Share This Page

Drug Price Trends for perindopril erbumine

✉ Email this page to a colleague

Average Pharmacy Cost for perindopril erbumine

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PERINDOPRIL ERBUMINE 2 MG TAB | 65862-0286-01 | 0.51506 | EACH | 2025-12-17 |

| PERINDOPRIL ERBUMINE 4 MG TAB | 65862-0287-01 | 0.52811 | EACH | 2025-12-17 |

| PERINDOPRIL ERBUMINE 8 MG TAB | 65862-0288-01 | 0.60397 | EACH | 2025-12-17 |

| PERINDOPRIL ERBUMINE 2 MG TAB | 65862-0286-01 | 0.53634 | EACH | 2025-11-19 |

| PERINDOPRIL ERBUMINE 4 MG TAB | 65862-0287-01 | 0.52856 | EACH | 2025-11-19 |

| PERINDOPRIL ERBUMINE 8 MG TAB | 65862-0288-01 | 0.60301 | EACH | 2025-11-19 |

| PERINDOPRIL ERBUMINE 2 MG TAB | 65862-0286-01 | 0.53634 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Perindopril Erbumine

Introduction

Perindopril Erbumine, aortically classified as an angiotensin-converting enzyme (ACE) inhibitor, holds a significant position within the antihypertensive and cardiovascular therapeutic market. Approved primarily for managing hypertension, stable coronary artery disease, and left ventricular systolic dysfunction, it benefits from a solid clinical evidence base and regulatory approval across multiple jurisdictions. This analysis offers a comprehensive examination of the current market landscape, growth drivers, competitive positioning, and future pricing trajectories for Perindopril Erbumine.

Market Overview

Global Market Size and Key Players

The global antihypertensive drugs market was valued at approximately USD 19 billion in 2022 and is projected to reach USD 25 billion by 2030, growing at a CAGR of approximately 3.5%.[^1] Within this, ACE inhibitors account for a substantial share, estimated at 30–35%, driven by their proven efficacy and safety profile.

Perindopril Erbumine,’s primary competitors include other ACE inhibitors such as enalapril, ramipril, lisinopril, and captopril. Notably, it has established market presence in Europe, Asia-Pacific, and select Latin American markets, often favored for its once-daily dosing and tolerability.

Regulatory and Patent Landscape

While Perindopril Erbumine gained regulatory approval in the late 1990s, patent protection in most key markets expired by the mid-2010s, leading to a surge in generic formulations. Consequently, the drug now faces stiff price competition from multiple generics, reducing its price points but expanding its accessibility.

Market Drivers and Challenges

Driving Factors

- Growing prevalence of hypertension and cardiovascular diseases: Globally, hypertension affects over 1.3 billion individuals, with prevalence rising due to aging populations and lifestyle factors.[^2] This sustains steady demand for ACE inhibitors like Perindopril Erbumine.

- Established clinical efficacy: Its proven benefits in reducing morbidity and mortality associated with heart failure and coronary artery disease reinforce continued prescribing.

- Shift toward generic formulations: Post-patent expiration, affordability has improved, broadening access in emerging markets.

Market Challenges

- Competition from newer agents: The advent of ARBs (angiotensin receptor blockers) and combination therapies offers alternatives, often with similar efficacy.

- Pricing pressures: Widespread generic availability lowers unit prices, compressing profit margins for manufacturers.

- Regulatory variations: Different jurisdictions may impose varying approval and reimbursement policies, impacting market penetration.

Pricing Dynamics

Current Price Landscape

Due to patent expiration and proliferation of generic formulations, per-unit prices of Perindopril Erbumine have declined substantially. For instance:

- In the United States: Generic 4 mg tablets retail at approximately USD 0.10–0.20 per tablet (per 30-day supply).

- In Europe: Prices range from EUR 2–4 per pack (30 tablets), depending on country-specific reimbursements and healthcare policies.

- Emerging markets: Prices can be as low as USD 0.05 per tablet, reflecting local market conditions and procurement mechanisms.

