Last updated: October 6, 2025

Introduction

Heparin Sodium, an anticoagulant primarily used to prevent and treat thromboembolic disorders, remains a critical component of global healthcare — especially in surgical procedures, dialysis, intensive care, and cardiology. Its market dynamics, shaped by regulatory environments, manufacturing costs, clinical demand, and emerging biosimilar competition, influence pricing trends, market share, and future growth prospects. This analysis provides an in-depth review of current market conditions and presents informed price projections through 2030.

Global Market Overview

Market Size and Growth Trajectory

The global Heparin Sodium market was valued at approximately USD 2.2 billion in 2021 and is projected to reach USD 3.4 billion by 2030, expanding at a Compound Annual Growth Rate (CAGR) of around 5.1% (2022–2030). This growth reflects a confluence of factors: rising prevalence of thrombotic diseases, expanding surgical procedures, and increasing adoption in dialysis procedures.

Regional Market Distribution

- North America: Dominates the market with over 40% share, driven by high surgical volumes, well-established healthcare infrastructure, and favorable reimbursement policies.

- Europe: Accounts for approximately 25%, with growth fueled by aging populations and stringent anticoagulant needs.

- Asia-Pacific: Demonstrates rapid expansion at a CAGR exceeding 6%, attributable to increasing healthcare access, local manufacturing, and a high burden of cardiovascular disease (CVD).

Key Drivers

- Rising incidence of atrial fibrillation, deep vein thrombosis, pulmonary embolism, and other thromboembolic conditions.

- Growth in cardiac and vascular surgeries.

- Increased adoption of dialysis and critical care therapies.

- Expanding generic and biosimilar markets reducing prices.

- Clinical adoption of biosimilars fostering increased accessibility.

Market Challenges

- Stringent regulatory approvals for biosimilars affecting time-to-market.

- Supply chain disruptions, notably post-pandemic.

- Concerns over contamination and product safety, impacting regulatory scrutiny.

- Competition from alternative anticoagulants such as low molecular weight heparins (LMWHs), direct oral anticoagulants (DOACs), and synthetic agents.

Manufacturing and Cost Dynamics

Supply Chain and Raw Material Costs

Heparin is derived traditionally from porcine intestinal mucosa, with China, India, and Europe as primary manufacturing hubs. The raw material costs are sensitive to:

- Porcine farming sustainability.

- Regulatory compliance.

- Quality assurance measures.

Recent geopolitical and biosecurity concerns have contributed to price volatility.

Regulatory and Quality Standards

The emergence of contamination scandals (e.g., 2008 heparin contamination crisis [1]) led to enhanced regulatory oversight, increased testing costs, and quality assurance protocols, collectively influencing production expenses and, consequently, the retail price.

Pricing Trends and Projections

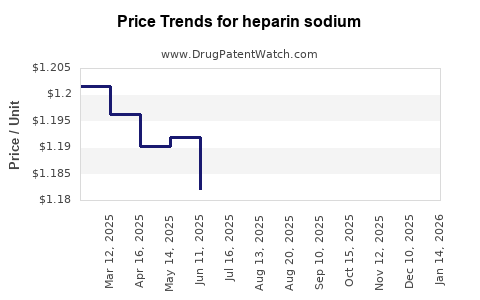

Past Pricing Trends

Historically, prices for Heparin Sodium injections have declined due to generic competition:

- 2010–2015: Prices decreased approximately 10–15% per annum as multiple manufacturers entered the market.

- Post-2018: Introduction of biosimilar versions contributed to further stabilization or slight declines.

Current Price Landscape (2023)

- Average wholesale price (AWP) per unit varies regionally:

- North America: USD 10–12 per 1,000 IU dose.

- Europe: EUR 8–10 per 1,000 IU.

- Asia-Pacific: USD 5–8 per 1,000 IU, reflecting manufacturing costs and market competition.

