Share This Page

Drug Price Trends for isradipine

✉ Email this page to a colleague

Average Pharmacy Cost for isradipine

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ISRADIPINE 5 MG CAPSULE | 64850-0911-01 | 2.13240 | EACH | 2025-11-19 |

| ISRADIPINE 5 MG CAPSULE | 42806-0264-01 | 2.13240 | EACH | 2025-11-19 |

| ISRADIPINE 5 MG CAPSULE | 16252-0540-01 | 2.13240 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Isradipine

Introduction

Isradipine, a calcium channel blocker primarily prescribed for hypertension and angina, is part of the dihydropyridine class of medications. Originally developed by GlaxoSmithKline (GSK) in the 1980s, it was later acquired by other pharmaceutical companies after patent expiry. While not as prominent as first-line agents like amlodipine, isradipine has garnered renewed interest owing to its potential neuroprotective properties and evolving therapeutic landscapes. This analysis evaluates the current market dynamics, patent status, competitive landscape, and future pricing trends of isradipine to assist stakeholders in strategic decision-making.

Market Overview

Historical Market Performance

Historically, isradipine experienced moderate commercial success within cardiovascular therapy, primarily across North American and European markets. Its initial usage was limited due to competition from more established calcium channel blockers (CCBs) such as amlodipine and nifedipine, which offered longer half-lives and broader indications. Nonetheless, isradipine maintained a niche role in specific hypertension cases, especially among patients intolerant to other CCBs.

Current Therapeutic Landscape

The standard care for hypertension involves a spectrum of first-line agents, including thiazide diuretics, ACE inhibitors, ARBs, and CCBs. The global hypertension market is projected to grow substantially, driven by aging populations and rising prevalence of cardiovascular diseases. Approximately 1.13 billion adults suffer from hypertension worldwide, signaling potential demand for a diversified portfolio of antihypertensives like isradipine [1].

Emerging therapeutic potential:

Recent studies suggest neuroprotective effects of isradipine in neurodegenerative conditions like Parkinson’s disease, increasing interest in its off-label use and repurposing potential. Although still experimental, this trajectory could influence market factors in future years.

Regulatory and Patent Status

The original patent for isradipine has long expired, which has led to the proliferation of generic versions globally. The loss of patent exclusivity diminishes pricing power and intensifies generic competition, placing downward pressure on drug prices.

However, specialty use for indications beyond hypertension, such as neuroprotection, may be subject to new patent filings or orphan drug designations, potentially creating niche markets with higher pricing premiums.

Competitive Analysis

Generic Market Presence:

The primary competitive edge in the current landscape stems from generic manufacturing. Major pharmaceutical firms produce isradipine generics, leading to price erosion.

Brand vs. Generic:

No recent blockbuster branded formulations dominate; instead, market share hinges on price, distribution strength, and physician prescribing patterns. Patients with specific contraindications to other CCBs constitute a small but steady demand segment.

Emerging Competition:

Newer CCBs with improved pharmacokinetics or safety profiles, such as amlodipine, continue to challenge isradipine’s market share.

Potential Niches:

The drug’s off-label neuroprotective application, if proven through clinical trials, may carve out a specialized market segment with potential for premium pricing.

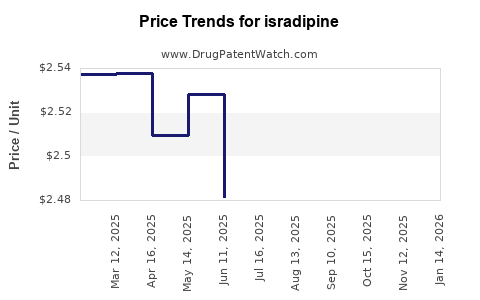

Price Projections

Current Pricing Dynamics

The average retail price of isradipine varies globally, generally ranging from $0.02 to $0.10 per tablet for generic formulations. In the United States, prices for generic 5 mg tablets hover around $0.03 to $0.05 per unit, reflecting significant price erosion following patent expiration. Bi-monthly therapy costs approximate $15 to $25, substantially lower than branded alternatives.

Future Price Trends

Short-term outlook (1-3 years):

Given widespread generic availability, prices are unlikely to increase. Competition will sustain low pricing, with minimal margins for manufacturers. Price stability or further reduction is expected unless supply chain anomalies or new formulations emerge.

Medium to long-term outlook (3-10 years):

Potential for marginal price increases exists if novel formulations or delivery mechanisms (e.g., controlled-release) are introduced, increasing manufacturing costs. A speculative rise could reach $0.05 to $0.12 per tablet if regulatory exclusivity is secured via indications such as neurodegeneration.

Impact of Repurposing and New Indications

If ongoing research establishes isradipine’s efficacy in neurodegenerative diseases like Parkinson's, regulatory approvals could lead to patent filings or orphan drug designations, justifying higher prices—possibly within $0.50 to $1.00 per tablet—aligned with niche therapies. However, such scenarios remain speculative pending clinical validation.

Regulatory and Market Barriers

-

Regulatory hurdles:

Approval for new indications involves significant clinical trial investments, extending timelines and costs. -

Manufacturing and supply chain:

Risks include shortages or quality control issues, which could temporarily affect pricing dynamics. -

Reimbursement policies:

Payer reconsideration of off-label uses and generic drug reimbursement rates may influence market prices.

Strategic Insights

-

For generic manufacturers, aggressively competing on price remains the optimal strategy due to intense market saturation.

-

For innovators, pursuing novelty—such as combination therapies or proprietary formulations—may unlock higher margins and market exclusivity.

-

For investors, early insights into ongoing research into neuroprotective applications can identify future value drivers, justifying potential premiums for companies filing new patents.

Key Takeaways

-

Market maturity constrains pricing power:

Upon patent expiry, isradipine faces fierce price competition, rendering substantial price hikes unlikely unless tied to novel formulations or indications. -

Off-label and niche uses present growth avenues:

Ongoing research into neuroprotective applications could reposition isradipine within specialized markets, potentially commanding premium pricing. -

Pricing stability is expected in the short term:

Generic availability sustains low prices; any future increase hinges on regulatory exclusivity or innovative formulations. -

Market growth driven by hypertension prevalence:

The expanding global hypertensive population provides stable demand, although it favors low-cost generic distribution rather than premium pricing. -

Monitoring clinical developments essential:

Scientific validation of new indications will be pivotal in shaping future market dynamics and pricing strategies.

FAQs

1. Will the price of isradipine increase due to new therapeutic indications?

While possible if regulatory exclusivity is granted for new indications, current evidence does not suggest imminent price surges. Most potential relies on clinical validation and subsequent patent protections.

2. How does generic competition impact the profitability of isradipine?

Intense generic competition has driven prices down, limiting margins for manufacturers. Profitability largely depends on manufacturing cost efficiencies and market share in specific regions.

3. Are there any patent protections remaining for isradipine?

No, the original patents have expired, and multiple generics are available worldwide, reducing patent-related pricing advantages.

4. Can isradipine be considered a high-growth drug in the near term?

No, unless significant breakthroughs in new indications occur, its growth is expected to be limited to existing hypertensive markets with stable demand.

5. What is the outlook for isradipine’s use in neurodegenerative disorders?

Pending ongoing research, if clinical trials demonstrate efficacy, this could open new markets, but commercialization and pricing are likely several years away.

References

[1] World Health Organization. Hypertension factsheet. 2021.

More… ↓