Last updated: July 28, 2025

Introduction

Nitazoxanide, a broad-spectrum antiparasitic and antiviral agent, has garnered increased attention due to its potential applications beyond its original indications. Initially approved by the FDA in 2002 for the treatment of diarrhea caused by Cryptosporidium parvum and Giardia lamblia, the drug's utility has expanded into potential therapies for viral infections, including influenza, hepatitis, and notably, COVID-19. This report provides a comprehensive market analysis and price projection for Nitazoxanide, considering current demand, clinical development, regulatory landscape, competitive positioning, and manufacturing dynamics.

Market Overview

Historical Market Landscape

Nitazoxanide's global sales have historically been modest, primarily driven by its use in parasitology. According to industry reports, the global antiparasitic market was valued at approximately $3.9 billion in 2022, with Nitazoxanide accounting for a small fraction due to limited indications and off-patent status. Its initial success was in low-resource settings where parasitic infections are endemic, with minimal access to newer therapeutics.

Emerging Therapeutic opportunities

The potential antiviral activity of Nitazoxanide has significantly altered its market outlook. Prominent clinical trials and studies have suggested efficacy against influenza and emerging viral diseases, including COVID-19. Specifically, during the pandemic, it gained emergency use authorization or investigational status in several countries, which expanded its market potential. As of 2023, ongoing trials and promising data hint at its future role in the antiviral pharmacopeia, especially considering its favorable safety profile and affordability.

Current Regulatory Status

- FDA (United States): Approved for parasitic infections; no official approval for viral indications.

- EMA (European Union): Similar positioning—approved for parasitic indications.

- Other jurisdictions: Some countries have granted emergency use or off-label authorization for COVID-19, though these are not equivalent to full market approval.

Market Penetration and Demand Drivers

Key Drivers

- COVID-19 and Viral Disease Management: A surge in clinical interest and trials has increased demand, especially in emerging markets.

- Antiparasitic Use Persistence: Continued use in endemic regions sustains steady, albeit limited, market share.

- Research and Development: Growing research interest fosters an environment favorable for potential new indications, with phase-III trials ongoing for multiple viral diseases.

Challenges

- Regulatory Approvals: Lack of formal approval for newer indications limits widespread adoption in developed markets.

- Competition: Alternatives like Favipiravir, Remdesivir, and newer antivirals have garnered preference.

- Pricing and Reimbursement: As an older, off-patent drug, price competition influences profit margins and market expansion.

Manufacturing and Supply Chain Dynamics

Nitazoxanide is manufactured via multi-step synthesis involving thiazolium salt precursors. Major pharmaceutical companies in India, China, and other emerging markets produce generic versions at scale, leading to price competitiveness. Supply chain resilience and raw material availability are generally stable; however, geopolitical factors could influence future production costs and capacity.

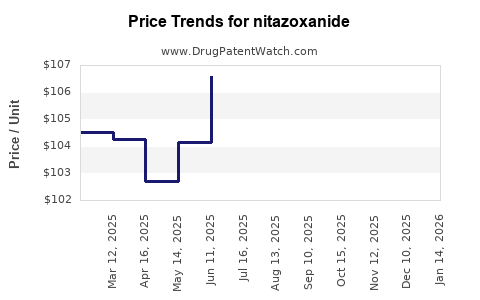

Price Trends and Projections

Historical Pricing

Historically, the price of Nitazoxanide tablets ranged between $0.50 and $2.00 per dose in generic formulations (USD), rendering it an affordable treatment option for parasitic infections, especially in low-income markets. Branded versions, when available, commanded higher prices, typically in the $3–$5 range per dose.

Factors Influencing Future Pricing

- Regulatory approvals for new indications: Could enable inclusion in reimbursement schemes, possibly increasing prices.

- Market competition: Entry of biosimilars or generic manufacturers could exert downward pressure.

- Manufacturing costs: Technological advancements and economies of scale may reduce costs further.

