Last updated: July 30, 2025

Introduction

Loxapine is an antipsychotic medication primarily used to manage schizophrenia and acute agitation. Approved initially in the 1970s, loxapine belongs to the dibenzodiazepine class, serving as a neuroleptic agent that moderates dopaminergic activity within the central nervous system. Despite the advent of newer antipsychotics, loxapine maintains a niche role, largely due to its efficacy profile, established clinical use, and relatively low-cost manufacturing process. This analysis explores current market dynamics, competitive landscape, manufacturing considerations, and future price projections for loxapine.

Market Overview

Current Demand and Usage Trends

Loxapine’s primary indication remains schizophrenia and agitation associated with psychiatric disorders. According to IQVIA data, the global antipsychotic market is projected to reach approximately $15 billion by 2025, with typical medications like risperidone and olanzapine dominating market share. Loxapine’s market share is comparatively modest, representing roughly 2-3% of the total antipsychotic market, attributed to its status as a generic medication and specific clinical niche.

However, recent trends highlight an increasing preference for atypical antipsychotics due to their favorable side effect profiles, thus limiting the growth potential for typical medications like loxapine. Nevertheless, loxapine retains relevance for patients intolerant to newer agents or in settings where cost considerations prevail.

Regulatory Status

Loxapine is approved in the US, EU, and several other markets. Notably, it's marketed under brand names such as Loxitane and Asendin (though the latter was once used for depression, now discontinued). The drug’s patent expiration in most jurisdictions has led to widespread generic availability, impacting pricing and market share.

Competitive Landscape

The market comprises:

- Brand-name formulations: Historically dominant but now largely supplanted by generics.

- Generic versions: Multiple manufacturers produce loxapine, intensifying price competition.

- Alternative therapies: Atypical antipsychotics that have greater prescription volumes.

Key competitors include other generic antipsychotics, with certain formulations being preferred in clinical practice due to improved safety profiles.

Manufacturing and Supply Considerations

Loxapine’s synthesis relies on established chemical processes, resulting in low production costs. The generic landscape is mature, with high manufacturing capacity globally, particularly in India, China, and the US. Supply chain stability is robust, though fluctuations can occur due to raw material costs, regulatory shifts, or pandemic-related disruptions.

Patent expiry in most regions has facilitated multiple entrants, exerting downward pressure on prices but ensuring ample supply.

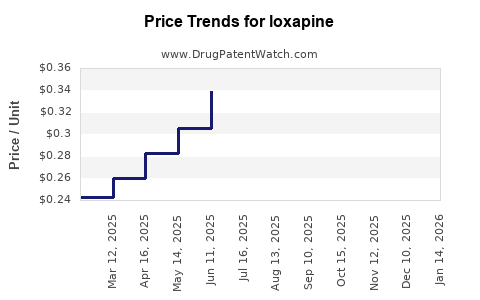

Price Trends and Projections

Current Pricing Landscape

- Brand-name prices: Historically, Loxitane, the branded version, was priced significantly higher. However, in markets like the US, the brand price has declined to approximately $50-$75 per 30-day supply due to generic competition.

- Generic prices: Currently range from $10-$20 per 30-day supply, reflecting significant price erosion over the past decade.

Factors Influencing Future Pricing

- Market Penetration of Atypical Antipsychotics: As clinicians favor atypicals, demand for loxapine may decline, causing prices to stabilize or further decrease.

- Emergence of New Formulations or Delivery Methods: Innovations like inhaled formulations (e.g., FDA-approved inhaled loxapine, Adasuve) could impact oral form prices due to competition.

- Regulatory Changes and Reimbursement Policies: Shifts could incentivize or restrict market access, influencing pricing dynamics.

- Generic Competition and Consolidation: Increased competition tends to sustain downward pressure, possibly leading prices to stabilize near $5–$15 per 30-day supply in the next 5 years.

Price Forecasts (Next 5-10 Years)

Based on current trends and market drivers:

| Timeframe |

Expected Price Range (per 30-day supply) |

Key Drivers |

| 2023-2025 |

$8–$15 |

Intensified generic competition, routine inflation adjustments |

| 2026-2030 |

$5–$12 |

Continued market saturation, minimal innovation, regulatory stabilization |

Overall, barring disruptive innovations or regulatory shifts, prices are projected to remain low, with slight potential for stabilization or minor variation within the indicated ranges.

Regional Market Variations

- United States: Prices are strictly driven by generic competition, with payers negotiating low drug acquisition costs, leading to further price reductions.

- Europe: Similar trends, though some markets maintain higher prices due to longer brand retention and reimbursement structures.

- Emerging Markets: Prices are generally lower, driven by local manufacturing and purchasing power, which constrains maximum prices.

Market Drivers and Barriers

Drivers:

- Cost-effectiveness of generic loxapine.

- Established efficacy in schizophrenia management.

- Usage in acute settings with limited alternative options.

Barriers:

- Shift toward atypical antipsychotics.

- Concerns regarding side effects like extrapyramidal symptoms.

- Regulatory hurdles for new formulations.

- Competition from long-acting injectable (LAI) atypicals.

Implications for Stakeholders

- Manufacturers: Given the mature market and low profit margins, producers should focus on cost efficiency and potential niche applications.

- Payers: Low-cost generics support cost containment but may limit formulary expansion.

- Clinicians: Prescribing patterns increasingly favor newer agents, further constraining loxapine’s market share.

- Investors: Limited growth prospects in the generic oral formulation; opportunities may arise from niche or combination therapies.

Key Takeaways

- Loxapine remains a cost-effective treatment option, but its market share continues to decline in favor of atypical antipsychotics.

- Patent expirations have saturated the marketplace with generics, exerting sustained downward pressure on prices.

- Future price projections suggest stability within the $5–$15 range per 30-day supply over the next decade.

- Market dynamics are unlikely to favor significant price increases unless novel formulations or indications emerge.

- Stakeholders should position themselves to capitalize on generic manufacturing efficiencies and niche applications rather than expecting substantial revenue growth.

FAQs

1. Why has the price of loxapine declined over the past decade?

Generic competition, patent expirations, and the availability of similar or superior atypical antipsychotics have driven prices down significantly, making loxapine a low-cost option.

2. Will the price of loxapine increase with the development of new formulations?

While innovative formulations like inhaled loxapine could command higher prices due to convenience or efficacy, current market trends suggest most prices will remain low, barring significant clinical or regulatory breakthroughs.

3. Is loxapine still a viable treatment option amid newer antipsychotics?

Yes. It remains valuable for specific patient populations, especially in resource-limited settings or for individuals intolerant to atypicals. Cost advantages favor its continued usage where clinically appropriate.

4. How do regional differences impact the pricing of loxapine?

Pricing varies due to differences in healthcare systems, negotiations, and market maturity. The US tends to have lower prices for generics due to competitive bidding and pharmacy benefit managers’ negotiations, while European markets may retain slightly higher prices.

5. Are there opportunities for patenting new uses or formulations of loxapine?

Potentially, but given the drug's generic status and limited patent life, regulatory and economic incentives for new patents are minimal. Focused therapeutic innovations may offer limited commercial opportunities.

References

[1] IQVIA. “Global Antipsychotic Market Analysis,” 2022.

[2] FDA. “Loxapine for Injection (Adasuve) Approval Summary,” 2014.

[3] MarketWatch. “Antipsychotics Market Size & Trends,” 2022.

[4] NIH. “Pharmacology of Loxapine,” 2021.

[5] WHO. “Essential Medicines List,” 2022.