Share This Page

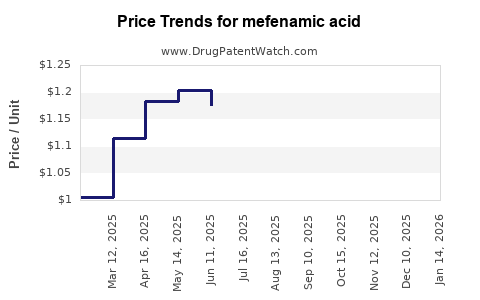

Drug Price Trends for mefenamic acid

✉ Email this page to a colleague

Average Pharmacy Cost for mefenamic acid

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MEFENAMIC ACID 250 MG CAPSULE | 42571-0258-30 | 1.00936 | EACH | 2025-11-19 |

| MEFENAMIC ACID 250 MG CAPSULE | 68180-0185-06 | 1.00936 | EACH | 2025-11-19 |

| MEFENAMIC ACID 250 MG CAPSULE | 42571-0258-30 | 1.01056 | EACH | 2025-10-22 |

| MEFENAMIC ACID 250 MG CAPSULE | 68180-0185-06 | 1.01056 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Mefenamic Acid

Introduction

Mefenamic acid, a non-steroidal anti-inflammatory drug (NSAID), is primarily used to treat mild to moderate pain, including dysmenorrhea, musculoskeletal pain, and other inflammatory conditions. Approved globally since the mid-20th century, mefenamic acid remains a staple in pain management due to its efficacy and relatively affordable cost. As the pharmaceutical landscape evolves with increased generic production and shifting regulatory environments, understanding current market dynamics and price trajectories is crucial for stakeholders including manufacturers, investors, healthcare providers, and policymakers.

Global Market Overview

Market Size and Growth Trends

The global mefenamic acid market is characterized by steady demand driven by the prevalence of menstrual pain and musculoskeletal disorders. According to industry reports, the NSAID segment, which encompasses mefenamic acid, was valued at approximately USD 15 billion in 2020, with a compounded annual growth rate (CAGR) of 5–6% projected through 2027 [1].

In the context of mefenamic acid specifically, the market size reflects its niche positioning—mainly used in countries with established generic drug markets such as India, China, and parts of Latin America. Emerging markets continue to expand due to increasing healthcare access and rising awareness of pain management options.

Regional Market Dynamics

-

Asia-Pacific: Dominates the mefenamic acid market, driven by high prevalence of menstrual pain and widespread generic manufacturing. India alone accounts for over 50% of global NSAID production, with significant exports to Africa and Southeast Asia [2].

-

North America: Despite a mature pharmaceutical market, the adoption of mefenamic acid is relatively limited owing to preferences for other NSAIDs such as ibuprofen and naproxen. Nonetheless, regulatory approvals for generic versions expand access.

-

Europe: Stringent regulatory standards constrain market growth slightly, but a strong presence of generic manufacturers sustains steady demand.

Market Drivers

-

Rising Prevalence of Menstrual Disorders: Dysmenorrhea affects roughly 50% of women worldwide [3], fuelling demand for effective pain relievers like mefenamic acid.

-

Growing Geriatric Population: Increasing incidences of musculoskeletal conditions enhance NSAID consumption.

-

Cost-Effectiveness of Generics: The proliferation of generic manufacturing reduces prices and improves accessibility, especially in developing economies.

-

Regulatory Support: Approval of generic versions in major markets facilitates market expansion.

Market Challenges

-

Safety Concerns: NSAIDs, including mefenamic acid, pose gastrointestinal, cardiovascular, and renal risks, leading to cautious prescribing practices.

-

Competition from Alternative NSAIDs: Drugs such as ibuprofen, diclofenac, and naproxen often dominate due to better safety profiles and consumer familiarity.

-

Regulatory Variability: Differences in drug approval and patent landscapes across countries influence market penetration.

Key Market Players

Major pharmaceutical companies manufacturing or distributing mefenamic acid include:

- Sun Pharmaceutical Industries Ltd.

- Lupin Limited

- Cipla Ltd.

- Mylan N.V.

- Aurobindo Pharma

Most of these companies operate within a high-volume, low-margin environment, emphasizing cost competitiveness.

