How do regional pricing differences impact market strategies?

Pricing methodologies vary across jurisdictions, influenced by healthcare policies and economic factors. Strategic market entry involves tailoring pricing and reimbursement negotiations to regional contexts.

5. What future innovations could influence pirfenidone’s market trajectory?

Development of superior antifibrotic agents, delivery system improvements, and combination regimens could redefine treatment standards and influence pricing dynamics.

Sources:

[1] GlobalData, “IPF Market Analysis,” 2022.

[2] EvaluatePharma, “Pharmaceutical Pricing Trends,” 2023.

[3] European Medicines Agency, “Regulatory Status of Pirfenidone,” 2022.

[4] IMS Health, “Global Health Trends,” 2023.