Share This Page

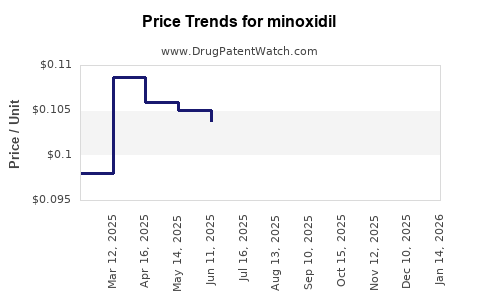

Drug Price Trends for minoxidil

✉ Email this page to a colleague

Average Pharmacy Cost for minoxidil

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MINOXIDIL 10 MG TABLET | 00591-5643-01 | 0.20014 | EACH | 2025-11-19 |

| MINOXIDIL 10 MG TABLET | 00591-5643-05 | 0.20014 | EACH | 2025-11-19 |

| MINOXIDIL 10 MG TABLET | 49884-0257-05 | 0.20014 | EACH | 2025-11-19 |

| MINOXIDIL 10 MG TABLET | 49884-0257-01 | 0.20014 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Minoxidil

Introduction

Minoxidil, primarily known as a hair growth stimulant, originally emerged as an antihypertensive medication before its topical form gained prominence for androgenetic alopecia treatment. Its shifting therapeutic applications and patent status have significantly influenced market dynamics, shaping pricing strategies and investment considerations. This comprehensive analysis explores the current market landscape, factors impacting pricing trends, and future projections for Minoxidil over the next five years.

Market Overview

Historical Development and Current Market Position

Introduced as an oral antihypertensive agent in the late 1970s, Minoxidil's topical formulation was approved for androgenetic alopecia in 1988 (US FDA). Its over-the-counter (OTC) availability in many markets, including the US and EU, has facilitated widespread use, particularly for hair loss treatments. The global hair growth market is projected to reach approximately $5.2 billion by 2028, with Minoxidil accounting for a significant share due to its affordability and established efficacy [[1]].

Key Market Segments

- Therapeutic Applications:

- Hair loss (androgenetic alopecia)

- Off-label uses such as hair growth for alopecia universalis and other dermatological conditions

- Formulations:

- Topical solution (2% & 5% branded/generic)

- Foam (5%)

- Orally (prescription, not approved for hypertension use anymore but explored for hair regeneration)

- Geographical Breakdown:

- North America: Leading market driven by OTC sales and high consumer awareness

- Europe: Growing demand with regulatory dose restrictions in some countries

- Asia-Pacific: Rapid market expansion due to increasing dermatological treatments and rising middle-class incomes

Competitive Landscape

Major players include Johnson & Johnson (Rogaine), Perrigo, Kirkman, and numerous generics manufacturers. Patent expirations have catalyzed generic competition, leading to price reductions and market penetration across diverse income segments.

Market Drivers and Challenges

Drivers

-

High consumer adoption:

The stigma of hair loss and its psychosocial impact drive demand. Minoxidil's proven efficacy and OTC status boost consumer confidence (e.g., Rogaine's strong branding). -

Herbal and natural formulations:

As consumers seek natural alternatives, formulations combining Minoxidil with herbal extracts gain popularity, exploring niche markets. -

Expanding indications:

Research exploring Minoxidil's potential in other dermatologic and systemic conditions could broaden the market.

Challenges

-

Side effects and safety concerns:

Thyroid and cardiovascular adverse effects limit oral use, and topical formulations may cause scalp irritation. -

Regulatory variability:

Different countries impose varying approvals and labeling restrictions, impacting market access. -

Pricing pressure from generics:

Patent expirations have led to substantial price erosion, especially in developed markets.

Pricing Analysis

Historical Price Trends

In the early 2000s, branded Minoxidil solutions ranged between $30–$50 for a three-month supply (e.g., Rogaine 5%). Generic formulations entered around 2010, reducing prices to approximately $10–$20 for comparable volumes in North America. Europe observed similar trends post-patent expiry, with prices stabilizing at reduced levels.