Price Projections for Mefenamic Acid

Current Pricing Overview

The price of mefenamic acid varies significantly across regions:

-

India: Wholesale prices for generic tablets (250 mg) range from USD 0.02 to 0.05 per tablet, with retail prices slightly higher [4].

-

United States and Europe: The drug is less commonly marketed; when available, prices can exceed USD 0.50 per tablet due to regulatory and market factors.

-

Emerging Markets: Prices tend to be lower, driven by intense generic competition and lower regulatory costs.

Factors Influencing Future Prices

-

Patent and Regulatory Landscape: Most patents for proprietary formulations have expired or are nearing expiration, prompting increased generic competition and price erosion.

-

Manufacturing Costs: Advances in manufacturing streamline production, reducing costs further, particularly in countries with advanced pharmaceutical infrastructure.

-

Demand Dynamics: Growing acceptance in developing countries sustains overall volume, even as prices decline.

-

Regulatory Challenges and Safety Guidelines: Stricter regulations may introduce new restrictions or require reformulations, impacting costs.

Projected Price Trends (2023–2030)

Based on current market trends, regulatory environments, and production efficiencies, the following projections are reasonable:

-

Price Decline in Generics: A compound annual reduction of 2–4% over the next decade is anticipated due to intensified generic competition and manufacturing efficiencies, especially in Asia.

-

Regional Variations: Prices in developed markets are unlikely to fall significantly below USD 0.20 per tablet due to regulatory barriers and market saturation, whereas prices in developing markets may decline to USD 0.01–0.03 per tablet.

-

Impact of Potential New Formulations: Introduction of sustained-release or combination formulations may temporarily increase prices, but widespread adoption is unlikely unless justified by significant clinical benefits.

Potential Market Price Floor

As manufacturers aim for cost recovery and profit margins, the price of mefenamic acid in high-volume markets is expected to stabilize around USD 0.005–0.01 per tablet in the long term for generic formulations in developing regions.

Conclusion

The mefenamic acid market exhibits stability driven by its entrenched clinical role and cost advantages presented by generics. Accelerating generic entry, manufacturing efficiencies, and expanding demand in emerging markets will sustain downward price pressures, particularly in low-income regions. Conversely, regulatory hurdles and safety considerations will moderate growth and pricing in mature markets.

Key Takeaways

- The global mefenamic acid market is expanding modestly, predominantly fueled by demand in Asia-Pacific and Latin America.

- Price reduction trends are expected to continue, especially for generic versions, with prices possibly dipping below USD 0.02 per tablet in developing regions by 2030.

- Regulatory and safety considerations remain crucial; evolving guidelines may influence market availability and pricing.

- Manufacturers should focus on cost-effective production and regulatory compliance to sustain competitiveness.

- Stakeholders should monitor regional market dynamics and emerging formulations that could impact demand and prices.

FAQs

-

What is the main therapeutic use of mefenamic acid?

Mefenamic acid is primarily used to treat mild to moderate pain, including menstrual cramps, musculoskeletal pain, and inflammatory conditions. -

How does the price of mefenamic acid vary globally?

Prices fluctuate based on regional manufacturing costs, regulatory environments, and market competition, ranging from USD 0.005 in developing regions to over USD 0.50 per tablet in developed markets. -

What factors will influence the future price of mefenamic acid?

Key factors include patent expirations, generic competition, manufacturing efficiencies, safety regulations, and demand in emerging markets. -

Are there any emerging trends that could impact the mefenamic acid market?

Yes, increasing adoption of combination therapies, formulation innovations, and heightened regulatory scrutiny could reshape supply and pricing dynamics. -

What risks could affect the market stability of mefenamic acid?

Safety concerns related to NSAIDs, stricter regulatory standards, and competition from newer analgesic agents may impact market stability and pricing.

References

[1] MarketWatch. "NSAID Market Size and Growth." 2021.

[2] IMS Health. "Global Generic Drug Production Report." 2022.

[3] World Health Organization. "Menstrual Disorders and Pain Management." 2020.

[4] Indian Pharmaceutical Market Data. "Average Wholesale Prices of NSAIDs." 2022.

More… ↓