Share This Page

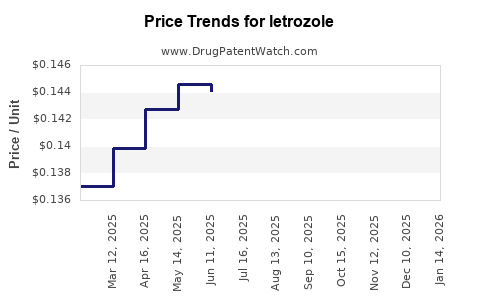

Drug Price Trends for letrozole

✉ Email this page to a colleague

Average Pharmacy Cost for letrozole

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LETROZOLE 2.5 MG TABLET | 50268-0476-11 | 0.13828 | EACH | 2025-11-19 |

| LETROZOLE 2.5 MG TABLET | 23155-0875-03 | 0.13828 | EACH | 2025-11-19 |

| LETROZOLE 2.5 MG TABLET | 23155-0875-10 | 0.13828 | EACH | 2025-11-19 |

| LETROZOLE 2.5 MG TABLET | 00093-7620-56 | 0.13828 | EACH | 2025-11-19 |

| LETROZOLE 2.5 MG TABLET | 23155-0875-09 | 0.13828 | EACH | 2025-11-19 |

| LETROZOLE 2.5 MG TABLET | 16729-0034-10 | 0.13828 | EACH | 2025-11-19 |

| LETROZOLE 2.5 MG TABLET | 16729-0034-15 | 0.13828 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Letrozole

Introduction

Letrozole, a non-steroidal aromatase inhibitor, is primarily prescribed for hormone receptor-positive breast cancer treatment in postmenopausal women. Since its initial approval in 1997 for breast cancer therapy, it has become a critical component of endocrine therapy, especially in adjuvant and metastatic settings. The market landscape for letrozole has evolved significantly, driven by the increasing prevalence of breast cancer, advancements in formulation options, and global patent strategies. This analysis explores current market dynamics, competitive landscape, regulatory considerations, and future price trajectories for letrozole.

Market Overview

Global Market Size and Growth Trends

The global breast cancer therapeutics market was valued at approximately USD 19.2 billion in 2021 and is projected to grow at a Compound Annual Growth Rate (CAGR) of around 8.2% through 2028 (Grand View Research). Letrozole occupies a substantial share within this segment, owing to its proven efficacy, safety profile, and inclusion in standard of care protocols.

The estimated global sales of letrozole reached USD 980 million in 2022, with an annual growth rate influenced by increasing breast cancer incidence, particularly in aging populations, and expanding off-label uses in fertility treatments. The Asia-Pacific (APAC) region is showing the fastest growth, driven by rising awareness and healthcare infrastructure improvements.

Key Drivers

- Rising Breast Cancer Incidence: WHO estimates approximately 2.3 million new cases globally in 2020, with an upward trend in both developed and developing regions.

- Expanded Indications: Emerging evidence supports use in fertility treatments and ovarian stimulation, broadening potential market applications.

- Healthcare Policy and Reimbursement: Favorable reimbursement policies in developed markets enhance accessibility, boosting sales.

- Generic Entry: The expiration of key patents, notably in major markets, has triggered a proliferation of generic options, reducing prices and increasing access.

Competitive Landscape

Patent and Regulatory Status

- The original patent for letrozole (marketed as Femara) expired in the U.S. in 2015, culminating in multiple generic manufacturers entering the market.

- Patent expiries are a pivotal factor influencing pricing and market share distribution.

- In emerging markets, patent protection varies, affecting local pricing strategies.

Major Manufacturers

- Novartis (Femara): The original innovator with significant brand recognition, though sales have declined post-patent expiry.

- Generic Manufacturers: Companies such as Teva, Mylan (now Viatris), Dr. Reddy’s Labs, and Cipla dominate the generics space, offering cost-competitive options.

- Regional Players: Local firms in Asia and Latin America are expanding their market share through local distribution channels and cost advantages.

Pricing Strategies

Post-patent expiration, prices for letrozole generics have dropped by approximately 50-70%, varying regionally. Price competition remains fierce, especially in markets with high price sensitivity, such as India and China.

Regulatory and Reimbursement Environment

In developed markets, regulatory agencies like the FDA and EMA facilitate approval pathways for generics, contributing to price declines. Reimbursement policies further influence market penetration; for example, in the U.S., Medicare and private insurers favor lower-cost generics, pressure pricing structures.

