Share This Page

Drug Price Trends for metolazone

✉ Email this page to a colleague

Average Pharmacy Cost for metolazone

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METOLAZONE 10 MG TABLET | 00378-6174-01 | 0.38687 | EACH | 2025-11-19 |

| METOLAZONE 10 MG TABLET | 58657-0742-01 | 0.38687 | EACH | 2025-11-19 |

| METOLAZONE 10 MG TABLET | 62332-0534-31 | 0.38687 | EACH | 2025-11-19 |

| METOLAZONE 10 MG TABLET | 50742-0351-01 | 0.38687 | EACH | 2025-11-19 |

| METOLAZONE 5 MG TABLET | 76385-0137-01 | 0.31764 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Metolazone

Introduction

Metolazone, a thiazide-like diuretic primarily used to manage edema and hypertension, occupies a niche in the pharmaceutical landscape due to its efficacy in volume management and blood pressure regulation. Its generic status, comparatively low manufacturing costs, and established clinical profile influence market dynamics and pricing trends. This analysis examines current market conditions, competitive landscape, regulatory considerations, and future price trajectories to inform strategic decision-making for stakeholders.

Current Market Landscape

Global Market Size and Segmentation

The global diuretics market, estimated at USD 8.4 billion in 2022, encompasses various classes including loop diuretics, thiazides, and potassium-sparing agents. Metolazone constitutes a smaller portion of this sector, primarily utilized in niche indications such as resistant hypertension and chronic heart failure. Its market share is driven by physician familiarity and long-standing clinical efficacy.

Key Geographic Markets

- United States: Dominates due to high hypertension prevalence (~45% of adults; CDC, 2021), widespread healthcare infrastructure, and the high prescription rate of diuretics.

- Europe: A mature market with established generic utilization, but facing pricing pressures, especially in countries with national health services.

- Emerging Markets: Rapidly expanding due to increasing hypertension awareness and expanding healthcare access, notably in Asia-Pacific and Latin America.

Competitive Landscape

The market for metolazone is highly commoditized, with multiple generic manufacturers like Mylan, Teva, and Sandoz offering the drug at low prices. Patent expirations for branded counterparts (though metolazone itself has long been genericized) have intensified price competition, emphasizing cost-effectiveness in prescribing.

Supply Chain and Manufacturing

The low barrier to manufacturing— due to straightforward synthesis— encourages a competitive environment. However, quality assurance standards and regulatory compliance impose high entry thresholds for new manufacturers, which affects supply stability and potential price fluctuations.

Demand Drivers & Market Dynamics

Clinician Preferences & Guidelines

Current guidelines from the American College of Cardiology and the American Heart Association highlight diuretics, including metolazone, as first-line agents in resistant hypertension. The drug’s efficacy in managing fluid overload also sustains demand in chronic kidney disease and heart failure patients.

Patient Demographics

An aging population globally elevates demand for antihypertensive and diuretic therapies, including metolazone, supporting steady future growth.

Regulatory Environment

- Generics & Approvals: The widespread approval of generics has led to price erosion, but also ensures steady availability.

- Reimbursement Policies: Variations across regions influence market penetration and pricing; countries with comprehensive insurance tend to have more consistent demand but pressure on drug prices.

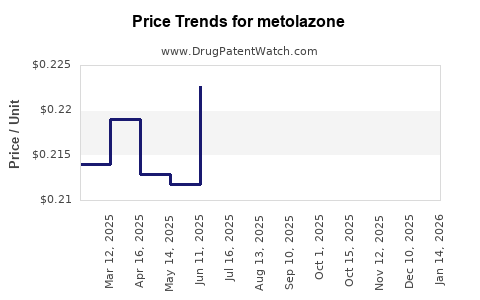

Price Trends and Projections

Historical Price Trajectory

Historically, metolazone’s cost has declined by approximately 60-80% over the last two decades, paralleling the genericization of related medications. In the U.S., prices for a 30-day supply of generic metolazone range from USD 4-15, depending on the supplier and formulation.