- Clinical trial outcomes: Positive trial data for viral indications could open premium pricing strategies, especially if approved for viral infections in high-income markets.

- Global health initiatives: Partnerships with WHO and GAVI could influence access and pricing, especially in low-resource settings.

Projected Price Range (Next 5 Years)

- Low-demand scenarios: In markets where regulatory approval remains limited, prices might stay within $0.50–$1.50 per dose.

- Enhanced demand via approved indications: Potential prices could rise to $3–$6 per dose, especially with inclusion in official treatment guidelines.

- Premium positioning: If phase-III trials confirm efficacy against COVID-19 or other viral infections and gain approval, prices could escalate further — projected at $8–$12 per dose, aligning with other antiviral agents.

Market Size Estimation

The global antiparasitic market's growth, coupled with increased antiviral research, could expand Nitazoxanide’s global sales from an estimated $40–$60 million annually (pre-2021 levels) to potentially $200–$500 million by 2028, depending on regulatory approvals and clinical outcomes.

Competitive Landscape

Key Players

- Generic manufacturers: Multiple companies, chiefly in India, China, and Eastern Europe, produce low-cost generics.

- Research institutions: Several ongoing trials are sponsored by academic and governmental agencies.

- Potential entrants: Patent expirations facilitate entry of new generics, intensifying price competition.

Intellectual Property Outlook

As of now, Nitazoxanide's patent protections have expired or are close to expiration, fostering an open competitive environment. However, secondary patents on formulations could affect exclusivity in certain jurisdictions.

Regulatory and Commercial Outlook

The future market for Nitazoxanide hinges upon successful clinical trial outcomes and regulatory endorsements for viral indications. A favorable regulatory environment in the US, EU, and emerging markets could significantly influence market penetration and pricing. Strategic partnerships with health agencies and inclusion in guidelines could further accelerate adoption.

Key Challenges and Opportunities

- Challenges: Lack of formal approvals for newer uses, competitive pressure, and pricing dynamics.

- Opportunities: Rapidly evolving viral disease landscape offers new markets, especially if clinical data substantiate efficacy. There's also scope for combination therapies, which could command higher prices.

Key Takeaways

- Nitazoxanide's market is primed for expansion owing to its broad antiviral potential, in addition to established parasitic uses.

- Pricing will remain competitive in low-resource markets, but approvals for new indications could unlock premium pricing.

- The global generics landscape will exert downward pressure, but clinical validation and strategic partnerships can foster growth.

FAQs

-

What are the main therapeutic indications for Nitazoxanide?

Traditionally used to treat parasitic infections like cryptosporidiosis and giardiasis; emerging evidence supports antiviral roles, particularly in influenza and COVID-19.

-

How does the expiration of patents affect Nitazoxanide's market?

Patent expirations facilitate generic manufacturing, reducing prices and increasing access, but may also limit the potential for branded premium pricing.

-

What are the prospects for Nitazoxanide in COVID-19 treatment?

Clinical trials have shown promising results, and regulatory approvals could significantly expand market size and pricing prospects.

-

How does global demand influence Nitazoxanide's price?

High demand driven by viral disease management and endemic parasitic infections favors price stability or growth in certain markets, especially if new indications are officially approved.

-

What are the key risks to Nitazoxanide's market growth?

Regulatory hurdles, competition from newer antivirals, and challenges in demonstrating efficacy in large-scale trials pose significant risks.

References

- [1] World Health Organization. WHO Model Lists of Essential Medicines. 2022.

- [2] U.S. Food and Drug Administration. FDA Approved Drugs Database. 2002.

- [3] MarketWatch. Global Antiparasitic Drugs Market Size, Share & Trends Analysis Report, 2022-2028.

- [4] ClinicalTrials.gov. Nitazoxanide studies related to viral diseases. 2023.

- [5] IQVIA. Global Generic Pharmaceuticals Market Report, 2023.

Note: Data projections are estimates based on current trends, clinical trial progress, and market dynamics.