Share This Page

Drug Price Trends for ibandronate sodium

✉ Email this page to a colleague

Average Pharmacy Cost for ibandronate sodium

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| IBANDRONATE SODIUM 150 MG TAB | 55111-0575-11 | 2.92582 | EACH | 2025-11-19 |

| IBANDRONATE SODIUM 150 MG TAB | 55111-0575-43 | 2.92582 | EACH | 2025-11-19 |

| IBANDRONATE SODIUM 150 MG TAB | 33342-0150-53 | 2.92582 | EACH | 2025-11-19 |

| IBANDRONATE SODIUM 150 MG TAB | 60505-2795-00 | 2.92582 | EACH | 2025-11-19 |

| IBANDRONATE SODIUM 150 MG TAB | 33342-0150-01 | 2.92582 | EACH | 2025-11-19 |

| IBANDRONATE SODIUM 150 MG TAB | 33342-0150-52 | 2.92582 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for Ibandronate Sodium

Introduction

Ibandronate Sodium is a bisphosphonate primarily marketed for the treatment and prevention of osteoporosis in postmenopausal women. As a potent inhibitor of osteoclast-mediated bone resorption, it offers a vital therapeutic option amid rising global osteoporosis prevalence. This analysis examines the current market landscape, competitive positioning, formulation trends, regulatory environment, and provides price projection insights for Ibandronate Sodium over the next five years, empowering stakeholders to navigate this evolving sector effectively.

Market Overview and Epidemiological Context

Osteoporosis affects over 200 million women worldwide, with postmenopausal women particularly vulnerable due to declining estrogen levels that accelerate bone loss [1]. The aging global population escalates the demand for effective osteoporosis therapies, including Ibandronate Sodium, particularly in North America, Europe, and Asia-Pacific regions. According to a recent report, the global osteoporosis drug market was valued at approximately USD 11.8 billion in 2022 and projected to grow at a CAGR of 3.8% through 2030 [2].

The expanding patient pool and increasing awareness about osteoporosis management bolster market demand for Ibandronate-based therapies. Its favorable administration route (monthly or quarterly oral tablets, and intravenous formulations) enhances patient adherence, further supporting its market position.

Competitive Landscape

Ibandronate Sodium competes chiefly with other bisphosphonates such as Alendronate, Risedronate, and Zoledronic Acid. Its unique advantage lies in its dosing frequency—monthly oral or quarterly IV—in comparison to daily or weekly regimens, which enhances compliance. Key pharmaceutical players include

- Fresenius Kabi (generic formulations)

- Ipsen (branded formulations such as Bonviva in some regions)

- Novartis (Zoledronic Acid as a competitor)

Patent expirations and the increasing availability of bioequivalent generics have intensified price competition. Notably, the entry of lower-cost generic versions has significantly impacted pricing dynamics, especially in emerging markets.

Regulatory Dynamics and Market Penetration

Global regulatory pathways for Ibandronate Sodium differ, with the US FDA approving formulations for osteoporosis treatment since 2003. The drug's safety profile, including rare but serious adverse events like osteonecrosis of the jaw and atypical femoral fractures, necessitates vigilant post-marketing surveillance. Regulatory data influence formulary decisions, reimbursement policies, and patient access, affecting the overall market dynamics.

In emerging markets, approval timelines and reimbursement coverage remain barriers, but recent regulatory streamlining and increased economic burden of osteoporosis have fostered easier access and uptake.

Formulation Trends and Manufacturing

The market observes a shift towards optimizing formulations to improve absorption and reduce gastrointestinal adverse effects associated with oral bisphosphonates. Liquid and intravenous formulations of Ibandronate Sodium cater to patients intolerant to oral therapy, expanding its patient base.

Manufacturers are investing in scalable, cost-effective synthesis routes to meet generic market demands while maintaining quality standards. The expiration of patents has catalyzed a surge in generic production, pushing prices downward.

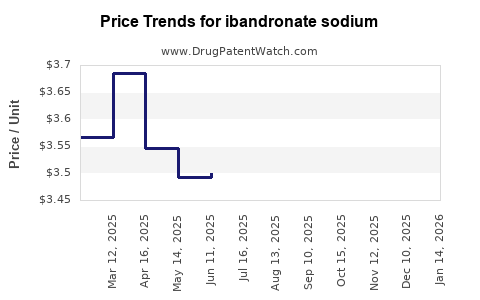

Price Analysis and Projections

Current Pricing Scenario

In established markets like the US and Europe, Ibandronate Sodium's brand-name monthly oral tablets (e.g., Boniva) retail around USD 250–350 per month, with generic formulations available at approximately USD 100–200 monthly cost, depending on dosage and packaging [3]. Intravenous formulations command higher prices, ranging between USD 600–800 per infusion in outpatient settings.