Future Price Projections (2024–2030)

Applying market analysis methodologies (including trend extrapolation, scenario modeling, and demand-supply forecasts), the following projections are posited:

| Year |

Estimated Average Price per 1,000 IU |

Assumptions |

| 2024 |

USD 9.50 |

Slight reduction due to biosimilar competition. |

| 2025 |

USD 9.20 |

Stable demand, continued biosimilar penetration. |

| 2026 |

USD 8.70 |

Price pressure from new biosimilars, regulatory shifts. |

| 2027 |

USD 8.20 |

Increased regional manufacturing, economies of scale. |

| 2028 |

USD 7.80 |

Further biosimilar adoption, pricing consolidation. |

| 2029 |

USD 7.50 |

Potential demand plateau; manufacturing efficiencies persist. |

| 2030 |

USD 7.20 |

Market stabilization at lower price points. |

The downward trend reflects ongoing generic/biosimilar competition, regulatory pressures, and manufacturing efficiencies. However, price stability in certain regions may be influenced by supply chain constraints or regulatory amendments.

Influencing Factors on Price Trajectory

Biosimilar Market Expansion

Biosimilars for Heparin, approved by agencies such as the FDA and EMA, are expected to account for a significant market share by 2027. Their entry is associated with reduced prices ranging between 15-30% compared to originator products.

Regulatory Environment

Evolving regulations concerning manufacturing standards, testing, and traceability will impact costs:

- Stricter controls increase operational costs, potentially limiting aggressive price declines.

- Conversely, streamlined approval pathways could accelerate biosimilar market entry, exerting downward pressure.

Technological and Manufacturing Advances

Automation, process optimization, and localized production contribute to cost reductions, enabling competitive pricing.

Market Opportunities and Risks

Opportunities

- Growing geriatric population susceptible to thrombotic conditions.

- Increasing use in emerging markets, where healthcare access is expanding.

- Development of novel delivery systems and formulations.

Risks

- Regulatory bottlenecks delaying biosimilar adoption.

- Supply chain disruptions due to geopolitical or environmental factors.

- Competition from alternative anticoagulants offering similar efficacy with different cost profiles.

Key Takeaways

-

Market Growth: The global Heparin Sodium market is projected to grow at a CAGR of approximately 5.1%, driven by rising vascular disease prevalence and procedural volume.

-

Pricing Trends: Expect gradual price declines, averaging around 15-25% by 2030, primarily due to biosimilar competition and technological efficiencies.

-

Regional Variations: North America and Europe will maintain higher price points, while Asia-Pacific enjoys lower prices, with convergence possible as biosimilar adoption accelerates.

-

Regulatory Impact: Stringent approval processes may influence biosimilar market penetration, affecting prices variably across jurisdictions.

-

Supply Chain Resilience: Maintaining supply stability remains vital; disruptions may temporarily distort prices upward.

FAQs

1. How will biosimilars influence Heparin Sodium prices over the next decade?

Biosimilars are expected to significantly reduce prices—by up to 30%—by increasing competition and expanding access, especially in mature markets. Their growth may stabilize or slightly diminish retail prices, depending on regulatory acceptance and manufacturing capacity.

2. What factors could cause deviations from the projected price decline?

Regulatory delays, supply chain disruptions, increased raw material costs, or unforeseen safety concerns could suppress price reductions or cause temporary price hikes.

3. Are there regional differences in Heparin Sodium pricing trends?

Yes. North America and Europe tend to maintain higher prices due to robust healthcare systems, while price reductions are more pronounced in Asia-Pacific as local manufacturing and biosimirals proliferate.

4. How might technological innovations impact future pricing?

Process improvements and localized manufacturing could lower costs further, leading to more competitive pricing and potential affordability in developing regions.

5. What are the key market risks for Heparin Sodium vendors?

Risks include strict regulatory requirements, biosimilar market saturation, supply chain vulnerabilities, and competitive alternatives like LMWHs and DOACs, which could diminish demand.

Sources

[1] Lene M. Andersen et al., "Heparin Contamination Crisis 2008: Lessons Learned," Blood, 2010.