Last updated: September 8, 2025

Introduction

Olanzapine, a second-generation antipsychotic medication, remains a cornerstone in the treatment of schizophrenia and bipolar disorder. Originally developed by Eli Lilly and Company, it has garnered widespread use due to its efficacy and favorable side-effect profile compared to first-generation antipsychotics. As the global mental health burden escalates, understanding the market dynamics and price trajectory of olanzapine is imperative for pharmaceutical stakeholders, investors, and healthcare policymakers.

Current Market Landscape

Global Market Share and Adoption

The global antipsychotic market is projected to reach approximately USD 15.2 billion by 2026, with olanzapine contributing a significant segment [1]. Its market share is buoyed by its long-standing approval, off-label uses, and the presence of generic formulations that enhance accessibility.

Olanzapine is marketed under various brand names, notably Zyprexa (Eli Lilly). Generic versions entered markets as patent protections expired, notably after patent cliff events in the United States and Europe, leading to substantial price reductions and increased usage [2].

Key Market Drivers

- Increasing Prevalence of Mental Disorders: WHO estimates underscore a rising prevalence of schizophrenia (~20 million globally) and bipolar disorder, fueling medication demand [3].

- Expanded Indications: Off-label uses, such as treatment-resistant depression, contribute to revenue streams.

- Generic Competition: Entry of multiple generics has dramatically lowered costs, spurring wider adoption, especially in cost-sensitive markets.

- Government and Insurance Coverage: Payers frequently favor generic olanzapine, increasing prescription rates.

Regional Variations

- North America: Largest market, driven by high diagnosis rates and advanced healthcare infrastructure. However, price pressures due to generics persist.

- Europe: Mature market with increasing focus on cost containment; generic penetration is high.

- Asia-Pacific: Rapidly growing due to expanding healthcare access and rising mental health awareness; price sensitivity is pronounced.

Market Challenges and Opportunities

Challenges

- Side Effect Profile: Risks like weight gain and metabolic syndrome may limit prescribing in certain populations.

- Patent Expirations: While generics reduce prices, they also threaten branded revenues.

- Regulatory Scrutiny: Off-label use and safety concerns attract regulatory attention, potentially impacting pricing.

Opportunities

- New Formulations: Long-acting injectables and combination therapies could command premium pricing.

- Emerging Markets: Expanding healthcare infrastructure enables sales growth in Latin America, Africa, and Asia.

- Personalized Medicine: Pharmacogenomics may optimize therapy, potentially influencing pricing strategies.

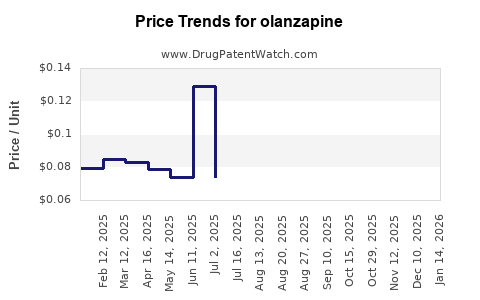

Price Trends and Projections

Historical Price Evolution

Post-patent expiry, olanzapine’s prices have seen substantial declines. In the U.S., brand-name Zyprexa’s retail price exceeded USD 600 per month before generic entry. Generic versions now range between USD 50-100 per month, approximately an 80-90% reduction [4].

Projected Price Trajectory (Next 5-10 Years)

Based on current trends:

- Generics Market Saturation: Continued high penetration will sustain low prices.

- Potential Market Entry of Biosimilars or New Chemical Entities: These could shift demand dynamics but are unlikely to affect olanzapine directly.

- Pricing in Emerging Markets: Expected to stabilize at low levels due to intense competition, but increased volume can compensate for margin compression.

Forecast: The average global price of olanzapine is anticipated to decline marginally by 5-10% annually over the next five years. In developed markets, stability or slight decrease is expected, whereas in emerging economies, prices will remain low but with volume-driven growth.

Impact of Patent Expiries and Regulatory Changes

The expiration of the last key patents in 2018 domestically has cemented the generic dominance. Future regulatory policies promoting biosimilars or encouraging alternative therapies could further exert downward pressure.

Potential Price Resurgence Factors

Product differentiation, such as extended-release formulations or combination therapies with other psychotropic agents, could enable higher pricing tiers. Additionally, evidence of superior efficacy or reduced side-effects may justify premium prices in niche markets.

Competitive Landscape

Major players include:

- Generic Manufacturers: Mylan, Teva, Sandoz, and others have aggressive pricing strategies.

- Brand Proprietors: Eli Lilly’s Zyprexa maintains a niche through formulations and specific indications, albeit at premium prices.

Market share is increasingly driven by price competition rather than brand loyalty, with generics dominate in volume.

Regulatory and Reimbursement Environment

Pricing strategies are heavily influenced by healthcare reimbursement policies. In countries with nationalized healthcare systems, strict formulary controls lead to significant price negotiations. Conversely, in private pay markets, prices tend to be higher but are under constant pressure to reduce costs.

Conclusion

The olanzapine market is characterized by mature, heavily genericized segments with declining prices driven by global competition. While growth opportunities exist in emerging markets and for innovative formulations, overall price trends are expected to see modest declines over the next decade. Stakeholders must consider these dynamics when planning product positioning, market entry, or investment strategies.

Key Takeaways

- Market Maturity: Olanzapine's patent expirations have resulted in an oversaturated, price-competitive environment.

- Price Trends: Expect continued gradual declines (~5-10% annually) owing to generic competition.

- Growth Opportunities: Focus on emerging markets, niche formulations, and combination therapies.

- Regulatory Impact: Policy shifts favoring biosimilars and cost containment will influence future pricing.

- Strategic Positioning: Differentiation through new formulations or superior safety profiles could mitigate price erosion.

FAQs

1. How have patent expirations affected olanzapine prices globally?

Patent expirations, notably in 2018, have led to a surge in generic versions entering the market, causing significant price reductions—up to 80-90%—and increasing overall accessibility.

2. What is the outlook for olanzapine prices in emerging markets?

Prices are expected to stay low due to intense generic competition, but increased demand volume could sustain revenue streams. Price margins will be narrower, emphasizing cost-effective distribution.

3. Are there new formulations of olanzapine that could command higher prices?

Yes. Extended-release and combination formulations, particularly injectable long-acting variants, may fetch premium prices by improving adherence and patient outcomes.

4. How does the safety profile of olanzapine influence its market?

While effective, olanzapine's metabolic side effects may limit use in certain populations, impacting demand. Innovations reducing adverse effects can positively influence market viability.

5. What factors could reverse the downward price trend of olanzapine?

Introduction of novel formulations, exclusive delivery rights, or new approved indications that demonstrate superior efficacy or safety could allow for premium pricing and market differentiation.

References

[1] MarketsandMarkets. "Antipsychotic Drugs Market by Type, Application, and Region – Global Forecast to 2026." (2022)

[2] IQVIA. "Global Use of Medicines Report," 2021.

[3] World Health Organization. "Mental Health Atlas," 2021.

[4] GoodRx.com. "Olanzapine Prices and Cost," 2022.