Last updated: July 27, 2025

Introduction

Imatinib Mesylate, marketed primarily under the brand name Gleevec, is a groundbreaking tyrosine kinase inhibitor developed by Novartis. Approved initially for chronic myeloid leukemia (CML), it revolutionized cancer treatment, setting a new standard in targeted therapy. With its expanding indications—including gastrointestinal stromal tumors (GIST), dermatofibrosarcoma protuberans (DFSP), and other malignancies—understanding its market trajectory and pricing dynamics is vital for pharmaceutical stakeholders, healthcare payers, and investors.

Market Landscape Overview

Global Market Size and Growth Trends

The global imatinib market was valued at approximately USD 4.2 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of approximately 4.5% through 2030, driven by rising cancer prevalence, increased diagnosis rates, and expanding therapeutic indications [1].

The market encompasses several key regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East. North America commands the largest share (~50%), attributable to advanced healthcare infrastructure, high drug adoption rates, and favorable reimbursement landscapes. The Asia-Pacific region exhibits rapid growth potential, buoyed by improving healthcare access and a burgeoning patient demographic.

Key Market Drivers

- Expansion of Indications: Beyond CML, imatinib’s approval for GIST, hypereosinophilic syndrome, and dermatofibrosarcoma protuberans broadens its utilization.

- Unmet Medical Needs: Rare and resistant cancers remain underserved, fostering demand for targeted therapies like imatinib.

- Generics and Biosimilars: Patent expirations and development of biosimilars threaten market share but also create opportunities for price competition and increased access.

- Pricing and Reimbursement Policies: Variability across regions significantly influences market penetration and revenue.

Competitive Landscape

Brand-Name vs. Generics

Originally launched in the early 2000s by Novartis, imatinib's patent life was set to expire in 2016–2017 (U.S. patent expiry in 2016). Generic versions entered subsequently, leading to substantial price erosion—up to 80% in some markets [2].

Major generic manufacturers include Celgene (acquired by Bristol-Myers Squibb), Mylan, Dr. Reddy’s Laboratories, and others. These entrants significantly influence pricing strategies and market dynamics.

Emerging Biosimilars

While biosimilars are more common in biologics, imatinib's small-molecule structure has facilitated the emergence of generic versions, intensifying competition.

Price Trends and Projections

Historical Price Trends

- Brand-Name Pricing: Initially, the wholesale acquisition cost (WAC) of imatinib was approximately USD 30,000–USD 40,000 per year per patient in the U.S.

- Post-Patent Expiry: Generic versions introduced in 2016 led to a dramatic drop in prices, with costs falling to below USD 10,000 annually in North America and Europe.

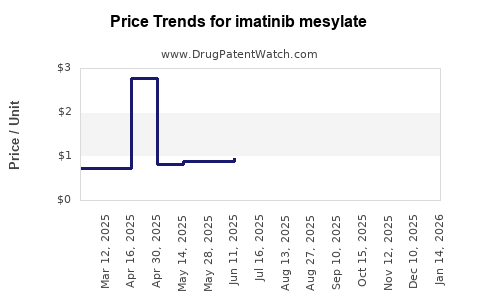

Current Price Environment

In 2023, the average wholesale price of generic imatinib ranges between USD 2,000–USD 5,000 per patient annually, varying by country and healthcare setting.

Projected Price Trajectory (2024–2030)

- Stabilization in Developed Markets: As patents expire and multiple generics saturate the market, prices are expected to stabilize at lower levels.

- Potential Price Increases in Emerging Markets: With increased healthcare infrastructure and rising cancer prevalence, prices may see modest growth, especially where local manufacturing ramps up.

- Impact of Biosimilar Entry: Should biosimilar imatinib gain regulatory approval, further price reductions are anticipated, potentially reaching USD 1,500–USD 3,000 annually.

Overall, average generic prices are projected to decrease by 15–20% annually over the next five years, driven by market competition and procurement policies.

Regulatory and Policy Influences

- Patent Laws and Market Exclusivity: Legal delays in generic approval or patent litigations can temporarily sustain high prices.

- Reimbursement Policies: Countries with aggressive price controls (e.g., certain European nations, Canada) tend to maintain lower prices and may limit off-label usage.

- Cost-Containment Strategies: Negotiated pricing, tendering, and value-based pricing models are increasingly employed to control expenditure.

Demand Dynamics and Market Segments

Oncological Indications

The primary driver remains CML, accounting for over 80% of imatinib’s sales. As new generations of tyrosine kinase inhibitors (e.g., bosutinib, ponatinib) emerge, market share may shift, influencing overall demand.

Non-Oncological Uses

Expanding indications, such as systemic mastocytosis, increase potential patient pools, with respective price adjustments per indication.

Future Opportunities and Threats

- Opportunities: Development of biosimilars, personalized concentration dosing, and new indications could stimulate growth.

- Threats: Pricing pressures from biosimilar competition, stricter reimbursement policies, and proprietary alternatives pose risks to revenue stability.

Key Takeaways

- The imatinib market is characterized by significant initial growth, followed by stabilization due to generic competition.

- Pricing in developed markets has dropped substantially, with further reductions expected.

- Emerging markets present growth opportunities, but price sensitivity remains high.

- Regulatory and patent landscapes markedly influence pricing trajectories.

- The future landscape depends on biosimilar development, regulatory policies, and the expansion of indications.

FAQs

Q1: How have patent expirations affected imatinib's market price?

Patent expirations in 2016–2017 led to widespread generic entry, resulting in a significant price decline—up to 80% in some markets—transforming imatinib from a high-cost treatment to a more accessible option.

Q2: What is the expected trend in imatinib prices over the next five years?

Prices are projected to stabilize at lower levels in developed countries due to market saturation of generics, with potential slight increases in emerging markets driven by local manufacturing and demand growth.

Q3: Are biosimilars or generics likely to further reduce imatinib prices?

Yes. If biosimilars receive regulatory approval across key markets, further price reductions—potentially 10–20%—are anticipated, enhancing affordability and broadening access.

Q4: How does regional variability influence the pricing of imatinib?

Pricing is heavily influenced by national healthcare policies, reimbursement frameworks, and legal environments. Developed countries typically see lower prices due to negotiations, while prices may be higher in markets with less regulation.

Q5: What are the key factors driving future demand for imatinib?

Expanded indications, increasing cancer prevalence, and technological innovations in manufacturing and delivery will drive future demand, albeit facing competition from newer targeted therapies.

References

[1] Grand View Research. “Imatinib Market Size, Share & Trends Analysis Report,” 2022.

[2] IMS Health. “Impact of Patent Expiry on Imatinib Pricing,” 2018.