Factors Influencing Future Pricing

- Market Saturation: Increased generic competition likely to maintain downward price pressure.

- Manufacturing Costs: Stabilized due to mature production processes but sensitive to raw material prices.

- Regulatory and Patent Landscape: No active patent protections; however, potential biosimilar or innovative formulations could impact prices.

- Healthcare Policies: Reforms targeting drug pricing transparency could reinforce cost reduction trends.

Projected Price Range (Next 5 Years)

- Conservative Scenario: Stable prices trending slightly downward by 3-5% annually, maintaining current ranges.

- Optimistic Scenario: Further commoditization and increased competition could push prices down by 10-15% annually, especially in emerging markets.

- Potential Upside: Rare supply disruptions or regulatory barriers could temporarily elevate prices, but such scenarios are unlikely absent significant market shifts.

Market Opportunities & Challenges

Opportunities

- Expansion in Emerging Markets: Growing hypertension prevalence offers tailored marketing and supply chain strategies.

- Formulation Innovation: Development of combination therapies or sustained-release formulations can command premium pricing.

- Brand Differentiation: While challenging, emphasizing quality assurance and manufacturing excellence could attract institutional customers.

Challenges

- Price Erosion: High generic competition constrains profit margins.

- Regulatory Risks: Stringent compliance requirements can delay market access or renewal.

- Market Penetration: Saturated markets limit growth potential unless new indications or formulations emerge.

Regulatory Considerations

The predictable regulatory pathway for generic drugs like metolazone, given their long-standing approval history, simplifies market entry. However, biosimilar or novel formulations could face lengthy approval processes, influencing pricing and market share strategies.

Strategic Recommendations

- Focus on cost-efficient manufacturing to sustain margins amidst price pressures.

- Explore expansion into underserved markets with integrated distribution channels.

- Innovate with delivery mechanisms or combination therapy formulations.

- Engage with payers and policymakers to advocate for formulary inclusion and favorable reimbursement policies.

Key Takeaways

- Market Maturity: The metolazone market is highly commoditized with declining prices driven by generics and fierce competition.

- Pricing Outlook: Slight downward pressure expected over the next five years, with potential for regional variations.

- Growth Drivers: Demographic shifts, rising chronic disease prevalence, and emerging markets present growth avenues.

- Challenges: Price erosion and regulatory hurdles remain key concerns.

- Strategic Edge: Efficiency in manufacturing, market diversification, and formulation innovation are critical for sustaining profitability.

FAQs

1. What are the main factors influencing metolazone pricing?

Generic competition, manufacturing costs, regulatory environment, and regional reimbursement policies primarily influence prices. The high availability of generic equivalents exerts consistent downward pressure on pricing.

2. How does the global demand for antihypertensive drugs impact metolazone?

As a component of resistant hypertension management, metolazone benefits from increasing hypertension prevalence, especially in aging populations, supporting steady demand.

3. Are there emerging markets potential for metolazone?

Yes, rising healthcare infrastructure and increased hypertension awareness position regions like Asia-Pacific and Latin America as promising markets for expansion.

4. How might regulatory changes affect metolazone prices?

Stringent regulatory policies could delay approvals, increasing manufacturing costs temporarily; alternatively, relaxed regulations could intensify competition and depress prices further.

5. What strategic approaches can manufacturers adopt to maintain profitability?

Focusing on operational efficiencies, exploring formulations and combination therapies, expanding geographically, and engaging with payers for favorable formulary positioning are effective strategies.

References

- Centers for Disease Control and Prevention (CDC). "High Blood Pressure Facts." 2021.

- MarketWatch. "Diuretics Market Size and Trends," 2022.

- American Heart Association. "2021 Hypertension Treatment Guidelines."

- EvaluatePharma. "Generic Drugs Market Trends," 2022.

- World Health Organization (WHO). "Global Status of Noncommunicable Diseases," 2021.

More… ↓