Last updated: July 27, 2025

Introduction

Flecainide acetate is a potent antiarrhythmic medication used primarily to treat atrial fibrillation, atrial flutter, and certain types of ventricular arrhythmias. As a Class IC antiarrhythmic agent, it exerts its effect by blocking sodium channels, stabilizing cardiac electrophysiology. The drug's efficacy, safety profile, and patent landscape significantly influence its market dynamics. This report provides a comprehensive analysis of the current market landscape for flecainide acetate, explores key drivers and challenges, and offers price projections grounded in current trends and economic factors.

Market Overview

Global Market Size

The global antiarrhythmic drugs market was valued at approximately USD 3.4 billion in 2022, projected to grow at a compound annual growth rate (CAGR) of around 4-6% through the next five years [1]. Flecainide acetate, though a niche segment within this market, commands a significant portion owing to its specific indication in rhythm management.

Key Players and Market Share

Prominent manufacturers include Teva Pharmaceuticals, Mylan (now part of Viatris), and Sandoz, along with generic drug producers in India and Europe. Branded patents, such as those initially held by AstraZeneca, have expired, enabling widespread generic manufacturing.

Geographical Distribution

North America, particularly the United States, remains the largest market, driven by high prevalence of atrial fibrillation and advanced healthcare infrastructure. Europe follows closely, with growing adoption in Asia-Pacific driven by increasing cardiovascular disease burden and rising healthcare expenditure.

Regulatory Landscape

Patent Status and Generic Competition

Flecainide acetate's original patents have expired in major markets, facilitating entry of generics that drastically reduce prices. Regulatory approval processes are well-established, with agencies like the FDA and EMA providing pathways for both brand-name and generic versions.

Off-Label Use and Off-Patent Drug Availability

While primarily indicated for arrhythmias, flecainide’s off-label uses include cardioversion in certain settings, stimulating sustained demand. Off-patent status supports broader availability but also intensifies price competition.

Market Drivers

- Growing Incidence of Cardiac Arrhythmias: Aging populations and increasing awareness lead to higher diagnosis and treatment rates.

- Advancements in Cardiac Care: Improvements in ECG and diagnostic capabilities promote earlier application of flecainide acetate.

- Cost-Effectiveness of Generics: The availability of affordable generic versions incentivizes use in developing markets.

- Clinical Evidence Supporting Safety and Efficacy: Therapeutic guidelines endorse flecainide as a first-line agent in specific arrhythmias.

Market Challenges

- Safety Concerns: Risks of proarrhythmic effects and contraindications in structural heart disease limit broader use.

- Competition from Other Antiarrhythmic Drugs: Class III agents like amiodarone and sotalol often serve as alternatives.

- Regulatory Hurdles in Emerging Markets: Variability in approval processes can delay market penetration.

- Limited Awareness in Certain Regions: Lower physician familiarity hampers adoption rates.

Price Trends and Projections

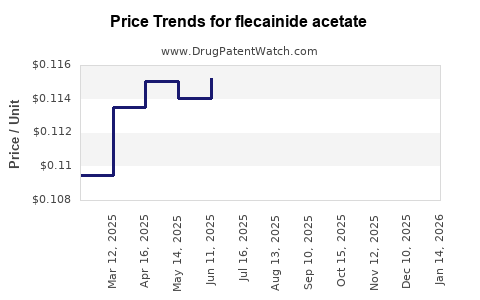

Current Pricing Landscape

The cost of flecainide acetate varies markedly between branded and generic formulations. In the U.S., the branded version (e.g., Tambocor) retails at approximately USD 300-400 per month, whereas generic versions are priced between USD 20-50 monthly, reflecting a substantial price differential [2].

In Europe and emerging markets, generic prices fluctuate based on regulatory policies and competitive dynamics, often residing at the lower end of this spectrum.

Factors Influencing Price Projections

- Patent Expiry and Generic Competition: As patents expire, a downward pressure on prices is expected, with more manufacturers entering the market.

