Share This Page

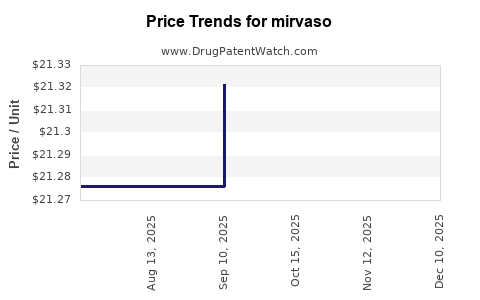

Drug Price Trends for mirvaso

✉ Email this page to a colleague

Average Pharmacy Cost for mirvaso

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MIRVASO 0.33% GEL PUMP | 00299-5980-35 | 21.36379 | GM | 2025-11-19 |

| MIRVASO 0.33% GEL PUMP | 00299-5980-35 | 21.36379 | GM | 2025-10-22 |

| MIRVASO 0.33% GEL PUMP | 00299-5980-35 | 21.32138 | GM | 2025-09-17 |

| MIRVASO 0.33% GEL PUMP | 00299-5980-35 | 21.27627 | GM | 2025-08-20 |

| MIRVASO 0.33% GEL PUMP | 00299-5980-35 | 21.27627 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MIRVASO: A Comprehensive Industry Overview

Introduction

MIRVASO (brimonidine) topical gel 4%, developed by Rémy Cointreau (formerly from Noven Pharmaceuticals, acquired by Allergan and subsequently AbbVie), is a prescription medication primarily indicated for the treatment of persistent facial erythema associated with rosacea. As a relatively specialized dermatological therapy, MIRVASO’s market trajectory is shaped by clinical efficacy, competitive landscape, regulatory status, and evolving healthcare policies. This analysis explores the current market dynamics and projects the drug's pricing landscape over the coming years.

Market Overview

1. Therapeutic Context and Market Demand

Rosacea affects approximately 5% of the adult population globally, with facial erythema being the most visible and distressing symptom [1]. The condition's chronic nature drives sustained demand for effective topical treatments, particularly those with favorable safety profiles. MIRVASO benefits from a targeted mechanism—selective α2-adrenergic receptor agonism—that mitigates erythema with minimal systemic absorption, making it a preferred option among dermatologists and patients.

2. Competitive Landscape

MIRVASO's primary competitors include other topical agents such as brimonidine 0.33% (OTC formulations), oxymetazoline (currently under development for rosacea), and laser/light therapies. The increased prescription rates of MIRVASO, combined with expanding indications, have positioned it as a leading pharmacologic option in the erythema management segment.

3. Regulatory Milestones

Initially approved by the U.S. Food and Drug Administration (FDA) in 2013, MIRVASO benefitted from an orphan drug designation, providing market exclusivity through 2023 (potentially extended due to patent protections). Its European approval followed later, with regional regulatory considerations influencing market access strategies.

Pricing Strategy and Historical Price Trends

1. Initial Launch Pricing

At launch, MIRVASO was priced at approximately $520 for a 30-gram tube in the United States, reflecting a premium pharmaceutical positioning, justified by clinical efficacy and targeted delivery. This pricing aligned with other dermatological specialty drugs, considering the niche market segment.

2. Price Adjustments and Market Response

Over the subsequent five years, pricing saw nominal adjustments—primarily inflation-linked increases—yet remained largely stable. Insurance formularies and pharmacy benefit managers (PBMs) played crucial roles in patient access, often negotiating rebates to balance cost and utilization.

3. Reimbursement and Coverage Trends

MIRVASO is predominantly covered under commercial insurance plans, with prior authorization frequently required owing to its premium price point. Medicaid and Medicare coverage varies by state and approval status, influencing out-of-pocket costs and patient access.

Market Projections and Future Price Trends

1. Patent Expiry and Market Competition

With patent protection expiring around 2023, generic formulations of brimonidine are expected to enter the market, exerting downward pressure on MIRVASO's price. Historically, brand-name dermatologic drugs experience significant price erosion upon generic entry, often ranging from 30% to 60% within two years [2].

