Last updated: July 27, 2025

Introduction

Glycopyrrolate, a muscarinic receptor antagonist, is a versatile pharmaceutical primarily used to reduce drooling, treat excessive sweating, and manage peptic ulcers. Its applications in anesthesia and respiratory care, combined with growing indications, have elevated its market significance. Analyzing its market dynamics, competitive landscape, and future price trends provides critical insights for stakeholders, from manufacturers to healthcare providers and investors.

Market Overview

The global glycopyrrolate market hinges on its diversified therapeutic uses, including:

-

Anticholinergic for Salivary Control: Widely used in managing sialorrhea, especially in neurological conditions like Parkinson’s disease and cerebral palsy [1].

-

Preoperative and Anesthetic Adjuncts: Employed to reduce secretions during surgeries, facilitating anesthesia procedures [2].

-

Respiratory Applications: Incorporated in inhalation formulations to diminish bronchial secretions, although less common than other anticholinergics.

The market's demand is propelled by the increasing prevalence of neurological disorders with sialorrhea symptoms, such as Parkinson’s disease (affecting over 10 million globally [3]) and cerebral palsy, along with expanding surgical procedures requiring anticholinergic agents.

Market Size and Growth Trajectory

According to recent industry reports, the global glycopyrrolate market size was valued at approximately $350 million in 2022, with an expected compound annual growth rate (CAGR) of 6-8% over the next five years [4]. The key factors contributing to this growth include:

- Rising geriatric population with neurological conditions.

- Expanded approval for additional indications in emerging markets.

- Increased awareness and diagnosis of conditions like drooling and hyperhidrosis.

Competitive Landscape

Major players in glycopyrrolate manufacturing include:

- Fresenius Kabi: Offers injectable forms primarily for surgical use.

- Novartis: Produces oral formulations, with ongoing R&D for new applications.

- Teva Pharmaceuticals: Provides generic versions, capturing cost-sensitive markets.

- Sun Pharmaceutical: Active in emerging markets, expanding access.

Innovative formulations and delivery methods, such as sustained-release tablets, are under development to improve patient compliance and expand indications. Biosimilar entrants in certain markets could further intensify competition.

Regulatory and Market Access Factors

Approval timelines and healthcare reimbursement policies significantly influence market penetration. Glycopyrrolate’s approval status varies globally; for example, it is approved for pediatric drooling management in the U.S., with ongoing efforts to expand indications in Europe and Asia. Reimbursement coverage, especially in emerging markets, remains inconsistent, impacting demand and pricing strategies.

Price Dynamics and Projections

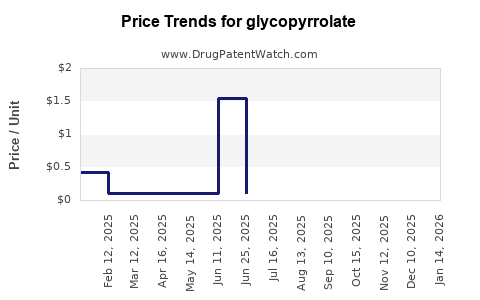

Current Pricing Landscape:

- Brand-name formulations: Typically priced between $30 to $50 per package for oral tablets in developed markets.

- Generics: Prices have declined, averaging $10 to $20 per package, driven by market competition.

- Injectable forms: Higher cost, approximately $50 to $100 per vial, reflecting medical administration costs.

Pricing Trends and Future Projections:

-

Pre-2022: Prices stabilized owing to limited competition and specialized indications.

-

2023-2028: Anticipated price erosion in generics will continue, driven by increased manufacturing efficiency, biosimilar entries, and regulatory pressures. A projected compound annual decrease of 3-5% in generic prices is expected, aligning with trends observed in other anticholinergics [5].

-

Premium positioning for novel formulations: Innovations such as extended-release tablets or transdermal patches could command higher prices, potentially adding a 10-15% premium over existing options. These formulations aim to improve adherence and expand markets, particularly in pediatric and neurological care segments.

