Share This Page

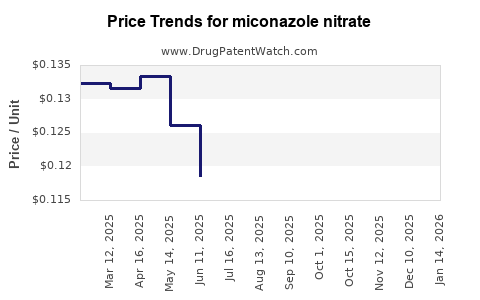

Drug Price Trends for miconazole nitrate

✉ Email this page to a colleague

Best Wholesale Price for miconazole nitrate

| Drug Name | Vendor | NDC | Count | Price ($) | Price/Unit ($) | Unit | Dates | Price Type |

|---|---|---|---|---|---|---|---|---|

| MICONAZOLE 7 | United Drug Supply, Inc. | 00113-0214-29 | 45GM | 4.12 | 0.09156 | GM | 2023-12-01 - 2028-11-30 | FSS |

| MICONAZOLE 7 | United Drug Supply, Inc. | 00113-0825-29 | 45GM | 4.12 | 0.09156 | GM | 2023-12-01 - 2028-11-30 | FSS |

| AZOLEN 2% TINCTURE,TOP | Stratus Pharmaceuticals, Inc. | 58980-0818-10 | 29.57ML | 10.35 | 0.35002 | ML | 2023-10-01 - 2028-09-30 | FSS |

| AZOLEN 2% SOLN,TOP | Stratus Pharmaceuticals, Inc. | 58980-0819-60 | 170ML | 12.95 | 0.07618 | ML | 2024-01-01 - 2028-09-30 | FSS |

| MICONAZOLE NITRATE 2% SOLN,TOP | AvKare, LLC | 50268-0503-29 | 29.57ML | 9.12 | 0.30842 | ML | 2023-06-15 - 2028-06-14 | FSS |

| >Drug Name | >Vendor | >NDC | >Count | >Price ($) | >Price/Unit ($) | >Unit | >Dates | >Price Type |

Market Analysis and Price Projections for Miconazole Nitrate

Introduction

Miconazole nitrate is an azole antifungal agent extensively used to treat various fungal infections, including superficial infections such as athlete’s foot, ringworm, candidiasis, and yeast infections. Its broad application, established efficacy, and widespread approval across different jurisdictions make it a notable compound in the antifungal pharmaceutical sector. This analysis explores the current market landscape, key drivers, competitive positioning, regulatory factors, and price projections for miconazole nitrate, providing insights for stakeholders and investors.

Market Landscape Overview

Global Market Size and Growth Trends

The global antifungal market, valued at approximately USD 9.3 billion in 2022, is projected to expand at a compound annual growth rate (CAGR) of around 4.2% through 2030 [1]. Miconazole nitrate accounts for a significant share within this domain, especially driven by increasing prevalence of fungal infections worldwide and expanding pharmaceutical applications.

The topical segment dominates, with skin, mucosal, and nail infections fueling demand. The rising burden of immunocompromised populations—such as HIV/AIDS patients, diabetics, and chemotherapy patients—further amplifies the need for effective antifungal therapies, including miconazole nitrate.

Key Market Drivers

-

Prevalence of Fungal Infections

The incidence of superficial fungal infections is increasing globally due to urbanization, rising humidity, and lifestyle factors. Invasive fungal infections, although less common, are also on the rise, indirectly supporting the demand for broad-spectrum antifungals. -

Expanding Application Spectrum

Innovative formulations like powders, creams, vaginal tablets, and oral gels enhance patient compliance and widen usage indications, boosting market growth. -

Regulatory Approvals and Patent Expirations

Generic manufacturing upon patent expiry has facilitated broader market penetration, boosting affordability and accessibility. -

Growing Pharmaceutical Manufacturing in Emerging Markets

Countries like India, China, and Brazil are expanding production capacities, reducing costs, and increasing supply.

Competitive Landscape

Miconazole nitrate’s pristine status as an off-patent, generic drug positions it within a highly competitive space. Major pharmaceutical players and generic manufacturers globally produce miconazole nitrate at varying quality and price points. Key competitors include WellX Pharmaceuticals, Teva, Sun Pharmaceutical Industries, and Dr. Reddy’s Laboratories.

Brand products like Monistat (by Menarini and others) still hold market share within branded segments, but generics dominate the market. The competition is primarily driven by formulation innovations and cost competitiveness.

Regulatory Environment

Globally, miconazole nitrate faces different registration and approval processes. Regulatory bodies like the U.S. FDA, EMA, and countries’ respective agencies have approved various topical and oral formulations, with some regional restrictions on dosage forms and indications.

Regulatory considerations influence market access and pricing strategies, especially where formulations are patented or restricted.