Current Price Landscape

-

United States:

The average retail price for OTC Minoxidil 5% foam ranges from $15–$25, with generic products available at lower prices ($8–$12). Discount pharmacy chains and online vendors offer further reductions. -

Europe:

Similar trends, with OTC 5% formulations costing €10–€20, driven primarily by generics. -

Emerging Markets:

Prices are significantly lower, often below $5 per month, owing to local manufacturing and reduced regulatory barriers.

Pricing Influences

Factors impacting current pricing include manufacturing costs, formulation type (foam tends to be marginally more expensive than solution), brand recognition, and distribution channels. The rise of e-commerce bolsters price competition, often leading to lower consumer prices.

Future Price Projections (2023–2028)

Factors Influencing Future Pricing

-

Patent Status:

Since Minoxidil patents expired in most regions, continued dominance of generics will pressure prices downward. However, innovative formulations or combination therapies could command premium pricing. -

Emerging Formulations:

Introduction of higher-concentration topical solutions or novel delivery systems (micro-needling, nanotechnology) may stabilize or increase prices temporarily. -

Market Penetration in Developing Regions:

As affordability improves, demand surges, potentially stabilizing prices at a lower but sustained level. -

Regulatory and Reimbursement Policies:

Enhanced regulatory frameworks may influence pricing, especially if new indications are approved with reimbursement pathways, as seen with hair regrowth treatments in certain European countries.

Projected Price Trends

- Generics dominance likely to persist, with prices in North America declining by approximately 10–15% annually until 2026, reaching as low as $5–$8 per three-month supply.

- Premium formulations or combination therapies could see margins maintained or increased, with prices stabilizing around $20–$30 per supply in niche markets.

- Emerging markets are anticipated to maintain lower price points ($2–$5), driven by local manufacturing and reduced regulatory costs.

Impact of Potential Regulatory Changes

- New therapeutic approvals or formulations could temporarily elevate prices if marketed as premium products.

- Price controls or reimbursement systems may exert downward pressure in certain jurisdictions, aligning prices closer to production costs.

Concluding Insights

Minoxidil's market is poised for modest decline in retail prices driven by generic proliferation and competitive pressures. However, innovation, emerging markets, and combination therapies could create segmentation, supporting a tiered pricing landscape. Stakeholders should monitor patent expirations, regulatory shifts, and technological advances to optimize market positioning and pricing strategies.

Key Takeaways

- Market maturity: The Minoxidil market is highly mature, with generics suppressing prices but sustaining robust demand across demographics.

- Price decline trajectory: Expect 10–15% annual reductions in developed markets over the next five years, reaching low-cost thresholds conducive to broad accessibility.

- Innovation opportunities: New formulations and combination therapies may enable premium pricing segments, offsetting generic price erosion.

- Emerging markets: Continued growth in Asia-Pacific and Latin America offers volume opportunities at lower price points, further influencing global pricing strategies.

- Regulatory and economic influences: Price adjustments will depend heavily on regulatory policies, reimbursement models, and patent landscapes.

FAQs

Q1: How will patent expirations impact Minoxidil prices globally?

A1: Patent expirations have historically led to increased generic competition, significantly reducing prices—by up to 50% or more in developed markets—thus making Minoxidil more affordable and accessible worldwide.

Q2: Are there any upcoming innovations that could influence Minoxidil pricing?

A2: Yes, formulations utilizing nanotechnology, sustained-release systems, or combination therapies with other dermatological agents could command higher prices due to perceived added value, potentially creating premium market segments.

Q3: What are the main factors that could cause price fluctuations in the near future?

A3: Changes include regulatory approvals for new indications, introduction of branded or innovative formulations, shifts in reimbursement policies, and manufacturing cost variations due to supply chain factors.

Q4: How significant is the role of e-commerce in shaping Minoxidil price trends?

A4: E-commerce enhances price transparency, increases competition, and often offers lower prices than traditional retail outlets, contributing to downward pressure on retail and wholesale prices.

Q5: Which regions are expected to see the most substantial price reductions?

A5: North America and Europe will likely see the most significant declines due to mature patent landscapes and intense generic competition, while emerging markets will continue to offer low-cost options with growth potential.

Sources:

[1] MarketWatch. "Hair Growth Market Size, Trends, and Forecast." 2022.

More… ↓