Last updated: July 27, 2025

Introduction

Ketoconazole, an azole antifungal agent primarily used for treating fungal infections, has historically maintained a significant presence in both prescription and over-the-counter pharmacological markets. Originally introduced in the 1980s, ketoconazole was one of the first broad-spectrum antifungals and remains relevant today for certain dermatological and systemic fungal conditions. This analysis examines current market dynamics, competitive landscape, regulatory factors, and provides price projections considering evolving therapeutic standards.

Market Overview

Historical Context and Usage

Ketoconazole’s initial prominence was driven by its broad antifungal efficacy, notably against systemic and topical infections such as candidiasis, dermatophyte infections, and seborrheic dermatitis. While oral formulations gained popularity, concerns around hepatotoxicity—highlighted by regulatory agencies like the U.S. Food and Drug Administration (FDA)—have curtailed its systemic use, shifting focus toward topical applications.

Current Market Size and Segments

The global antifungal market was valued at approximately USD 14.1 billion in 2021, with ketoconazole accounting for a significant share in topical formulations. The topical segment dominates due to its safer profile compared to oral formulations, which are now restricted in several regions.

North America and Europe constitute the largest markets, driven by high healthcare expenditures and awareness of fungal infections. The Asia-Pacific region presents emerging opportunities owing to increasing healthcare access and prevalence of fungal infections, especially in developing countries.

Key Players

Major pharmaceutical companies manufacturing ketoconazole include Johnson & Johnson (Nizoral), Novartis, and Sun Pharma. Generic manufacturers also supply market volume, often at lower prices, affecting overall pricing structures.

Regulatory and Safety Considerations

Regulatory agencies have significantly impacted ketoconazole’s market trajectory:

-

FDA Restrictions: In 2013, the FDA restricted oral ketoconazole use to treat serious fungal infections only when no suitable alternatives are available, citing risks of hepatotoxicity and adrenal insufficiency.

-

EMA and Other Agencies: Similar measures have been adopted elsewhere, with emphasis on topical and other antifungal agents as safer alternatives.

These safety concerns have resulted in a decline in systemic ketoconazole prescriptions, transforming the market landscape predominantly into topical formulations.

Competitive Landscape and Alternatives

With the decline of oral ketoconazole use, competition has intensified from other antifungals, including:

- Itraconazole and fluconazole—broad-spectrum oral antifungals with better safety profiles.

- Efinaconazole and sertaconazole—newer topical azoles with improved efficacy.

- Non-azole antifungals such as allylamines and newer topical agents.

Market share shifts reflect a focus on safer, more effective, and better-tolerated options, which impacts ketoconazole’s positioning.

Pricing Dynamics

Historical Pricing

Historically, ketoconazole's price was influenced by patent protections and brand dominance. With the expiration of key patents, generic versions flooded the market, substantially reducing prices.

Brand-name topical formulations: Historically ranged between USD 10–20 per tube.

Generic formulations: Prices dropped below USD 5 per tube, increasing accessibility but reducing profit margins.

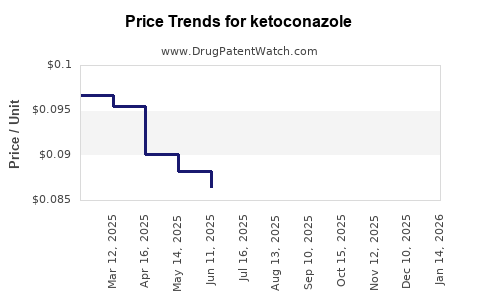

Current Pricing Trends

In recent years, regulatory restrictions on oral formulations caused a shift toward topical applications, which are generally priced lower due to market competition. The average retail price of generic ketoconazole cream (2%) is approximately USD 3–6 per tube [2]. Brand-name products like Nizoral can command prices up to USD 10–15 per tube.