Pricing Dynamics and Future Projections

Current Price Benchmarks

Prices for generic miconazole nitrate products vary across regions:

-

United States:

Topical creams (2%) generally retail between USD 10–20 for a 15-gram tube [2]. -

India:

Generic topical formulations cost approximately INR 50–150 (~USD 0.65–2). Bulk manufacturing and lower regulatory costs contribute to significantly lower prices. -

Europe:

Prices are comparable to the U.S., with variations based on formulation, brand, and dispensing channels.

Factors Influencing Future Pricing

-

Manufacturing Costs

Advances in extraction and synthesis reduce production costs, enabling more competitive pricing. Economies of scale, especially in emerging markets, will further lower costs. -

Market Competition

Increased generic competition tends to compress prices, particularly in mature markets. Price wars are expected to persist unless brand-name formulations introduce novel delivery mechanisms. -

Regulatory Pricing Policies

Governmental price controls and reimbursement policies influence retail prices. Countries with stringent controls (e.g., certain European nations) may limit price increases. -

Formulation Innovations

Development of sustained-release, combination, or novel delivery systems could command premium pricing, offsetting price declines caused by generics. -

Demand Fluctuations and New Indications

Growing application in veterinary medicine and other off-label uses could influence supply/demand dynamics and pricing.

Projected Price Trends (2023-2030)

-

Short Term (1-3 years):

Expect stabilization of prices within existing ranges due to mature generic markets. In mature markets like the U.S. and Europe, minimal increases aligned with inflation are anticipated. -

Medium to Long Term (3-8 years):

With emerging markets expanding production capacity and regulatory pressures intensifying, prices are likely to decrease by an average of 5–10% annually in price-sensitive regions. -

Premium Segment:

Formulation innovations may sustain or elevate prices for specialized products (e.g., sustained-release gels), potentially maintaining margins in niche markets.

Strategic Opportunities and Risks

Opportunities

-

Formulation Diversification:

Developing novel delivery systems like transdermal patches or long-acting gels can fetch premium prices. -

Geographic Expansion:

Penetrating underserved regions, especially Africa, Southeast Asia, and Latin America, can significantly grow market share. -

Partnerships and Licensing:

Collaborations with local manufacturers can optimize production costs and market access.

Risks

-

Price Erosion:

Excessive generic competition may drive prices downward, impacting margins. -

Regulatory Barriers:

Stringent approval processes can delay market entry of new formulations, affecting revenue projections. -

Supply Chain Disruptions:

Raw material shortages and geopolitical issues could hinder manufacturing volumes and stabilize prices.

Conclusion

The market for miconazole nitrate remains robust, with sustained demand driven by the global rise in superficial fungal infections. While competitive pressures and regulatory policies exert downward pressure on prices, ongoing formulation innovations and expanding markets in developing regions offer growth opportunities. Market players must strategically balance cost efficiencies with innovation to optimize profitability over the coming years.

Key Takeaways

- The global antifungal market is projected to grow at a CAGR of over 4%, with miconazole nitrate contributing substantially due to its efficacy and widespread use.

- Generic manufacturing has lowered prices worldwide, especially in emerging markets; however, innovation-driven formulations can sustain premium pricing in niche segments.

- Price projections indicate stability in mature markets and potential declines of up to 10% annually in commoditized regions, driven by increased competition.

- Strategic expansion into underserved regions and development of advanced formulations can provide competitive advantages.

- Regulatory environments will continue to shape pricing and market access, necessitating vigilant compliance strategies.

FAQs

1. What are the primary applications of miconazole nitrate?

Miconazole nitrate is mainly used for treating superficial fungal skin infections, including athlete’s foot, ringworm, candidiasis, and yeast infections. It is also employed in certain vaginal infections and, in some formulations, oral thrush.

2. How does the patent landscape affect the pricing of miconazole nitrate?

Since miconazole nitrate is an off-patent drug, the market is dominated by generics, leading to significant price competition. The absence of patent restrictions allows numerous manufacturers to produce and sell the drug, driving prices downward.

3. Which regions offer the highest growth opportunities for miconazole nitrate?

Emerging markets such as India, China, Brazil, and Southeast Asian countries present substantial growth potential due to increasing healthcare infrastructure, higher prevalence of fungal infections, and cost-sensitive demand for generic medications.

4. Will formulation innovations influence future pricing strategies?

Yes. Novel delivery systems like long-acting gels, patches, or combination products can command premium prices and differentiate products in competitive markets.

5. What regulatory challenges might impact the market for miconazole nitrate?

Regulatory agencies may impose restrictions or require extensive testing for new formulations or indications, potentially delaying market entry. Policy changes such as price caps can also influence profitability.

Sources

[1] Grand View Research, “Antifungal Drugs Market Size, Share & Trends,” 2022.

[2] GoodRx, “Price comparison for miconazole topical cream,” 2023.

More… ↓