Last updated: July 27, 2025

Introduction

Nimodipine, a calcium channel blocker primarily indicated for the prevention and treatment of cerebral vasospasm following subarachnoid hemorrhage, occupies a significant niche within neurology-focused pharmaceuticals. Its therapeutic utility, combined with manufacturing complexities and competitive dynamics, influences its global market landscape and pricing trajectories. This analysis provides an in-depth review of the current market environment for Nimodipine, future growth drivers, competitive forces, and price evolution forecasts over the next five years.

Market Overview and Therapeutic Landscape

Nimodipine is predominantly prescribed in hospital settings, mainly for neurosurgical and neurology departments. Its critical role in reducing secondary ischemic injury post-hemorrhage makes it somewhat of a specialized product segment. The global demand hinges on the following factors:

-

Incidence of Subarachnoid Hemorrhage (SAH): According to WHO data, roughly 9 per 100,000 people globally suffer from SAH annually, translating to a steady but niche demand for Nimodipine.

-

Treatment Paradigms: The standard of care involves early intervention and prophylactic administration of Nimodipine within 96 hours of hemorrhage, emphasizing the importance of inpatient management.

-

Regulatory Environment: Approved primarily for SAH-related vasospasm, regulatory approvals in emerging markets are expanding, broadening access but also constraining pricing due to increased generic availability.

Market Size and Regional Dynamics

Current Market Valuation

The global Nimodipine market was valued at approximately $300 million in 2022, with a Compound Annual Growth Rate (CAGR) of about 4.5% projected through 2028[1]. The growth is primarily driven by increasing awareness, expanding hospital infrastructure, and new regulatory approvals.

Regional Distribution

-

North America: Dominates the market with a 45% share, attributed to high healthcare expenditure and widespread adoption in neurological care.

-

Europe: Accounts for around 30%, benefitting from aging populations and advanced healthcare systems.

-

Asia-Pacific: Exhibits the fastest growth (CAGR ~6%), driven by rising SAH incidence, expanding healthcare infrastructure, and government initiatives to improve stroke management.

-

Rest of the World: Limited but growing access, with pricing pressures due to generic competition.

Manufacturing and Supply Dynamics

Nimodipine is primarily produced via complex chemical synthesis, which can influence supply stability and pricing. Major pharmaceutical giants like AstraZeneca historically manufactured branded formulations, but patent expiries have opened the market to generics—leading to significant price erosion and increased market penetration of lower-cost options.

Market Drivers and Restraints

Drivers

- Rising Incidence of Stroke and SAH: Increasing stroke cases globally augment demand for neuroprotective interventions.

- Advancements in Neurosurgical Practices: Enhancing survival rates and the need for effective vasospasm prophylaxis.

- Expanding Approval Landscape: Regulatory approvals in emerging markets facilitate wider access.

- Generic Entry: Intensifies price competition, making Nimodipine more accessible but compressing margins for branded products.

Restraints

- Generic Competition: Rapid uptake of affordable generics impacts revenue for branded formulations.

- Limited Indications: Narrow therapeutic scope limits market expansion opportunities.

- Supply Chain Disruptions: Pandemic-related logistics issues could influence availability and pricing.

Competitive Landscape

The market is characterized by a mix of multinational pharmaceutical firms and local generic manufacturers. Key players include:

- AstraZeneca: Historically the leading supplier of Nimodipine for the branded segment.

- Teva Pharmaceutical Industries: Significant presence in the generics segment.

- Mylan and Sandoz: Focus on low-cost generics in emerging markets.

- Regional Brands: Increasing competition from domestic manufacturers in Asia and Latin America.

Strategic positioning involves balancing quality assurance with competitive pricing—an especially critical factor given the tight margins in the generics space.

