Share This Page

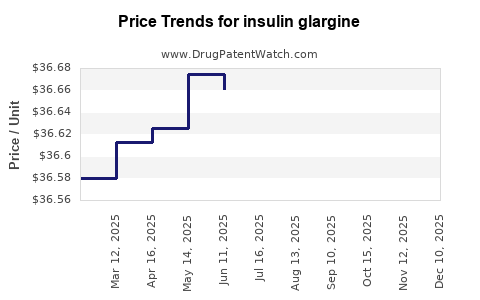

Drug Price Trends for insulin glargine

✉ Email this page to a colleague

Average Pharmacy Cost for insulin glargine

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INSULIN GLARGINE-YFGN U100 PEN | 83257-0015-32 | 5.91627 | ML | 2025-11-19 |

| INSULIN GLARGINE-YFGN U100 VL | 83257-0014-11 | 6.12560 | ML | 2025-11-19 |

| INSULIN GLARGINE MAX SOLO U300 | 00955-2900-02 | 36.68193 | ML | 2025-11-19 |

| INSULIN GLARGINE-YFGN U100 VL | 49502-0393-80 | 6.12560 | ML | 2025-11-19 |

| INSULIN GLARGINE SOLOSTAR U300 | 00955-3900-03 | 36.63367 | ML | 2025-11-19 |

| INSULIN GLARGINE-YFGN U100 PEN | 49502-0394-75 | 5.91627 | ML | 2025-11-19 |

| INSULIN GLARGINE-YFGN U100 PEN | 83257-0015-32 | 5.91665 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Insulin Glargine

Introduction

Insulin Glargine, a long-acting basal insulin analog, is a cornerstone treatment for diabetes mellitus type 1 and type 2. Its market dynamics, pricing strategies, and future projections remain pivotal for stakeholders—including pharmaceutical companies, healthcare providers, and policymakers—aiming to optimize access, innovation, and profitability. This report offers an in-depth market analysis and price forecast for Insulin Glargine, considering recent trends, competitive landscape, regulatory influences, and evolving healthcare demands.

Market Overview

Global Size and Growth Dynamics

The global diabetes prevalence exceeded 537 million adults in 2021, and is projected to reach approximately 643 million by 2030, according to the International Diabetes Federation (IDF) [1]. As a primary treatment modality, insulin analogs—including Insulin Glargine—capture a significant market share. The insulin market (including basal and prandial insulins) was valued at around USD 25 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of approximately 7-8% over the next decade [2].

Key Market Segments

- Branded formulations: Sanofi’s Lantus (original Insulin Glargine), and subsequent biosimilars.

- Biosimilar landscape: Increased entry of biosimilars such as Basaglar (Eli Lilly/Biocon), Semglee (Mylan/Belgium’sbi Olympia), which are facilitating price competition.

Geographical Dynamics

- North America: Largest market, driven by high diabetes prevalence, advanced healthcare infrastructure, and considerable brand loyalty to Lantus.

- Europe: Expanding biosimilar adoption, with substantial price sensitivity.

- Asia-Pacific: Rapid market growth due to increasing diabetes burden, rising healthcare access, and evolving regulatory policies favoring biosimilars.

Regulatory and Competitive Landscape

Patents and Biosimilar Entry

Sanofi held patents for Lantus until around 2015-2017, after which biosimilar competitors entered the market. The introduction of biosimilars has disrupted pricing strategies, especially in Europe, where regulatory frameworks incentivize biosimilar uptake through simplified approval pathways and price margins.

Pricing Trends

- Original Insulin Glargine (Lantus): Traditionally commanded premium prices—approximately USD 200-300 per mL (per 10 mL vial)—though prices declined post-biosimilar entry.

- Biosimilars: Usually priced 15-30% lower; for example, Basaglar and Semglee entered the U.S. market at approximately USD 100–150 per vial.

Reimbursement and Policy Impact

Government payers and formularies increasingly favor biosimilars, pressuring branded insulin prices downward. Some countries implement price-capping measures, e.g., the UK’s National Health Service (NHS) actively promotes biosimilar insulin adoption.

Market Drivers and Challenges

Drivers

- Growing global diabetes prevalence, especially type 2.

- Increasing awareness and diagnosis.

- Biosimilar proliferation fostering price competition.

