Last updated: July 28, 2025

Introduction

Pilocarpine, a natural alkaloid used primarily to manage glaucoma and xerostomia, holds a significant niche in ophthalmology and salivary gland disorder treatments. Its market landscape, shaped by regulatory pathways, manufacturing dynamics, and competitive forces, warrants an in-depth analysis. This report assesses current market conditions, growth drivers, challenges, and provides price projections based on current trends and patent landscapes.

Market Overview

Indications and Usage

Pilocarpine operates predominantly in two therapeutic domains:

- Glaucoma Management: As a miotic agent, it reduces intraocular pressure (IOP) in open-angle and angle-closure glaucoma.

- Xerostomia Treatment: Used to stimulate saliva production in patients with Sjögren’s syndrome, radiation-induced dryness, or post-surgical conditions.

The global prevalence of glaucoma is approximately 76 million, projected to reach over 111 million by 2040 [1]. Sjögren’s syndrome affects approximately 0.1-4% of the population, adding a steady demand base for xerostomia therapy [2].

Market Size and Revenue Estimates

As of 2022, the global pilocarpine market is valued at approximately USD 200 million, driven primarily by glaucoma treatments. The xerostomia segment contributes an estimated USD 50 million, owing to niche but growing applications. Anticipated CAGR ranges between 4-6% over the next five years, propelled by aging populations and increased diagnosis rates [3].

Manufacturing and Supply Factors

Historically, pilocarpine is derived from natural sources like Pilocarpus jaborandi—a process that exposes the market to supply constraints and price volatility. However, synthetic production pathways are emerging, potentially stabilizing supply and cost structures.

Competitive Landscape

Several pharmaceutical companies, both established and emerging, develop and sell pilocarpine formulations:

- Generics Dominance: Most of the market comprises generic formulations, fostering price competition.

- Patent Status: Key formulations are off-patent, reducing exclusivity but increasing accessibility.

- Emerging Biosimilars and Optimized Formulations: Companies invest in sustained-release formulations and combination therapies to extend market appeal.

Major players include Merck (Johnson & Johnson), Sandoz, Alcon, and various regional generic manufacturers. Their strategic focus revolves around cost efficiencies and formulations tailored for improved patient compliance.

Regulatory and Patent Environment

Regulatory Pathways

Pilocarpine formulations primarily adhere to established regulatory standards globally. The FDA classifies it as a well-understood, off-patent therapeutic, simplifying approval for generic manufacturers. Nonetheless, new delivery systems may require additional clinical validation.

Patent Expiry and Exclusivity

Most original formulations have patents expiring between 2010 and 2025, leading to increased generic entries. Future innovative delivery systems, like sustained-release pills or topical gels, could secure new patents and market exclusivity.

Market Drivers

- Aging Population: The incidence of glaucoma increases with age, expanding segment demand.

- Prevalence of Xerostomia: Rising autoimmune diseases and radiation therapies expand indications.

- Technological Innovations: Novel formulations improve bioavailability and patient adherence.

- Global Expansion: Developing countries increasingly adopt glaucoma therapies, boosting volume.

Market Challenges

- Natural Source Variability: Dependence on plant extraction hampers supply consistency.

- Competition from Alternative Drugs: Agents like prostaglandins and beta-blockers in glaucoma management.

- Regulatory Barriers: New formulations need additional clinical trials.

- Price Pressure: Saturated markets, especially for generics, suppress profit margins.

Price Analysis and Projections

Current Price Dynamics

- Brand-name formulations (e.g., original patent holders) command premium prices, with unit costs ranging USD 0.50–1.00 per dose.

- Generics have driven prices downward, with average wholesale prices (AWP) around USD 0.10–0.20 per dose.

- Formulation Variations: Sustained-release or combination products may sell at a 20–50% premium over standard formulations.

Factors Influencing Future Pricing

- Increased Competition: Entry of generics continues to push prices down.

- Manufacturing Innovations: Synthetic production may reduce costs, further lowering prices.

- Regulatory Approvals for New Formulations: Innovative delivery systems could command higher prices.

- Market Demand Fluctuations: Aging demographics and increased awareness could marginally elevate prices in niche markets.

