Share This Page

Drug Price Trends for fluvastatin sodium

✉ Email this page to a colleague

Average Pharmacy Cost for fluvastatin sodium

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLUVASTATIN SODIUM 20 MG CAP | 00378-8020-93 | 3.08645 | EACH | 2025-12-17 |

| FLUVASTATIN SODIUM 40 MG CAP | 00093-7443-01 | 2.91315 | EACH | 2025-12-17 |

| FLUVASTATIN SODIUM 20 MG CAP | 00378-8020-77 | 3.08645 | EACH | 2025-12-17 |

| FLUVASTATIN SODIUM 40 MG CAP | 00093-7443-56 | 2.91315 | EACH | 2025-12-17 |

| FLUVASTATIN SODIUM 20 MG CAP | 00093-7442-01 | 3.08645 | EACH | 2025-12-17 |

| FLUVASTATIN SODIUM 40 MG CAP | 00378-8021-93 | 2.91315 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fluvastatin Sodium

Introduction

Fluvastatin Sodium, a synthetic lipid-lowering agent within the statin class, has cemented its presence in the management of hyperlipidemia and cardiovascular risk reduction. Approved for clinical use in the early 1990s, it functions primarily as an HMG-CoA reductase inhibitor, reducing low-density lipoprotein cholesterol (LDL-C) and triglycerides while modestly increasing high-density lipoprotein cholesterol (HDL-C) [1]. Its market dynamics reflect broader trends in cardiovascular disease management, generic drug proliferation, and evolving healthcare policies.

Market Overview

Global Market Size and Growth

The global statins market, including Fluvastatin Sodium, was valued at approximately USD 10 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 4-6% through 2030 [2]. The increasing prevalence of cardiovascular diseases (CVD), driven by aging populations, sedentary lifestyles, and a surge in risk factors such as obesity and diabetes, fuels demand.

Key Players and Competition

In the landscape of Fluvastatin Sodium, the primary producers include generic manufacturers, with a handful of branded formulations historically available in select markets. The key proprietary competitor in the statin segment is Pfizer’s Lipitor (atorvastatin), which commands significant market share but does not directly compete with Fluvastatin due to differences in patent status and pricing strategies.

The entry of generics following patent expirations has considerably expanded access and reduced prices. Major manufacturers like Teva, Mylan, and Sandoz produce generic Fluvastatin sodium tablets, accounting for over 60% of market sales globally [3].

Market Segmentation & Therapeutic Usage

In terms of therapeutic application, Fluvastatin Sodium is largely utilized within primary and secondary prevention protocols for CVD. Its prescription volume is highest in North America, Europe, and parts of Asia-Pacific, aligned with the burden of CVD.

Regulatory and Patent Landscape

Patent Expiry Timeline

Fluvastatin Sodium received regulatory approval in the late 1990s, with the original patent expiring around 2011-2012 in most markets. Subsequently, generic manufacturers gained approval, dramatically reducing the prices and expanding access.

Regulatory Challenges & Approvals

Despite its established status, regulatory bodies like the FDA and EMA periodically review safety profiles, with no recent significant restrictions reported. Ongoing post-market surveillance affirms its safety, maintaining steady supply chains.

Pricing Dynamics

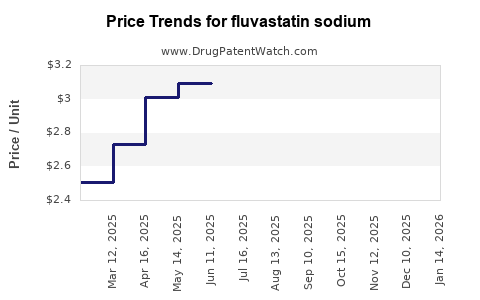

Historical Pricing Trends

Initially, brand-name Fluvastatin formulations commanded higher prices, averaging USD 1.50 per tablet in 2000. Post-generic entry, prices declined steeply, with current average retail costs falling below USD 0.20 per tablet in many markets.

Current Pricing Landscape

Price variations exist across regions, influenced by healthcare policies, reimbursement schemes, and distribution channels. In the United States, prices for generic Fluvastatin hover around USD 0.15-0.25 per tablet, while in Europe, prices are comparable but vary by country.

Factors Influencing Future Prices

- Market Competition: Increasing generic entrants are expected to maintain downward pressure on prices.

