Share This Page

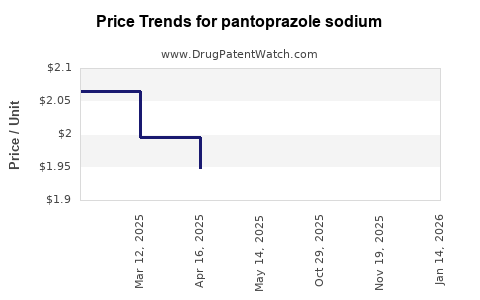

Drug Price Trends for pantoprazole sodium

✉ Email this page to a colleague

Average Pharmacy Cost for pantoprazole sodium

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PANTOPRAZOLE SODIUM 40 MG VIAL | 72603-0128-10 | 1.85138 | EACH | 2025-05-21 |

| PANTOPRAZOLE SODIUM 40 MG VIAL | 25021-0751-10 | 1.85138 | EACH | 2025-05-21 |

| PANTOPRAZOLE SODIUM 40 MG VIAL | 00143-9300-10 | 1.85138 | EACH | 2025-05-21 |

| PANTOPRAZOLE SODIUM 40 MG VIAL | 00781-3232-95 | 1.85138 | EACH | 2025-05-21 |

| PANTOPRAZOLE SODIUM 40 MG VIAL | 31722-0204-10 | 1.85138 | EACH | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Pantoprazole Sodium

Introduction

Pantoprazole sodium, a Proton Pump Inhibitor (PPI), is widely used for the treatment of gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and other acid-related disorders. Since its approval, the drug has gained substantial global market traction due to the increasing prevalence of acid-related conditions and shift toward chronic disease management. This analysis evaluates the current market landscape, competitive dynamics, regulatory influences, and future price projections for pantoprazole sodium.

Market Overview

Global Market Size and Growth

The global proton pump inhibitors market, including pantoprazole sodium, was valued at approximately USD 14.7 billion in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of around 4.2% until 2030 [1]. Pantoprazole accounts for a significant segment, driven by its favorable efficacy profile and established patent statuses.

Key Market Drivers

- Rising Prevalence of Acid-Related Disorders: Increasing incidences of GERD and peptic ulcers are primary drivers.

- Chronic Disease Management Trends: Shift toward long-term therapy regimens, with PPIs being a leading choice.

- Generic Entrants and Price Competition: Post-expiry of patent protections, generics have increased affordability, expanding access.

- Healthcare Policy and Reimbursement: Favorable reimbursement policies in developed regions support accessibility and sales.

Market Constraints

- Emergence of PPI Alternatives: H2 antagonists and newer drugs with better safety profiles.

- Regulatory Changes: Stricter safety warnings, particularly regarding long-term PPI use, could influence prescribing behaviors.

- Patents and Exclusivity: Patent expirations in key markets have led to price erosion and increased generic competition.

Competitive Landscape

Patent and Generic Competition

Original brands like Wyeth (now part of Pfizer) held early patents, but these have largely expired worldwide. The prolific entry of generics such as Teva Pharmaceuticals, Sandoz, and Mylan has driven prices downward substantially. For instance, in the U.S., generic pantoprazole tablets account for over 90% of prescriptions, resulting in significant price drops compared to branded formulations.

Manufacturers and Market Share

Pfizer’s branded Protonix remains relevant in some markets but has seen declining prescription volumes due to generics. Generic manufacturers dominate the market, leveraging cost advantages and wide distribution networks.

Formulation and Delivery

While tablets remain the primary formulation, IV formulations are gaining traction for hospital use, potentially influencing overall pricing and market dynamics.

Pricing Landscape

Current Pricing Trends

- Branded vs. Generic: Original branded formulations typically retail at 2–3 times the cost of generic versions.

- Regional Variations: Pricing is highly variable; in the U.S., a 40mg tablet costs approximately USD 2.50–USD 4.00 (brand), whereas generics are around USD 0.25–USD 0.50 per tablet.

- Reimbursement and Negotiation: Health insurers often negotiate significant discounts, further reducing effective prices.