Future Pricing Outlook

As newer azoles with enhanced efficacy and safety profiles dominate the market, the demand and pricing for ketoconazole, especially in systemic form, are expected to decline further.

However, topical formulations, owing to their broad availability and lack of stringent regulation, will likely maintain stable, low pricing levels driven by generic competition. Price projections suggest:

-

Near-term (1–3 years): Stable prices for topical formulations, around USD 3–6 per tube.

-

Long-term (3–5 years): Slight decline or stabilization at current levels, with marginal influence from potential formulation innovations or regional market adjustments.

Market Drivers and Constraints

Drivers:

- Rising incidence of superficial fungal infections globally.

- Increasing awareness and diagnosis rates.

- Cost-effective generics expanding access, particularly in emerging markets.

- Regulatory push towards safer, topical antifold agents aligning with safety profiles.

Constraints:

- Regulatory restrictions on systemic use.

- Competition from newer, more effective antifungals.

- Market preference shifting toward drugs with improved safety and efficacy profiles.

- Patent expirations reducing profit margins for branded formulations.

Regional Market Insights

- North America: Mature market with widespread adoption of topical formulations; constrained systemic use.

- Europe: Similar trends, with increased regulation influencing prescription patterns.

- Asia-Pacific: Expanding markets with high fungal infection prevalence; price-sensitive markets favor generics.

- Latin America and Africa: Growing demand, but constrained by affordability and healthcare infrastructure.

Strategic Implications

Pharmaceutical companies seeking to capitalize on ketoconazole should focus on:

- Enhancing topical formulations with improved delivery mechanisms.

- Differentiating through combination therapies or novel formulations.

- Expanding access in developing regions through competitive pricing.

- Navigating regulatory landscapes to optimize market entry and sustainability.

Conclusion

The market for ketoconazole, especially in topical form, is characterized by steady demand driven by dermatological needs and price competitiveness. Systemic indications have largely declined in prominence, replaced by newer azoles with better safety profiles. Price projections indicate stability in generic topical formulations, with slight downward pressure due to increasing competition. Innovation, regulatory navigation, and regional expansion are key to maintaining relevance in an evolving antifungal landscape.

Key Takeaways

- Market size remains substantial for topical ketoconazole, driven by fungal infection prevalence and cost-effective generics.

- Regulatory scrutiny on systemic use has reshaped the market, favoring safer topical formulations.

- Pricing is expected to remain stable for generic topical products, with marginal declines due to market competition.

- Opportunities exist in emerging markets through affordable formulations and distribution channels.

- Innovation and strategic positioning are essential to sustain market relevance amid competition from newer antifungals.

FAQs

1. How has regulatory action impacted ketoconazole’s market?

Regulatory agencies, notably the FDA, restricted oral ketoconazole use due to safety concerns, leading to a decline in systemic prescriptions. This shift increased reliance on topical formulations, which are less regulated and more affordable, altering the market dynamics.

2. What is the current average price of topical ketoconazole?

Generic topical ketoconazole creams typically retail between USD 3–6 per tube. Brand-name products like Nizoral are priced higher, around USD 10–15 per tube.

3. Are there new developments that could influence ketoconazole pricing?

While current formulations are mature, innovations such as nanoparticle delivery or combination therapies could enhance efficacy, potentially influencing market prices and positioning. However, these are in developmental stages.

4. How does regional variation affect ketoconazole pricing?

In developed markets like North America and Europe, prices tend to be higher due to branding and healthcare infrastructure, whereas in emerging markets, pricing is driven by generic availability and affordability considerations.

5. What competitors threaten ketoconazole’s market share?

Newer azole antifungals (e.g., efinaconazole, sertaconazole) and non-azole agents with improved safety and efficacy profiles are gaining traction, especially for topical use, thus eroding ketoconazole’s dominance.

Sources:

[1] MarketsandMarkets. (2022). Antifungal Drugs Market Analysis.

[2] FDA Drug Safety Communications. (2013). FDA updates on ketoconazole safety.