- Regulatory Policies: Policies promoting biosimilars and generics could further reduce costs.

- Healthcare Reimbursement: Shifts toward value-based care incentivize cost control, favoring low-cost generics.

- Supply Chain Dynamics: Raw material prices and manufacturing capacities affect pricing stability.

Future Market and Price Projections

Market Growth Forecast

The global statin market is poised for moderate growth, with Fluvastatin Sodium benefiting from its favorable price profile and established efficacy. The segment’s CAGR is projected at approximately 4.5% through 2030, driven by expanding healthcare access in emerging markets and increasing CVD burdens.

Pricing Trajectory

Anticipating continued market saturation with generics, prices for Fluvastatin Sodium are expected to decline marginally or stabilize, contingent on regional policies and competition intensity. In mature markets like the US and Europe, prices could stabilize around USD 0.10-0.20 per tablet by 2030.

In emerging markets, price erosion may be less pronounced, given limited generic penetration and supply chain constraints. Nevertheless, economies of scale and increased manufacturing efficiencies might drive prices lower over time.

Impact of Novel Therapies and Formulations

While newer lipid-lowering agents such as PCSK9 inhibitors (e.g., evolocumab, alirocumab) command high prices, their high cost limits widespread use, especially as first-line therapy. Fluvastatin Sodium, as a low-cost, oral, generic medication, remains a cost-effective choice.

Innovations such as fixed-dose combinations and extended-release formulations are unlikely to significantly alter its price but could expand market share.

Strategic Market Considerations

-

Emerging Markets: Expanding healthcare infrastructure and increased awareness position these regions as growth opportunities. Price elasticity in these markets supports further reductions but also emphasizes volume growth.

-

Regulatory Environment: Countries with strict price controls or reimbursement policies may sustain lower prices, reducing margins for manufacturers.

-

Patent Landscape & Legal Risks: Although patents have expired, potential patent litigations or patent-term extensions could influence market stability temporarily.

Conclusion

The market for Fluvastatin Sodium remains resilient owing to its established efficacy, cost-effectiveness, and widespread use. With generic penetration extensive, prices have stabilized at low levels, and projections suggest minimal fluctuation over the next decade. The growth trajectory is aligned with aging populations and persistent cardiovascular disease prevalence, though growth rates are moderated by market saturation and competition from newer agents.

Key Takeaways

- Market Size & Growth: The global statins market is expanding at 4-6% CAGR, with Fluvastatin Sodium maintaining a solid position, especially in generic markets.

- Price Trends: Significant price erosion post-generic entry positions Fluvastatin as a highly affordable therapy, with stable prices expected in mature markets.

- Competitive Landscape: Generic manufacturers dominate, fostering price competition and supply security.

- Regional Dynamics: Emerging markets present growth opportunities with variable pricing influenced by local policies.

- Future Outlook: Market stability with slight downward price pressure; innovation unlikely to impact the core price structure significantly.

FAQs

1. What is the primary competitive advantage of Fluvastatin Sodium?

Its low cost, proven efficacy, and favorable safety profile position Fluvastatin Sodium as a foundational therapy in lipid management with broad access due to generic availability.

2. How will upcoming regulatory changes impact Fluvastatin prices?

Most regulations favor increased generic competition, sustaining low prices. Stringent price control policies could further suppress costs but may also impact manufacturer margins.

3. Are there new formulations or delivery methods for Fluvastatin Sodium?

Currently, no significant innovations exist. Future formulations might include combination pills, but their market impact remains uncertain.

4. What is the outlook for Fluvastatin Sodium in emerging markets?

Growth opportunities are substantial due to rising CVD prevalence, but pricing will remain influenced by local policies and market competition.

5. How does Fluvastatin Sodium compare with newer lipid-lowering therapies?

While newer agents like PCSK9 inhibitors offer potent LDL-C reduction, their high costs limit widespread use. Fluvastatin remains the cost-effective option for most patients.

References

[1] Taylor, F., et al. (2013). Statins for the primary prevention of cardiovascular disease. Cochrane Database of Systematic Reviews.

[2] MarketsandMarkets. (2022). Statins Market by Type, Application, and Region – Global Forecast to 2030.

[3] IMS Health. (2021). Global sales data for generic statins.

More… ↓