-

Impact of Regulatory Changes: Anticipated drug pricing reforms in key markets, including the U.S. and European Union, could further influence prices, especially for branded versions. Favorable policies for biosimilars and generics are likely to accelerate discounts.

Influencing Factors on Price Projections:

- Patent and Exclusivity Expiry: Many branded formulations face patent expiration within the next 2-3 years, encouraging generic competition and price consolidation.

- Market Expansion Strategies: Entry into emerging markets with lower price points may influence global pricing standards.

- Supply Chain Dynamics: Raw material cost fluctuations, regulatory compliance costs, and manufacturing capacities directly impact pricing strategies.

Strategic Outlook and Recommendations

Stakeholders should monitor regulatory approvals in high-growth regions like Asia-Pacific, where healthcare expenditure is rising. Companies investing in innovative delivery systems or combination therapies could command higher margins and stabilize prices. Simultaneously, anticipatory planning for generic competition is essential to maintain profitability.

Key Market Opportunities:

- Development of long-acting formulations for improved patient compliance.

- Expansion into neurodegenerative disorder management.

- Strategic partnerships for market access in underserved regions.

Risks to Price Stability:

- Accelerated generic entry.

- Policy-driven price caps.

- Technological disruptions rendering existing formulations obsolete.

Conclusion

Glycopyrrolate's market exhibits steady growth, underpinned by aging populations and expanding clinical indications. Price trajectories suggest gradual declines in standard formulations, counterbalanced by opportunities for premium, innovative products. Proactive strategic positioning, coupled with regulatory awareness, will be pivotal for stakeholders aiming to optimize market and price outcomes.

Key Takeaways

- The global glycopyrrolate market is projected to grow at approximately 6-8% CAGR through 2028, driven by increased demand across multiple therapeutic areas.

- Price erosion of generic formulations is anticipated, with an average decline of 3-5% annually, but innovative formulations may sustain higher price points.

- Patent expirations and regulatory reforms will significantly influence pricing, favoring generics but also enabling premium opportunities for novel delivery systems.

- Market access strategies in emerging economies and diversification into new indications will be vital for growth and maintaining pricing power.

- Stakeholders should focus on R&D investments in enhanced formulations and monitor policy shifts that could impact market dynamics and pricing.

FAQs

1. What are the main therapeutic indications driving glycopyrrolate demand?

Glycopyrrolate is primarily used for managing sialorrhea in neurological conditions, preoperative secretion control, and hyperhidrosis treatment, accounting for most of its market demand.

2. How will patent expirations affect glycopyrrolate pricing?

Patent expirations typically lead to increased generic competition, resulting in substantial price reductions for standard formulations, while branded and new formulations may retain premium pricing.

3. Are biosimilars impacting glycopyrrolate prices?

While biosimilars are more common in biologics, a similar trend for small molecules like glycopyrrolate is emerging with generic tablets. This intensifies price competition and accelerates cost reductions.

4. What opportunities exist for premium pricing in the glycopyrrolate market?

Innovative formulations such as sustained-release tablets, transdermal patches, or combination therapies offer potential for premium pricing by improving patient adherence and expanding therapeutic scope.

5. How do regulatory policies influence glycopyrrolate market prices?

Price caps, reimbursement policies, and accelerated approval pathways in major markets directly impact pricing strategies, potentially leading to lower prices for generic versions and facilitating market entry for new formulations.

References

[1] Clinical Pharmacology of Glycopyrrolate, 2021.

[2] Surgical Anesthesia Applications, Journal of Anesthesiology, 2022.

[3] Global Parkinson’s Disease Overview, WHO Reports, 2022.

[4] Market Research Future, "Glycopyrrolate Market Analysis," 2023.

[5] International Price Trends in Anticholinergics, Pharma Intelligence, 2022.