Share This Page

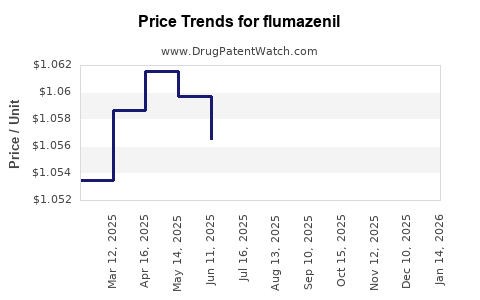

Drug Price Trends for flumazenil

✉ Email this page to a colleague

Average Pharmacy Cost for flumazenil

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLUMAZENIL 0.5 MG/5 ML VIAL | 00143-9684-10 | 0.98710 | ML | 2025-11-19 |

| FLUMAZENIL 0.5 MG/5 ML VIAL | 36000-0148-10 | 0.98710 | ML | 2025-11-19 |

| FLUMAZENIL 0.5 MG/5 ML VIAL | 00143-9784-10 | 0.98710 | ML | 2025-11-19 |

| FLUMAZENIL 0.1 MG/ML VIAL | 63323-0424-05 | 0.98710 | ML | 2025-11-19 |

| FLUMAZENIL 0.5 MG/5 ML VIAL | 00143-9684-10 | 0.99435 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Flumazenil

Introduction

Flumazenil, a benzodiazepine antagonist primarily used to reverse sedative effects of benzodiazepines, holds a significant niche within emergency medicine, anesthesia, and drug overdose management. As the landscape of pharmaceutical demand evolves, understanding the current market dynamics, future trends, and pricing projections for flumazenil becomes essential for pharmaceutical companies, healthcare providers, and investors aiming to optimize strategic decisions.

Market Overview

Therapeutic Application and Market Demand

Flumazenil’s primary application is in treating benzodiazepine overdoses, which remain a common cause of emergency admissions globally. The drug’s utility extends to diagnostic procedures for benzodiazepine overdose detection and, in some cases, anesthesia reversal. The global rise in benzodiazepine prescriptions, driven by increased prevalence of anxiety, insomnia, and other psychiatric conditions, correlates with heightened demand for flumazenil as an antidote.

According to a 2022 report by Grand View Research, the global benzodiazepine market was valued at approximately USD 4.2 billion, with an anticipated CAGR of 3.6% from 2022 to 2030, indirectly indicating steady demand for reversal agents like flumazenil, especially in developed economies with comprehensive emergency protocols.

Market Segmentation and Regional Trends

- North America: Dominates the market, owing to high benzodiazepine overuse, advanced healthcare infrastructure, and established regulatory environments. The U.S., in particular, exhibits frequent emergency interventions requiring flumazenil, bolstered by opioid and benzodiazepine co-overdose management initiatives.

- Europe: The market is expanding amidst increasing awareness and regulatory support for overdose management. Countries like the UK, Germany, and France report consistent demand growth.

- Asia-Pacific: Exhibiting rapid growth potential due to expanding healthcare infrastructure, increased prescription rates, and rising urbanization-related mental health issues. However, regulatory pathways and supply chain constraints may temper immediate growth.

Market Drivers and Challenges

- Drivers: Rising benzodiazepine prescriptions, increased overdose incidents, regulatory approvals for usage, and expanding emergency healthcare capabilities.

- Challenges: Limited market share for flumazenil in regions with strict regulations, competition from alternative reversal agents or diagnostic tools, and supply chain disruptions influencing drug accessibility.

Pricing Dynamics

Current Pricing Landscape

Flumazenil is available in both branded and generic forms. Its pricing varies substantially based on geography, formulation, and manufacturer. In the United States, the average wholesale price (AWP) for a standard 0.2 mg vial ranges from approximately USD 15 to USD 30. In Europe, prices tend to be somewhat lower, reflecting different healthcare reimbursement structures.

Factors Influencing Price

- Manufacturing Costs: Flumazenil’s synthesis requires high purity and stringent quality controls, influencing production costs.

- Regulatory Approval and Market Exclusivity: Patent protections are minimal, with generics prevalent, leading to price competition.