- Expansion into emerging markets with large diabetic populations.

- Advances in delivery devices enhancing patient adherence.

Challenges

- Manufacturer brand loyalty and physician prescribing habits favoring established brands.

- Stringent regulatory requirements for biosimilar approval.

- Pricing and reimbursement hurdles in certain regions.

- Supply chain complexities impacting distribution costs.

Price Projection Analysis

Short-term (Next 2-3 Years)

In the immediate future, insulin prices—particularly for branded formulations—may stabilize or experience minor declines, as biosimilar competition intensifies. According to market reports, prices for biosimilar Insulin Glargine in the U.S. are expected to hover around USD 100–150 per vial, representing a 25-40% reduction from original Lantus prices.

Medium-term (3-5 Years)

Over this period, broader biosimilar adoption and healthcare policies focusing on cost containment are projected to depress prices further. Governments and payers in Europe and Asia are likely to negotiate lower prices, possibly reducing biosimilar insulin prices by an additional 10-20%.

Long-term (Beyond 5 Years)

Emerging innovative delivery systems, such as ultra-long-acting insulins and closed-loop systems, might marginally impact Insulin Glargine's market share. However, price reductions could plateau at 50-60% below original branded prices, depending on patent litigation outcomes, regulatory policies, and biosimilar acceptance.

Forecast Summary

| Period | Expected Price Range (USD per vial) | Drivers | Risks |

|---|---|---|---|

| 2023-2025 | USD 100–150 | Biosimilar competition, policy shifts | Market resistance, regulatory delays |

| 2026-2030 | USD 80–130 | Increased biosimilar penetration, healthcare cost reforms | Patent litigations, innovation disruptions |

Implications for Stakeholders

- Manufacturers: Need to innovate and develop next-generation insulin analogs to sustain premium pricing.

- Healthcare providers: Should monitor biosimilar approvals and formulary decisions to optimize costs.

- Payers: Benefit from competitive biosimilar markets but require strategic formulary management.

- Patients: Will increasingly access more affordable insulins, improving adherence and health outcomes.

Conclusion

The Insulin Glargine market remains dynamically poised, with biosimilar competition acting as a primary catalyst for price reductions. While original formulations will maintain a market niche due to brand loyalty and clinical confidence, widespread biosimilar adoption will drive average prices down significantly over the next five years. Stakeholders must adapt to these shifts through strategic procurement, investment in innovation, and policy engagement.

Key Takeaways

- The global insulin market is projected to grow to nearly USD 35 billion by 2030, driven by rising diabetes prevalence.

- Biosimilars have significantly suppressed prices—original Insulin Glargine sales are now challenged by more affordable alternatives.

- Price trajectories suggest reductions of up to 50-60% over the next decade, particularly driven by policy and regulatory frameworks.

- Manufacturers should innovate or diversify pipelines to maintain market share amid intensifying competition.

- Healthcare systems will benefit from increased biosimilar uptake, enabling broader access and improved adherence.

FAQs

1. How will biosimilar entry influence the price of Insulin Glargine?

Biosimilar entry typically leads to price reductions of 15-30% initially, with potential further declines as adoption increases, fostering a highly competitive market environment.

2. Are there regional differences in Insulin Glargine pricing?

Yes. While the U.S. historically maintained higher prices due to limited biosimilar penetration initially, Europe and Asia have experienced more aggressive pricing declines owing to regulatory incentives and healthcare policies favoring biosimilars.

3. What technological innovations could disrupt the Insulin Glargine market?

Ultra-long-acting insulins, closed-loop insulin delivery systems, and implantable continuous glucose monitors are transforming diabetes management, potentially impacting Insulin Glargine's market share.

4. Will branded Insulin Glargine products maintain premium pricing?

Probably in the short term, due to brand loyalty and perceived clinical advantages, but long-term pressure from biosimilars and emerging technologies will likely erode this premium.

5. What strategies can manufacturers adopt to remain competitive?

Investing in new formulation research, developing innovative delivery devices, engaging in strategic collaborations, and engaging with policymakers on biosimilar regulations are critical for sustaining market relevance.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition. 2021.

[2] MarketsandMarkets. Diabetes Care Devices Market by Product, Region, and Distribution Channel. 2022.

More… ↓