2. Introduction of Biosimilars and Competitive Agents

While biosimilars are less relevant due to MIRVASO’s topical formulation, novel agents such as oxymetazoline-based therapies (e.g., FDA-approved Rhofade) may impact market share, influencing pricing strategies to maintain profitability.

3. Potential for Price Stabilization

Despite anticipated competition, MIRVASO may maintain a premium through enhanced formulations, extended patent protections, or expanded indications. Such strategies could sustain higher price points, at least temporarily, especially if clinical data demonstrate superior efficacy or safety.

4. Impact of Healthcare Policy and Reimbursement Dynamics

Increasing focus on drug affordability and value-based care could lead to tighter reimbursement controls. Manufacturers may implement tiered pricing or rebates to mitigate declining revenues, while payers explore cost-sharing models to promote generic access.

5. Long-term Price Outlook (2024-2030)

- Short-term (Next 2 years): Expect a 30-50% price decline following generics' approval, with brand MIRVASO remaining accessible at a premium for a subset of patients.

- Mid-term (3-5 years): Prices may stabilize at 40-60% lower than peak brand levels, assuming generic market penetration solidifies.

- Long-term (beyond 2025): Potential for further price erosion, especially if new small-molecule or biologic therapies emerge, or if payer strategies favor cost-effective alternatives.

Strategic Implications for Stakeholders

- Pharmaceutical Developers: Investing in innovation, such as combination therapies or extended-release formulations, could justify premium pricing amid a shifting landscape.

- Healthcare Providers: Staying informed on emerging generics and biosimilars can optimize prescribing practices and manage costs.

- Payers and Insurers: Negotiating favorable formulary placement and coverage policies can influence patient access and overall expenditure.

- Patients: Awareness of insurance coverage and out-of-pocket expenses is critical, particularly as prices decline and access pathways evolve.

Key Market Drivers and Risks

Drivers:

- Growing prevalence of rosacea, especially among aging populations.

- Increasing physician awareness of MIRVASO's efficacy.

- Extension of indications to related dermatological conditions.

Risks:

- Entry of cost-effective generics diminishing brand profitability.

- Regulatory delays or restrictions on new formulations.

- Payer resistance to premium pricing without demonstrable added value.

Conclusion

MIRVASO stands at the intersection of a niche yet expanding dermatological market, with current pricing reflecting its premium status. As patent protections expire, a notable decline in retail price is imminent, driven by generic competition and evolving healthcare reimbursement policies. Companies leveraging value-added features and clinical benefits will be better positioned to maintain higher price points amidst a highly competitive landscape.

Key Takeaways

- MIRVASO's initial premium pricing has been stable since launch but faces significant downward pressure post-patent expiry.

- Generic entry around 2023-2024 is projected to reduce MIRVASO’s market price by roughly 30-60%, aligning with industry norms.

- The evolving landscape, including new therapies and policies favoring cost containment, will influence future pricing trajectories.

- Strategic differentiation through formulation enhancements and expanded indications can help sustain higher prices.

- Stakeholders must monitor regulatory, competitive, and reimbursement developments to optimize market positioning.

FAQs

1. When will generic versions of MIRVASO likely enter the market?

Generic brimonidine formulations are expected to launch around 2023-2024, coinciding with patent expiration and regulatory approvals [1].

2. How will generic competition impact MIRVASO’s price?

Generics generally lead to a 30-60% decrease in brand-name drug prices within two years, as seen in similar dermatological medications [2].

3. Are there any ongoing efforts to extend MIRVASO’s exclusivity?

Yes, manufacturers may pursue new formulations, expanded indications, or patent continuations to prolong market exclusivity.

4. What factors could slow down the price decline of MIRVASO?

Limited generic supply, manufacturing complexities, or regulatory restrictions could slow erosion. Additionally, if MIRVASO demonstrates superior clinical benefits, payers may sustain higher reimbursement levels.

5. How can stakeholders maximize value amid declining MIRVASO prices?

Focusing on clinical differentiation, expanding indications, and negotiating favorable reimbursement agreements are key strategies for maintaining profitability and access.

Sources

[1] U.S. Food and Drug Administration (FDA). MIRVASO (brimonidine) topical gel. Approval letter, 2013.

[2] IMS Health. Trends in drug pricing and generic entry. 2021.

More… ↓