- Manufacturing Costs: Advances in synthesis and production efficiencies will further reduce costs.

- Market Penetration: Increased use in emerging markets will moderate prices due to broader volume-based sales.

- Regulatory Changes: Price controls and reimbursement policies, especially in regulated markets, will impact net prices.

Forecasted Price Trends (2023–2028)

- Short-Term (2023–2024): Stabilization of generic prices, slight decline driven by increased competition; branded prices likely to remain stable due to brand loyalty and patent protections.

- Mid-Term (2025–2026): Significant price erosion anticipated as new generics gain market share; expect a 30-50% reduction annually.

- Long-Term (2027–2028): Prices could plateau around USD 10-20 per month for generics in mature markets; in developing regions, prices may stay below USD 10 due to competitive local manufacturing.

Market Opportunities and Future Outlook

The improved understanding of flecainide’s pharmacogenomics and better risk stratification could expand its use, influencing demand stability. Additionally, combination therapies and novel formulations might serve as differentiators, potentially maintaining premium pricing in certain niches.

Emerging markets such as Asia, Latin America, and parts of Africa offer untapped potential, provided regulatory pathways and physician awareness improve. As healthcare infrastructure strengthens, the demand for affordable, effective antiarrhythmic agents will likely rise.

Regulatory and Commercial Strategies

Manufacturers should focus on patent litigation, quality assurance, and expanding clinical evidence to support off-label and niche indications. Strategic pricing aligned with local economic conditions will optimize market penetration and revenue.

Conclusion

Flecainide acetate, historically driven by patent protections, is now predominantly a generic product that faces intense price competition worldwide. The market is set to experience further price declines as generics deepen market penetration. However, stable demand persists owing to its clinical niche and efficacy profile. Companies entering or competing within this space should anticipate continued downward price pressure while seeking value differentiation through clinical evidence and regional customization.

Key Takeaways

- The global flecainide acetate market is in decline in terms of pricing but maintains demand via its efficacy in arrhythmia management.

- Expiration of patents and increased generic competition drive significant price erosion, with potential reductions of 30-50% over the next three years.

- North America remains the dominant market, followed by expanding opportunities in Asia-Pacific, Latin America, and Africa.

- Strategic focus on clinical evidence, regional regulatory navigation, and cost-effective manufacturing remains essential for market players.

- Price projections suggest affordable generics could stabilize around USD 10-20 per month by 2028 in mature markets, with even lower prices in emerging regions.

FAQs

1. What factors influence the pricing of flecainide acetate globally?

Prices are primarily influenced by patent status, generic competition, manufacturing costs, regulatory policies, and regional market dynamics. Patents initially maintained higher prices, but expiry facilitates generic entry, leading to substantial price reductions.

2. How does the patent landscape affect the future of flecainide acetate?

Patent expirations in major markets open the floodgates to generics, intensifying price competition. Continued patent litigations or exclusivity extensions could temporarily sustain higher prices but are unlikely to overshadow the broader trend of declining costs.

3. What clinical considerations impact the demand for flecainide acetate?

Safety concerns such as proarrhythmic risks and contraindications in structural heart disease limit its widespread use. Nevertheless, in appropriately selected patients, clinical guidelines endorse flecainide as a first-line therapy, securing steady demand.

4. Which regions present the highest growth prospects for flecainide acetate?

Emerging markets like China, India, and Brazil anticipate increased adoption due to rising cardiovascular disease burdens, improving healthcare infrastructure, and favorable pricing for generics.

5. Will new formulations or combination therapies affect flecainide’s market?

Potentially. Development of sustained-release formulations or combination products enhancing safety profiles could sustain or expand market share, especially in markets emphasizing adherence and reduction of side effects.

References

[1] MarketsandMarkets, “Antiarrhythmic Drugs Market,” 2022.

[2] Medicare and Prices Data, Consumer Reports, 2023.