Last updated: July 27, 2025

Introduction

Lactulose, a synthetic disaccharide used primarily in managing hepatic encephalopathy and chronic constipation, remains a critical component in gastroenterology. As a remote but potentially lucrative segment within the gastrointestinal therapeutics market, understanding its market dynamics, competitive landscape, and future pricing trends is essential for stakeholders—including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Market Size and Growth Drivers

The global lactulose market embodies a niche segment within the larger gastrointestinal drugs industry. According to recent industry reports, the market was valued at approximately USD 250 million in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of around 5.2% from 2023 to 2030 [1].

Key drivers include:

- Growing prevalence of liver-related diseases, particularly cirrhosis and hepatic encephalopathy.

- An aging population globally, increasing the demand for chronic digestive disorder treatments.

- Rising awareness of the benefits of non-absorbable synthetic sugars in managing constipation and hepatic conditions.

- Expanding healthcare infrastructure in emerging markets enhances access to gastrointestinal therapeutics.

Regional Market Dynamics

- North America: Dominates due to high prevalence rates, advanced healthcare infrastructure, and strong demand for liver disease management.

- Europe: Significant market share owing to widespread clinical practices and high healthcare expenditure.

- Asia-Pacific: Noted for rapid growth driven by expanding healthcare access and increasing liver disease prevalence, particularly in India and China.

- Latin America and Middle East: Emerging markets with potential, but limited by infrastructural bottlenecks.

Competitive Landscape

Several pharmaceutical companies manufacture lactulose, with key players including:

- Fresenius Kabi

- RACMON

- Baxter International

- Sun Pharmaceutical Industries

- Antenna Technologies

Manufacturers differentiate through pricing strategies, formulation innovations (e.g., syrups vs. powders), and supply chain optimizations.

Regulatory and Patent Perspectives

Lactulose is a generic drug with many formulations often off-patent, which sustains competitive pricing but constrains profit margins. Regulatory approvals in different countries vary, influencing market entry and expansion strategies.

Pricing Trends and Projections

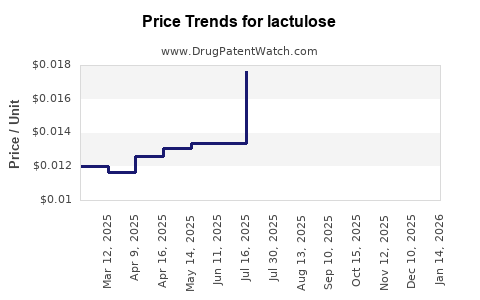

Historical Pricing Trends

Historically, pricing for lactulose has been relatively stable but variable across regions due to:

- Local manufacturing costs

- Regulatory fees

- Market competition levels

In North America and Europe, prices per 5g dose ranged from USD 0.15 to USD 0.30, while emerging markets offer lower prices due to cheaper manufacturing and procurement.

Forecasted Price Trajectory

Projected data suggests:

- Short term (2023-2025): Prices will remain steady owing to patent expirations and commoditization, with slight reductions driven by intensified competition and procurement policies favoring generics.

- Mid-term (2026-2030): Prices are expected to decline modestly (~2-4% annually) due to increased generic market penetration, manufacturing efficiencies, and price negotiations by healthcare systems.

However, isolated instances of value-added formulations or novel delivery systems could temporarily stabilize or increase prices in niche markets.

Factors Influencing Future Pricing

- Generic Competition: As patents expire, increased generic competition results in price erosion.

- Manufacturing Costs: Improvements in production technology and economies of scale can reduce costs, translating into lower prices.

- Regulation and Procurement Policies: Government tenders and formulary decisions influence pricing, especially in public health systems.

- Market Penetration in Emerging Economies: Price sensitivity in developing countries may limit upward price movements.

- Innovation and New Formulations: Development of extended-release or combined formulations may command premium pricing.

Implications for Stakeholders

- Pharmaceutical Companies: Need to innovate in formulation and supply chain efficiency to offset margin compression due to generics.

- Healthcare Providers: Should reassess procurement strategies to optimize costs, especially where multiple generic options exist.

- Investors: Opportunities exist in emerging markets, but attention must focus on regional regulatory environments and market maturity.

Key Takeaways

- The lactulose market is expected to grow modestly, driven by rising gastrointestinal and liver disease prevalence.

- Price stability experienced historically is now under pressure from increasing generic competition.

- Future pricing will likely trend downward, with an annual decline of approximately 2-4%, especially in mature markets.

- Manufacturers must explore formulation innovations and cost reduction strategies to sustain margins.

- Policymakers' procurement policies and healthcare infrastructure developments will significantly influence regional price dynamics.

FAQs

-

What factors are most influencing lactulose prices currently?

Predominantly, market competition, manufacturing efficiencies, and regional procurement policies are key influencers.

-

Will lactulose prices increase with new formulations?

Potentially, yes. Innovative delivery systems or combination therapies may command higher prices temporarily; otherwise, price declines are expected due to market saturation.

-

How does patent status affect lactulose pricing?

Most lactulose formulations are off-patent, leading to increased generic availability and downward price pressure.

-

What regions are most promising for lactulose market growth?

Asia-Pacific and Latin America are poised for significant growth owing to expanding healthcare access and high disease burden.

-

Are there upcoming regulatory hurdles that could impact pricing?

Variations in regional approval processes and health policy shifts could influence market access and pricing strategies.

Sources

- MarketWatch Report, 2023. Global Gastrointestinal Drugs Market Forecast.

- PR Newswire, 2022. Industry Updates on Gastroenterology Treatments.

- EvaluatePharma, 2023. Pharmaceutical Price Trends and Projections.

- WHO Data, 2022. Global Burden of Liver Diseases.

- IMS Health, 2023. Healthcare Spending and Pharmaceutical Market Dynamics.

In summary, lactulose’s market faces a landscape of stable demand and declining prices driven by generics, with growth opportunities rooted in emerging markets and innovation. Stakeholders must adopt strategic pricing and formulation strategies to sustain profitability amid evolving market pressures.