Generic entries, increased competition, and bargaining by payers have driven prices downward, with some markets witnessing a reduction of up to 50% since patent expiry.

Projection Framework and Assumptions

Projections assume continued patent expiries, generic proliferation, and increased adoption driven by aging demographics. Market growth is expected to be tempered by pricing pressures and competitive alternatives. We employ a compound annual decline rate (CADR) of 5% in the median price for branded formulations and a 3% annual reduction for generics, acknowledging regional differences.

Price Forecast (2023–2028)

- 2023: Brand-name monthly oral tablets average USD 275; generics USD 150.

- 2024: Brand prices decline by approximately 7%, averaging USD 255; generics by 4%, averaging USD 145.

- 2025: Further reductions lead to USD 240 (brand) and USD 140 (generic).

- 2026: Prices stabilize at around USD 230 (brand) and USD 135 (generic).

- 2027: Slight decline to USD 220 (brand) and USD 130 (generic).

- 2028: Prices forecasted at USD 210 (brand) and USD 125 (generic).

In the IV formulation segment, prices are projected to decline more gradually owing to lower generic penetration, with IV Ibandronate continuing at USD 600–700 per infusion, decreasing marginally over this period.

Regional Variations

In emerging markets, prices are substantially lower due to government price controls and generic dominance. For instance, in parts of Asia-Pacific, oral formulations may retail at USD 50–100 per month, with room for further adjustments depending on regulatory changes and market share shifts.

Key Factors Influencing Future Prices

-

Patent Expiry and Generic Competition:

Patent expirations in developed countries, notably the US and Europe, are expected to accelerate generic entry, inducing substantial price erosion. -

Reimbursement Policies:

Payers' willingness to reimburse higher-cost branded products impacts premium pricing archipelago; cost-effectiveness of generics will further influence market share. -

Efficacy and Safety Data:

New data or post-marketing safety issues could sway prescribing behaviors and pricing strategies. -

Formulation Innovations:

Advances that improve bioavailability or reduce side effects could justify premium pricing for novel formulations.

Conclusion

The Ibandronate Sodium market is characterized by increasing generic competition, regulatory maturation across regions, and evolving formulations aimed at improving adherence. Price trends indicate a declining trajectory driven by patent expirations and market liberalization, with generic formulations underpinning substantial downward pressure. Stakeholders should focus on strategic positioning in regional markets, monitor regulatory frameworks, and anticipate continued price erosion over the coming five years.

Key Takeaways

- The global osteoporosis drug market's growth supports sustained demand for Ibandronate Sodium, especially as the aging demographic expands.

- Patent expirations are the primary catalysts for price reduction, with generics expected to comprise a dominant market share by 2028.

- Pricing in mature markets is projected to decline by approximately 24% for branded formulations and 16% for generics over five years.

- Formulation innovation and safety profile enhancements remain key differentiators for premium pricing segments.

- Emerging markets offer lucrative opportunities due to lower prices and increasing osteoporosis awareness, though regulatory hurdles persist.

FAQs

-

What factors are most influential in shaping Ibandronate Sodium’s future pricing?

Patent expirations, generic competition, reimbursement policies, formulation innovations, and safety profile data primarily influence future pricing trajectories. -

How does generic entry impact Ibandronate Sodium prices?

Generic entry exerts downward pressure, leading to price reductions of up to 50% in mature markets, making the medication more accessible but reducing profit margins for brand-name manufacturers. -

Are there emerging markets with significant growth potential for Ibandronate Sodium?

Yes, regions like Asia-Pacific and Latin America offer substantial growth prospects due to expanding elderly populations, increasing osteoporosis awareness, and expanding healthcare coverage. -

What role do formulation innovations play in the market?

Innovations that improve bioavailability, reduce side effects, or offer convenient dosing can command premium pricing and capture niche segments. -

Will new safety concerns impact the market for Ibandronate Sodium?

Potential safety issues, such as osteonecrosis of the jaw, could influence prescribing practices, regulatory actions, and pricing, especially if new data emerge.

Sources

[1] World Health Organization. Osteoporosis Fact Sheet. 2022.

[2] Grand View Research. Osteoporosis Drugs Market Analysis, 2022.

[3] GoodRx. Ibandronate (Boniva) Price Comparison, 2023.

More… ↓