In emerging markets, regulatory barriers and procurement processes can delay generic introduction, impacting pricing dynamics.

Price Projections

Historical Price Trends

- Brand-Name Price (U.S.): A six-month prescription of Femara has historically averaged USD 700– USD 1,200, depending on dosage and pharmacy.

- Generic Price (U.S.): Post-patent expiry, prices declined sharply, with a typical six-month supply costing approximately USD 150–USD 350.

Future Price Trajectory

Given the proliferation of generics and biosimilars, prices are expected to stabilize at low levels in mature markets, with minimal fluctuations over the next 5 years.

In developed markets:

- Stabilization at low-cost generics (~USD 100–USD 200 per 30-count tablet pack) is anticipated, driven by intense rivalry among manufacturers.

- Premium formulations or combination pills might retain higher prices but will constitute niche segments.

In emerging markets:

- Prices are projected to decline further, with some markets possibly reaching below USD 50 per pack within the next 3–4 years, guided by local regulatory policies and procurement practices.

Influencing Factors

- Patent Litigation and Expiry: As additional patents expire, price reductions are likely to accelerate.

- Supply Chain Dynamics: Increased manufacturing capacity and local production will reinforce price competitiveness.

- Governmental Price Controls: Countries implementing strict price controls will maintain lower prices, limiting upward movement.

Market Challenges and Opportunities

Challenges

- Pricing Pressure: Continuous erosion of brand and early-mover advantage due to generics.

- Regulatory Barriers: Stringent approval and registration processes in some markets slow down new entrants.

- Market Saturation: Established markets near saturation limit growth.

Opportunities

- Emerging Markets Expansion: Growing breast cancer prevalence presents open avenues with less saturated markets.

- Combination Therapies: Partnership opportunities with oncology or fertility drug developers.

- Digital and Value-Based Pricing Models: Adoption of innovative pricing strategies aligned with healthcare outcomes.

Implications for Industry Stakeholders

- Pharmaceutical Companies: Focus on cost-efficient manufacturing, patent strategies, and regional market adaptations to optimize profit margins amid declining prices.

- Investors: Recognize slowing growth in mature markets but anticipate expansion in underpenetrated regions.

- Healthcare Providers: Navigate affordability challenges ensuring access with the availability of low-cost generics.

- Policymakers: Balance affordability and innovation incentives via appropriate regulation.

Key Takeaways

- The global market for letrozole remains robust, primarily supported by increasing breast cancer cases and expanding indications.

- The expiration of key patents has triggered a significant price decline, especially in North America and Europe, with generic prices stabilizing at USD 100–USD 200 per month supply.

- Emerging markets will continue to see dynamic pricing reductions, with local manufacturing and regulatory frameworks facilitating increased affordability.

- Future price projections suggest minimal upward movement in mature markets due to intense generic competition, but regional variations will persist.

- Strategic focus on developing regionally adapted sourcing, intellectual property management, and market diversification will be essential for stakeholders aiming to sustain profitability.

FAQs

1. How will patent expiries influence the future price of letrozole?

Patent expiries lead to increased generic competition, which markedly reduces prices. As more patents expire, prices will stabilize at lower levels, especially in mature markets with multiple generic suppliers.

2. Are there any upcoming formulations or approvals that could impact the market?

While current formulations are well-established, there is ongoing research into combination therapies and novel delivery systems. Pending regulatory approvals could create niche markets or slight price adjustments.

3. Which regions represent the highest growth opportunities for letrozole?

Emerging markets in Asia-Pacific, Latin America, and Africa offer substantial growth potential due to rising breast cancer rates, improving healthcare infrastructure, and less saturated markets.

4. How do pricing strategies differ between brand-name and generic letrozole?

Brand-name drugs command higher prices to recover R&D investments, whereas generics focus on price competition, often offering prices 50-70% lower than the brand, especially after patent expiry.

5. What factors could hinder price reductions or market expansion?

Regulatory hurdles, supply chain issues, patent litigations, and government price controls can impede price reductions and slow market expansion in certain regions.

References

- Grand View Research. Breast Cancer Therapeutics Market Size & Trends. 2022.

- World Health Organization. Global Cancer Statistics 2020.

- U.S. Food and Drug Administration. Patent and exclusivity information for Femara.

- IMS Health (IQVIA). Pharmaceutical Market Data. 2022.

- MarketWatch. Industry reports on generic pharmaceutical pricing trends.

More… ↓