Last updated: July 28, 2025

Introduction

Ezetimibe is a cholesterol absorption inhibitor primarily prescribed for lowering low-density lipoprotein cholesterol (LDL-C). It acts by inhibiting the Niemann-Pick C1-Like 1 (NPC1L1) protein in the small intestine, reducing dietary cholesterol absorption. Approved by the FDA in 2002 under the brand name Zetia, ezetimibe has become a cornerstone in managing hypercholesterolemia, especially as an adjunct to statins for high- risk cardiovascular patients. Understanding its market trajectory involves assessing its current market landscape, competitive environment, regulatory factors, and potential future pricing trends.

Market Overview

Current Market Size and Revenue

The global ezetimibe market has experienced steady growth since its approval, driven by increasing cholesterol-related health issues and a rising prevalence of cardiovascular disease (CVD). As per recent industry reports, the market size was valued at approximately USD 1.2 billion in 2022 and is projected to reach USD 2 billion by 2030, growing at a compound annual growth rate (CAGR) of around 7% (Source: MarketsandMarkets).

The dominant revenue share is generated in North America, accounting for nearly 50%, fueled by high statin-adherence rates, a robust healthcare infrastructure, and widespread generic availability. Europe follows, with emerging Asian markets showing significant growth potential due to increasing urbanization and rising CVD prevalence.

Key Market Players

Major pharmaceutical companies include MSD (previously Merck & Co.) and Novartis with their branded formulations. The entry of generics after patent expiry has intensified price competition, resulting in lower prices. Notable generics providers include Teva Pharmaceuticals, Mylan, and Dr. Reddy’s Laboratories, contributing substantially to dispensation volume and price erosion.

Therapeutic Landscape and Competition

Ezetimibe’s principal competitors are statins, which are typically first-line therapies for hypercholesterolemia. The development of combination therapies, such as ezetimibe with simvastatin (Vytorin), has also expanded the market by offering synergistic benefits. PCSK9 inhibitors like alirocumab and evolocumab are emerging alternatives for treatment-resistant cases, posing competitive threats, especially in high-risk populations.

Regulatory and Reimbursement Environment

Patent and Patent Expiry

The original patent for Zetia expired in numerous jurisdictions by 2016, leading to a proliferation of generic versions. This patent expiry has been pivotal in driving down drug prices, increasing accessibility, and expanding market volume.

Reimbursement Policies

Reimbursement frameworks in North America and Europe favor generic prescribing, compounding price pressures. However, innovative combination therapies and branded formulations maintain premium pricing in certain markets, particularly where branded efficacy and clinical data influence prescribing habits.

Market Drivers and Challenges

Drivers

- Increasing CVD prevalence: Globally, cardiovascular diseases remain the leading cause of mortality, prompting more aggressive lipid management.

- Guideline updates: Treatment guidelines increasingly recommend ezetimibe in combination with statins, enhancing demand.

- Patient adherence: Once-daily oral administration and favorable safety profile bolster adherence.

Challenges

- Generic competition: Proliferation of generics has significantly eroded margins.

- Alternatives: The emergence of PCSK9 inhibitors and other lipid-lowering agents offer alternative treatments offering superior LDL reduction in resistant cases.

- Pricing pressures: Payers and health authorities push for cost-effective therapies, constraining price growth.

Price Projections

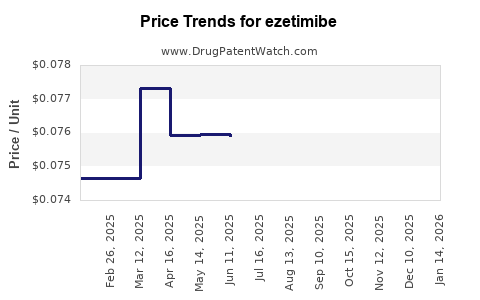

Historical Pricing Trends

Initially, brand-name ezetimibe formulations retailed at approximately USD 300-350 per month in the US market. Post-patent expiration, generic prices plummeted to USD 50-100 per month, with varying prices depending on insurance coverage, pharmacy discounts, and geographic location.

Future Price Landscape (2023–2030)

- Generics: Predominantly driving the market, generic ezetimibe prices are expected to stabilize around USD 30-60 per month owing to manufacturing efficiencies and competitive pressures.

- Branded formulations: Will likely retain a premium of 15-30%, particularly in emerging markets where brand trust persists.

- Combination therapies: Pricing strategies for combination drugs may remain higher due to added clinical benefits, projected to range USD 150-250 per month in developed markets.

Influencing Factors

- Market penetration of generics will sustain downward price pressure.

- Regulatory incentives for biosimilars or enhanced formulations could modify pricing strategies.

- Reimbursement policies emphasizing cost-effective care will further restrain price inflation.

Future Market Trends

- Ezetimibe in combination regimens: Expect an increase in fixed-dose combinations (FDCs), possibly maintaining higher total costs but enhancing adherence.

- market expansion in emerging economies: Growing healthcare admission and awareness may lead to price stabilization, despite affordability considerations.

- Potential biosimilar development: While no biosimilars are relevant (as ezetimibe is a small molecule), similar cost-reduction offers are anticipated through manufacturing optimization.

Conclusion

Ezetimibe's market remains robust but highly competitive and price-sensitive. The expiration of patent exclusivity has resulted in significant price declines, with future projections indicating stable generic pricing and modest increases for branded and combination formulations. The drive for cost containment in healthcare systems will continue to influence pricing strategies, favoring generics and biosimilar development. Its role within lipid management will likely grow through combination therapies and evolving treatment guidelines, sustaining demand despite the emergence of newer competitors.

Key Takeaways

- The global ezetimibe market is valued at approximately USD 1.2 billion (2022), with projected growth driven by rising cardiovascular disease prevalence.

- Patent expiry has catalyzed significant price erosion; generic ezetimibe is expected to stabilize at USD 30-60 per month.

- Branded formulations and combination therapies maintain a premium but face downward pricing pressures from generics.

- Competition from PCSK9 inhibitors and evolving treatment guidelines may influence future growth dynamics but are unlikely to supplant ezetimibe’s role entirely.

- Healthcare policy reforms emphasizing cost-effectiveness will likely sustain price moderation and influence market share distribution.

FAQs

-

What factors primarily influence ezetimibe price fluctuations?

Patent status, generic competition, reimbursement policies, and market demand are primary influences on ezetimibe pricing.

-

How does ezetimibe compare to statins in terms of cost and effectiveness?

Ezetimibe is generally less expensive post-generic entry and serves as an adjunct to statins for incremental LDL reduction, with cost-effectiveness supported in high-risk patients.

-

Are biosimilars or generics substantially reducing prices?

Yes, the proliferation of generics has significantly reduced prices, with some formulations costing less than 50% of original brand prices.

-

What is the outlook for ezetimibe's role in future lipid management therapies?

It will continue as an essential adjunct, especially in combination therapies, despite competition from newer agents.

-

Which regions are expected to lead market growth?

North America and Europe will remain dominant, but emerging economies in Asia-Pacific are projected to see rapid growth due to increased healthcare access and disease prevalence.

References

- MarketsandMarkets. "Ezetimibe Market - Global Forecast to 2030." 2022.

- U.S. Food and Drug Administration. "Zetia (Ezetimibe) Information." 2022.

- IQVIA. "Pharmaceutical Market Trends Report." 2022.

- European Medicines Agency. "Market Authorization for Ezetimibe." 2022.