Pricing Influencers

- Regulatory Decisions: Safety warnings (e.g., associations with kidney injury) can influence demand and price strategies.

- Supply Chain Factors: Raw material costs, manufacturing efficiency, and supply chain disruptions can impact prices.

- Market Penetration: Entry into emerging markets often involves lower prices to gain share.

Future Price Projections

Market Drivers for Future Pricing

- Emerging Market Growth: Increased penetration in regions like Asia-Pacific and Latin America, where price sensitivity is higher.

- Patent Expirations and Generics: Continued proliferation of low-cost generics will exert downward pressure on prices.

- Innovation and Formulation Developments: Introduction of new delivery mechanisms or combination therapies may command premium pricing temporarily.

Forecasted Trends

- Pricing Stabilization: Over the next five years, prices for generic pantoprazole are expected to plateau or decline marginally due to intense price competition.

- Premium Pricing Possibilities: Limited scope for premium pricing outside niche markets (e.g., IV formulations for hospitalized patients) due to generic saturation.

- Market Entry of Biosimilars/Innovators: Though unlikely in the short term, potential future biosimilar development could influence pricing dynamics.

Overall, the average price for generic pantoprazole sodium tablets is projected to decrease by approximately 10–15% globally over the next five years, mainly driven by increased generic competition. In mature markets like the U.S. and Europe, the price decline could accelerate due to policy interventions and negotiated discounts.

Regulatory and Patent Considerations

Patent protection for pantoprazole sodium has expired in major markets like the U.S. (2017) and the EU (2016), facilitating market entry for generics. Regulatory agencies continue emphasizing safety surveillance, which could influence prescribing and pricing strategies, especially if new safety concerns emerge.

Key Market Opportunities and Challenges

-

Opportunities:

- Expansion into emerging markets with growing healthcare infrastructure.

- Development of novel formulations (e.g., fast-dissolving tablets, injectable forms).

- Strategic partnerships or collaborations for marketing and distribution.

-

Challenges:

- Increasing price competition reducing margins.

- Regulatory pressures and safety concerns.

- Competition from newer, patent-protected PPIs and alternative drugs.

Conclusion

Pantoprazole sodium operates in a mature, highly competitive market characterized by significant generic penetration, aggressive price competition, and evolving regulatory standards. While the overall market continues to grow steadily, the pricing landscape is under downward pressure, particularly in developed markets. Companies aiming to maintain profitability must focus on optimizing supply chains, exploring niche formulations, or expanding into emerging markets with tailored pricing strategies.

Key Takeaways

- Market maturity and generic commoditization suggest continued declining prices for pantoprazole sodium, especially in established markets.

- Emerging markets offer growth opportunities with potential for higher, though still competitive, prices.

- Formulation innovation and strategic partnerships can create differentiation beyond price.

- Regulatory environment influences demand; safety concerns might limit price premiums.

- Long-term prospects hinge on balancing volume growth in new markets against eroding prices in mature regions.

FAQs

Q1: What factors most significantly influence the pricing of pantoprazole sodium?

Pricing is primarily affected by patent status, generic competition, regulatory safety profiles, regional healthcare policies, and supply chain costs.

Q2: How will patent expirations impact the market for pantoprazole sodium?

Patent expirations facilitate increased generic entry, leading to substantial price reductions and expanding access, especially in price-sensitive markets.

Q3: Are there opportunities to charge premium prices for pantoprazole sodium?

Premium pricing may occur with specialized formulations (e.g., IV products) or in regions with limited generic competition. However, widespread commoditization limits premium opportunities for standard tablets.

Q4: How might emerging safety concerns affect future prices?

Safety warnings or new adverse effect reports may reduce demand or necessitate formularies’ restrictions, potentially lowering prices and profit margins.

Q5: What strategies can companies adopt to maximize profitability amid declining prices?

Focusing on niche markets, developing innovative formulations, expanding into emerging markets, and forging strategic collaborations can help maintain margins despite price erosion.

References

[1] MarketWatch. (2022). Global Proton Pump Inhibitors Market Size, Share & Trends Analysis Report.

More… ↓