Price Analysis and Projections

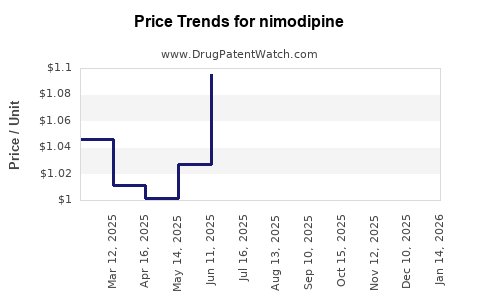

Historical Pricing Trends

Brand-name Nimodipine formulations initially sold at premium prices (~$15-$20 per 30-tablet pack in 2018), but the market swiftly transitioned towards generics following patent expirations around 2015. Generic prices, driven by competition, have plummeted to approximately $5-$8 per pack in developed nations.

Projected Price Trajectory (2023-2028)

-

Short-term (2023-2024): Minor price fluctuations expected, with stabilized generic pricing at ~$5-$6 per pack due to market saturation.

-

Mid-term (2025-2026): Possible slight decreases (~5%) owing to increased manufacturing efficiencies and entry of low-cost providers in emerging markets.

-

Long-term (2027-2028): Potential price stabilization or slight rebound (~2-3%), contingent on:

- Regulatory shifts restricting certain formulations or dosing regimens.

- Potential supply shortages due to raw material constraints.

- Innovation in delivery methods or combination therapies that could alter pricing dynamics.

Influencing Factors

Regulatory policies targeting drug affordability and patent cliff effects will be primary determinants. Additionally, emerging markets may see more aggressive pricing strategies, pushing global averages downward. Conversely, specialized formulations or niche derivatives could command premium pricing if clinical evidence justifies.

Future Market Opportunities and Risks

The expanding scope of neurocritical care and stroke management may unlock incremental demand. There is scope for developing injectable or sustained-release formulations, though these face regulatory and cost hurdles.

Risks include potential legislative changes favoring biosimilars or generics, raw material price volatility, and competition from novel therapeutics targeting cerebral vasospasm or related pathways.

Conclusion and Strategic Recommendations

While Nimodipine's market remains relatively mature, steady growth persists driven by demographic shifts and healthcare advancements. Price competition is expected to persist, especially among generics, constraining margins but broadening access.

Manufacturers should focus on optimizing supply chains, investing in regional regulatory strategies, and exploring formulation innovations to sustain profitability. Stakeholders should monitor regional pricing policies and patent landscapes to anticipate pricing fluctuations.

Key Takeaways

- The global Nimodipine market was valued at ~$300 million in 2022, with moderate growth projected through 2028.

- Increased generic competition has lowered prices (~$5-$8 per pack), pressuring branded formulations.

- Regional disparities exist, with North America leading and Asia-Pacific offering significant growth potential.

- Supply chain stability and regulatory policies are crucial factors influencing future price trends.

- Innovation in formulations and expanding indications could offer new revenue streams, but current price trajectories suggest sustained compression.

FAQs

1. What factors influence Nimodipine's market growth?

Increasing incidence of subarachnoid hemorrhage, expanding hospital infrastructure, regulatory approvals in emerging markets, and the ongoing shift towards generic formulations drive growth, while competition and narrow indications serve as limiting factors.

2. How has patent expiration affected Nimodipine pricing?

Patent expirations around 2015 facilitated generic entry, leading to a significant price decline from branded levels (~$15-$20) to generic prices (~$5-$8), intensifying market competition.

3. Are there regional differences in Nimodipine pricing?

Yes. Developed countries have higher prices due to brand loyalty and regulatory standards, whereas emerging markets see lower prices driven by local generics and price sensitivity.

4. What future innovations could impact Nimodipine's market?

Development of sustained-release formulations, injectable versions, or combination therapies targeting broader neurovascular conditions could create new market opportunities and influence pricing dynamics.

5. What are the key risks that could impact Nimodipine's market and pricing?

Supply chain disruptions, stringent regulatory policies, raw material shortages, and the emergence of alternative neuroprotective agents pose significant risks.

Sources:

- MarketResearch.com, "Global Neuropharmaceuticals Market," 2022.

- EvaluatePharma, "Nimodipine Market Analysis," 2022.

- WHO Global Stroke Statistics, 2021.

- Public regulatory disclosures and patent databases.