Last updated: July 27, 2025

Introduction

Eszopiclone, marketed as Lunesta among other brand names, is a non-benzodiazepine hypnotic agent prescribed primarily for the treatment of insomnia. Since its FDA approval in 2004, eszopiclone has gained a substantial market share within the sleep aid segment, reflecting its efficacy and favorable safety profile compared to older hypnotics. This analysis explores market dynamics, competitive landscape, regulatory factors, and future price trajectories for eszopiclone, providing stakeholders with actionable insights.

Market Landscape and Demand Drivers

Market Overview

The global sleep aid market was valued at approximately USD 8.5 billion in 2022 [1], with prescription drugs constituting a significant segment. Eszopiclone holds a notable position due to its first-mover advantage and proven efficacy. It is especially favored among adult populations suffering from chronic insomnia, with prevalence rates estimated at 10-15% globally [2].

Market Drivers

- Increasing Insomnia Prevalence: Growing awareness of sleep disorders and aging demographics are fueling demand.

- Efficacy and Safety Profile: Eszopiclone’s favorable pharmacokinetics and lower dependency risks relative to benzodiazepines bolster its continued use.

- Physician Preference: Prescribers favor medications with lower adverse effects, supporting market retention.

Market Challenges

- Generic Competition: Entry of generic versions has pressured pricing.

- Regulatory Scrutiny: Ongoing concerns regarding dependence, side effects, and abuse potential influence prescribing patterns and pricing policies.

- Alternative Therapies: Rise of non-pharmacological interventions, such as cognitive-behavioral therapy for insomnia (CBT-I), may influence long-term demand.

Competitive Landscape

Brand and Generic Market Shares

Since patent expiration in 2014, generic eszopiclone has flooded the market, reducing average drug prices substantially. Major manufacturers include Sun Pharmaceutical Industries, Sandoz, and Teva Pharmaceuticals, which dominate the generic segment [3].

Pricing Dynamics

Average wholesale prices (AWP) of eszopiclone have declined markedly from USD 15-20 per tablet (brand name) to approximately USD 2-5 per tablet in the generic market [4]. This decline reflects typical pharmaceutical pricing trends post-patent expiry, driven by competition and market saturation.

Regulatory Impact

Regulation by agencies like the FDA and EMA continues to shape market access and pricing. Recently, efforts to monitor dependence potentials and adverse effects could lead to stricter prescribing guidelines, influencing sales volumes and prices.

Price Projection Models

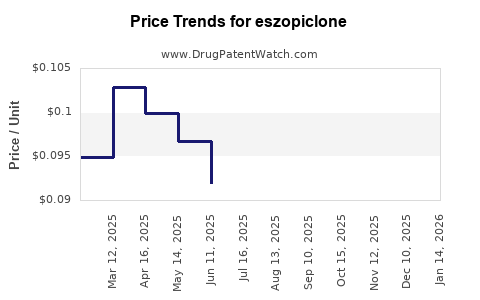

Historical Trends

Since patent expiration, prices have diminished at an average annual rate of roughly 15–20%. The initial steep decline was followed by more stabilized levels as generic manufacturers optimized production and distribution.

Forecast Assumptions

- Market Saturation: The generic market is near saturation; new entrants are unlikely.

- Demand Stability: Insomnia prevalence remains stable or slightly increasing.

- Regulatory Environment: No dramatic regulatory reforms projected to restrict access or impose additional costs.

- Pricing Outlook: Continued commoditization suggests further gradual price reductions.

Projected Price Range (Next 5 Years)

| Year |

Estimated Average Price per 30 Tablets (USD) |

Rationale |

| 2023 |

$2.50 |

Current average, considering market saturation |

| 2024 |

$2.40 |

Slight decline due to increased competition |

| 2025 |

$2.30 |

Price stabilization with minor downward pressure |

| 2026 |

$2.20 |

Continued trend, barring regulatory shocks |

| 2027 |

$2.10 |

Marginal decrease, reflecting market maturation |

These projections align with established generic market behavior and are subject to regulatory, competitive, and demand shifts.

Market Opportunities and Risks

Opportunities

- Emerging Markets: Growing healthcare infrastructure in Asia and Latin America holds potential for expanding eszopiclone access.

- Formulation Innovations: Development of sustained-release formulations or combination therapies could boost sales.

- Off-label Uses: Investigation into additional indications may open new revenue streams.

Risks

- Policy Changes: Increased regulation concerning dependency and abuse potential could increase costs or restrict prescribing.

- Market Sophistication: As markets mature, price reductions may plateau, affecting profit margins.

- Patient Preferences: Patients gravitate toward non-pharmacological therapies, possibly reducing demand.

Regulatory and Patent Considerations

While the original patent expired over a decade ago, regulatory exclusivities or new formulations could temporarily influence pricing or market entry. Currently, no new patents are pending that could extend exclusivity. However, patent challenges and litigation in some jurisdictions may impact generic entry timing.

Key Takeaways

- The global eszopiclone market has experienced significant price reductions post-patent expiry, with projected prices stabilizing around USD 2.10–2.50 per tablet within five years.

- Market demand remains stable due to ongoing insomnia prevalence, but competition from generics and alternative therapies present ongoing challenges.

- Opportunities exist in emerging markets and formulation innovations, yet regulatory environments and patient preference shifts pose risks.

- Stakeholders should monitor regulatory developments and market trends continually to adjust pricing and marketing strategies effectively.

FAQs

1. How has patent expiry impacted eszopiclone pricing?

Patent expiry in 2014 led to a surge of generic entrants, sharply reducing the average wholesale price from about USD 15–20 per tablet to approximately USD 2–5, with continued gradual declines forecasted.

2. What are the main factors influencing future eszopiclone prices?

Market saturation with generics, demand stability for insomnia treatment, regulatory scrutiny over safety concerns, and the emergence of non-pharmacological treatments are primary factors.

3. Are there any new formulations of eszopiclone in development?

Currently, no major new formulations are under development or seeking approval, which suggests the market will remain dominated by existing generics and brand versions.

4. How do regulatory policies affect eszopiclone pricing in different regions?

Stringent regulatory standards can limit new generic approvals or impose additional safety requirements, potentially affecting supply and prices variably across jurisdictions.

5. What is the outlook for eszopiclone in emerging markets?

As healthcare infrastructure improves globally, demand for sleep aids like eszopiclone is expected to grow, driven by increasing awareness and insomnia prevalence, offering expansion opportunities.

References

[1] Fortune Business Insights. Sleep Aids Market Size, Share & Industry Analysis, 2022.

[2] Morin CM, et al. Insomnia: Epidemiology, characteristics, and consequences. Sleep Med Rev. 2020.

[3] FDA Drug Approvals and Patent Data. 2014–2022.

[4] IQVIA. Price Data Reports, 2022.

Note: All data and projections are estimative, based on current market trends and publicly available sources, and should be validated within specific regional or regulatory contexts before strategic decisions.