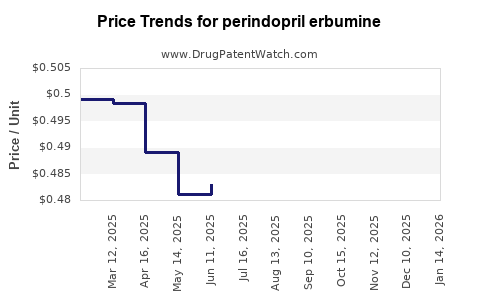

Price Trends and Projections

Considering the widespread availability of generics and competitive pressures, it is anticipated that:

- Near-term stability: Prices will remain under downward pressure over 2023–2025.

- Long-term stabilization or slight increase: As demand persists, especially in developing countries with expanding healthcare coverage, prices could stabilize or increase marginally in select sectors with higher regulatory or procurement barriers.

Future Market Projections

Growth Outlook (2023–2030)

Despite low pricing, the volume of prescriptions for Perindopril Erbumine is expected to expand driven by:

- Aging populations expanding the patient pool.

- Improving healthcare infrastructure in emerging economies.

- Preference for cost-effective, well-established medications over newer, costlier agents.

Forecasts suggest a compound annual growth rate (CAGR) of approximately 2–3% in global volume, with revenues plateauing or declining slightly in highly mature markets due to intense price competition but rising in markets with expanding healthcare access.

Price Projection Scenarios

- Conservative Scenario: Continuation of current generic price trends with minimal fluctuation, maintaining profit margins for manufacturers at current levels.

- Moderate Upside Scenario: Slight price increases in specific markets due to inflation, supply chain adjustments, or procurement shifts.

- Optimistic Scenario: Introduction of fixed-dose combinations or new formulations that command premium pricing, offsetting generic price declines and stimulating revenue growth.

Competitive Positioning and Strategic Considerations

Market dominance for Perindopril Erbumine depends largely on differentiating factors such as:

- Formulation convenience: Once-daily dosing and fixed-dose combinations.

- Brand recognition: Owned by key pharmaceutical players with established distribution networks.

- Pricing strategies: Engaging in volume-based sales with competitive pricing to sustain market share amid generic competition.

Emerging strategies include partnering with government health programs, implementing differential pricing in low-income countries, and leveraging clinical data to support expanded indications.

Conclusion

Perindopril Erbumine's market continues to evolve primarily driven by demographic trends, clinical efficacy, and generics’ impact on pricing. While current unit prices are near their lowest, an expanding global patient base offers opportunities for volume-driven growth. Price projections suggest minimal fluctuations in mature markets but potential slight increases in emerging economies. Strategic positioning through formulation innovation and partnership models will be pivotal for sustained profitability.

Key Takeaways

- The global market for Perindopril Erbumine remains solid, mainly supported by cardiovascular disease prevalence and established efficacy.

- Patent expirations have led to significant price erosion, especially in mature markets, with generics dominating the landscape.

- Future revenues are expected to depend more on volume than unit price, with growth prospects in emerging markets.

- Price stability is anticipated in the short term; however, market dynamics and formulation innovations may influence long-term pricing.

- Strategic focus on access expansion, fixed-dose combinations, and differentiated formulations can mitigate competitive pressures and optimize profit margins.

FAQs

Q1: How does Perindopril Erbumine compare in efficacy to other ACE inhibitors?

A: Perindopril Erbumine exhibits comparable efficacy to other ACE inhibitors like enalapril and ramipril, with some studies indicating superior tolerability and once-daily dosing advantages, which can improve adherence.

Q2: What are the main factors affecting the pricing of Perindopril Erbumine?

A: Patent status, generic competition, regional pricing policies, healthcare reimbursement frameworks, and manufacturing costs predominantly influence its pricing landscape.

Q3: Which markets offer the highest growth potential for Perindopril Erbumine?

A: Emerging economies in Asia-Pacific and Latin America, driven by expanding healthcare access and increasing cardiovascular disease burden, present significant growth opportunities.

Q4: Are there any upcoming regulatory or patent changes that could impact the market?

A: Most patents have expired, leading to generic proliferation; future regulatory changes could impact reimbursement policies, but significant patent threats are unlikely for already off-patent formulations.

Q5: What strategies can manufacturers adopt to sustain profitability in this competitive environment?

A: Emphasizing fixed-dose combination therapies, expanding indications, improving formulation convenience, engaging in differential pricing, and strengthening distribution channels are effective strategies.

References

[^1]: Grand View Research. "Antihypertensive Drugs Market Size, Share & Trends." 2022.

[^2]: World Health Organization. "Hypertension." 2021.

More… ↓