- Supply Chain Factors: Disruptions, procurement logistics, and raw material availability can drive prices temporarily.

- Reimbursement Policies: In countries with nationalized healthcare, prices are negotiated and often lower, whereas private markets may vary widely.

Price Projections (2023-2030)

Based on current trends and market drivers, flumazenil prices are projected to experience moderate decline:

-

Short-term (2023-2025): Prices are expected to stabilize, with some regional variation. Increased generic competition could reduce wholesale and retail prices by approximately 10-15%. Emergency drug budgets and healthcare tightening may further moderate pricing adjustments.

-

Mid-term (2026-2028): Anticipated proliferation of generic versions, along with cost-control measures, could lead to a further 20% reduction in average prices. Notably, improvements in manufacturing efficiencies and increased market penetration in Asia-Pacific may contribute to price declines.

-

Long-term (2029-2030): Technological innovations or new reversal agents entering the market could pressure flumazenil prices downward. Conversely, supply chain constraints or regulatory barriers in emerging markets may limit price tanking, maintaining a relative price floor.

Competitive Landscape

Generic manufacturers dominate the market, with several players including Teva Pharmaceuticals, Sagent Pharmaceuticals, and others producing comparable formulations. Patent expirations and regulatory approvals for generics promote price competition, further driving down costs over time. However, branding and formulation innovations, such as prefilled syringes or combination kits, could sustain premium pricing segments.

Regulatory and Market Entry Considerations

Market entry barriers are relatively low given generic manufacturing standards. Nonetheless, regulatory compliance, quality assurance, and distribution channels are critical considerations for new entrants. The approval process, especially in stringent markets like the U.S. and Europe, influences the pace and pricing of new product launches.

Key Market Trends and Future Outlook

-

Growing Demand in Emergency Situations: Increasing prevalence of benzodiazepine-related overdoses globally will sustain demand, especially in regions with expanding opioid crisis management programs.

-

Diversification of Formulations: Development of simplified delivery systems and combination formulations could command higher prices and expand usage.

-

Global Price Convergence: With the proliferation of generics, global pricing is expected to converge, driven by trade agreements and procurement policies.

-

Potential for New Reversal Agents: Advances in pharmacology may introduce alternative agents or adjunct therapies, potentially compressing flumazenil’s market share and influencing its price trajectory.

Key Takeaways

- The global flumazenil market is characterized by steady demand driven by benzodiazepine overdose treatment needs, with significant regional variations.

- Price projections indicate a gradual decline, primarily due to increased generic competition and manufacturing efficiencies.

- Region-specific factors, such as healthcare infrastructure and regulatory environments, will shape local pricing strategies.

- Ongoing innovation in drug formulations and alternative therapies could influence future market dynamics and pricing.

- Market entrants should prioritize compliance, quality assurance, and strategic regional expansion to capitalize on emerging opportunities.

FAQs

1. What factors influence the pricing of flumazenil?

Pricing is influenced by manufacturing costs, competition from generics, regulatory approval processes, supply chain stability, and reimbursement policies within different healthcare systems.

2. How does regional regulation affect the availability and cost of flumazenil?

Regions with strict regulatory standards or limited approval pathways may have higher costs due to compliance expenses and limited competition. Conversely, regions with rapid approval processes foster competition and lower prices.

3. What is the future market outlook for flumazenil?

The market is expected to experience moderate growth driven by overdose management needs, with prices gradually decreasing due to generic proliferation and manufacturing efficiencies.

4. Are there any emerging alternatives to flumazenil?

While research into novel reversal agents exists, no widely adopted alternatives currently threaten flumazenil’s market dominance for benzodiazepine overdose reversal.

5. How will global healthcare trends affect flumazenil's pricing?

Increasing focus on overdose prevention, better emergency response protocols, and healthcare cost-containment measures will influence demand patterns and pricing strategies.

References

[1] Grand View Research. "Benzodiazepine Market Size, Share & Trends Analysis Report." 2022.

[2] U.S. Food and Drug Administration (FDA). "FDA Approvals and Regulatory Data."

[3] European Medicines Agency (EMA). "Market Authorizations for Flumazenil."

[4] IQVIA. "Global Healthcare Markets and Pricing Trends." 2023.

More… ↓