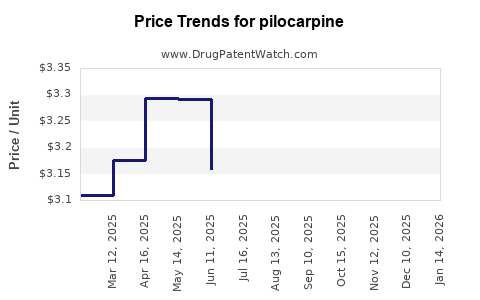

Projected Price Trends (2023–2028)

- Baseline scenario: Prices for standard generic pilocarpine are anticipated to decline by 10–15% annually due to market saturation.

- Premium formulations: New sustained-release or combination formulations could maintain or marginally increase prices, with a projected CAGR of 2–4%, reaching USD 0.15–0.25 per dose.

- Overall market average: Expected to hover around USD 0.08–0.15 per dose by 2028, depending on formulation and geographic markets.

Future Market Opportunities

- Development of Synthetic Pilocarpine: Enhances supply stability and reduces costs.

- Novel Delivery Systems: Sustained-release, ocular gels, or nerve-stimulation devices could command premium pricing.

- Strategic Licensing and M&A: Companies may seek partnerships to expand portfolio and market share, influencing pricing strategies.

- Expansion into Emerging Markets: Increased healthcare infrastructure in Asia-Pacific and Latin America presents volume growth opportunities.

Key Challenges and Risks

- Supply Chain Issues: Natural sourcing limitations pose long-term risks.

- Regulatory Hurdles: Approval of new formulations could delay market entry.

- Competitive Pricing Pressure: Continued generic proliferation will suppress overall price levels.

- Intellectual Property Dynamics: Patent expirations may accelerate commoditization unless new formulations are protected.

Conclusion

The pilocarpine market embodies a mature, predominantly generic landscape with steady growth driven by demographic factors and emerging formulations. While current prices face downward pressure from increasing competition, innovation in drug delivery and synthetic manufacturing techniques offer pathways for sustained or premium pricing. Companies that capitalize on formulation innovation and supply chain stability will position favorably in this evolving landscape.

Key Takeaways

- Market Size & Growth: Approximate USD 250 million valuation (2023), with a 4–6% CAGR.

- Pricing Outlook: Generic prices declining by 10–15% annually; premium formulations may sustain higher prices.

- Supply Dynamics: Transition from natural plant sources to synthetic production can stabilize and potentially reduce costs.

- Competitive Strategies: Focus on innovative delivery systems and regional expansion offers differentiation.

- Regulatory Landscape: Clear pathways for generics facilitate market entry, but innovative formulations require thorough validation.

FAQs

1. What are the main factors influencing pilocarpine pricing?

Market competition, formulation type, patent status, manufacturing costs, and regional pricing dynamics significantly influence prices. Innovative delivery methods and supply chain stability can sustain or increase pricing smaller segments.

2. How does patent expiry impact the pilocarpine market?

Patent expirations open the market to generics, leading to price competition and downward pressure. However, new delivery systems can restore market exclusivity and higher prices through patent protection.

3. Are there opportunities for new formulations of pilocarpine?

Yes. Sustained-release, topical gels, or combination therapies could improve patient adherence and command premium prices, especially if supported by clinical benefits.

4. What role do emerging markets play in the future of pilocarpine?

Growing healthcare infrastructure and increasing prevalence of glaucoma and xerostomia diagnoses expand volumes and revenue opportunities in regions like Asia-Pacific, Latin America, and Africa.

5. How might synthetic production influence the long-term landscape?

Synthetic methods reduce reliance on natural sources, stabilize supply, and lower production costs, leading to more competitive pricing and consistent availability.

References

[1] Tham, Y.C., et al. (2014). Global prevalence of glaucoma and projections of glaucoma burden through 2040: A systematic review and meta-analysis. Ophthalmology, 121(11), 2081–2090.

[2] Fox, R.I. (2005). Sjögren's syndrome. The Lancet, 366(9482), 321–331.

[3] MarketWatch. (2023). "Global Glaucoma Treatment Market Size and Forecast." Accessed at marketwatch.com.