Last updated: July 28, 2025

Introduction

Miglitol, branded commercially as Glyset, is an oral antihyperglycemic agent used primarily in the management of type 2 diabetes mellitus. As an alpha-glucosidase inhibitor, miglitol delays carbohydrate absorption, thereby moderating postprandial blood glucose levels. Its portfolio comprises a niche segment within the broader diabetes therapeutics market, which has experienced notable growth driven by rising prevalence and advances in diabetes management. This report conducts a comprehensive market analysis and projects future pricing dynamics for miglitol, aiding stakeholders in strategic planning and investment.

Market Landscape and Epidemiological Trends

Global Burden of Type 2 Diabetes

The global diabetes epidemic fuels demand for diverse therapeutic options. The International Diabetes Federation (IDF) estimates that approximately 537 million adults worldwide lived with diabetes in 2021, with projections reaching 700 million by 2045 [1]. The majority of these cases are type 2 diabetes, a condition requiring multifaceted pharmacotherapy.

Market Penetration of Alpha-Glucosidase Inhibitors

Within oral antihyperglycemics, alpha-glucosidase inhibitors (AGIs) like miglitol occupy a modest segment relative to biguanides (e.g., metformin) and SGLT2 inhibitors. Notably, miglitol's usage remains constrained in regions where acarbose (another AGI) is preferred due to cost considerations, as well as due to its limited efficacy and tolerability profile.

Regulatory and Market Access Landscape

Miglitol's approval status varies globally. It has received regulatory clearance in countries including Japan, the United States (FDA approval in 1995), and several European nations. Despite regulatory approval, its market share is limited, partly due to competition from newer agents with superior efficacy profiles.

Competitive Positioning and Market Dynamics

Competitive Landscape

Miglitol faces competition from therapeutics like metformin, thiazolidinediones, DPP-4 inhibitors, SGLT2 inhibitors, and GLP-1 receptor agonists. Among AGIs, acarbose dominates, especially in Asian markets, due to lower costs and established formulary presence.

Patent Status and Generic Availability

Miglitol's patent life has expired or is nearing expiration in multiple jurisdictions, exposing it to generic competition that could pressure prices downward. The lack of patent exclusivity diminishes market exclusivity and limits revenue potential.

Market Drivers and Barriers

Drivers:

- Growing prevalence of type 2 diabetes globally.

- Increasing adoption of combination therapies for glycemic control.

- Adoption in specific patient subsets, such as those intolerant to other drug classes.

Barriers:

- Modest efficacy relative to newer agents.

- Gastrointestinal side effects that impact tolerability.

- Price sensitivity in price-sensitive markets.

Pricing Analysis

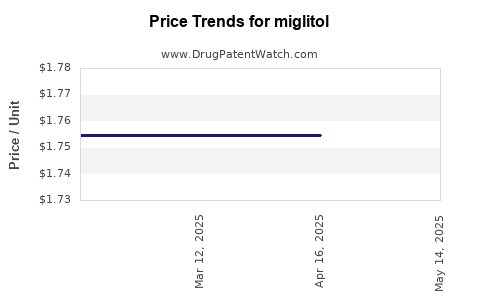

Historical Pricing Trends

Historically, miglitol has been priced higher than generic acarbose but remains more affordable than incretin-based therapies. In the U.S., the average retail cost for a 100 mg tablet ranges between $0.50 and $1.00, depending on insurance coverage and pharmacy discounts [2].

Current Market Pricing

In developed markets, the price is primarily influenced by generic competition and healthcare policies. The entry of generics has pushed prices downward, aligning with overall market trends favoring cost-effective therapeutics.

Future Price Projections

Given the impending patent expirations and generic entry, prices are expected to decline further over the next 5 years. Analysts forecast a price decrease of approximately 20-30% in mature markets, contingent on the extent of generic adoption and formulary inclusion strategies.

In emerging markets, where generic versions prevail and healthcare infrastructure is developing, the price decline trajectory may be more pronounced, with prices stabilizing at significantly lower levels to accommodate local economic conditions.

Forecasting Market Revenue and Volume

Market Size Projections

The global market for glucose-lowering agents is projected to reach USD 128 billion by 2025, with oral agents comprising approximately 70% [3]. Miglitol's segment, however, accounts for less than 2% of this market, translating to an estimated USD 2.5-3 billion globally. Considering its niche status, the drug’s annual revenues are projected to grow modestly, correlating with the growth in diabetes prevalence, especially in Asia.

Sales Volume Forecast

The sales volume of miglitol is expected to grow at a compound annual growth rate (CAGR) of 3-5%, driven by increased diagnosis rates and incremental adoption in existing and new markets. However, this growth may be tempered by competition from more efficacious agents and shifting prescribing patterns favoring newer classes.

Price-and-Volume Interaction

Overall revenue growth for miglitol will be inversely linked to pricing pressures. As prices decline due to generics and increased competition, volume increases may partially offset revenue losses, maintaining steady market share levels.

Strategic Considerations for Stakeholders

Pharmaceutical Manufacturers

- Differentiation through formulation improvements or combination therapies may offset pricing pressures.

- Expansion into emerging markets remains critical, where patent barriers less constrain market entry.

- Investments in clinical development demonstrating broader benefits could enhance market positioning.

Healthcare Providers & Payers

- Emphasis on cost-effectiveness analyses favors preferring generics and cheaper alternatives.

- Incorporation into combination regimens enhances its clinical value proposition.

Policy & Regulatory Environment

- Price controls in various countries may suppress growth and profitability.

- Regulatory pathways for biosimilars or interchangeable generics influence market dynamics.

Key Takeaways

- The global diabetes epidemic sustains demand for oral antihyperglycemics like miglitol, but its market share remains small compared to dominant therapies.

- Patent expirations and generic entry will drive prices downward, leading to a projected 20-30% price decline over the next five years.

- Revenue growth is expected to be modest, constrained by stiff competition and its niche positioning.

- Emerging markets offer significant growth opportunities due to less price sensitivity and expanding healthcare access.

- Strategic differentiation and clinical positioning are crucial for stakeholders aiming to optimize profit margins and market share in this evolving landscape.

FAQs

-

What factors influence the pricing of miglitol across different markets?

Price determinants include regulatory environment, patent status, manufacturing costs, competition from generics, healthcare reimbursement policies, and regional economic factors.

-

How does miglitol compare to other antihyperglycemic agents in terms of cost-effectiveness?

Miglitol typically demonstrates lower cost than newer agents like SGLT2 inhibitors but may be less effective, especially when considering tolerability and side effect profiles. Its cost-effectiveness is most favorable in cost-sensitive, resource-limited settings where generics are available.

-

What are the main barriers to wider adoption of miglitol?

Key barriers include limited efficacy relative to newer agents, gastrointestinal side effects, limited prescriber familiarity, and competition from more effective or better-tolerated drugs.

-

Are there emerging trends that could alter miglitol’s market prospects?

Advances in combination therapies, biosimilar entries, and shifting clinical guidelines favoring newer drug classes could further diminish miglitol’s market share.

-

What strategies could extend miglitol’s market viability?

Developing fixed-dose combinations, expanding into underserved markets, highlighting unique clinical benefits, and optimizing manufacturing efficiencies could enhance its market position.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2021.

[2] GoodRx. Miglitol prices and comparisons. Accessed January 2023.

[3] MarketWatch. Diabetes drugs market overview. 2022.

This analysis provides a comprehensive understanding of the current market dynamics and future pricing of miglitol, equipping stakeholders to make informed strategic decisions.