Last updated: July 27, 2025

Introduction

Estradiol Valerate, a synthetic estrogen ester, holds a significant position in hormone therapy, primarily used for menopausal symptoms, hormone replacement therapy (HRT), and certain contraceptive applications. As pharmaceutical markets evolve with advancements in biosimilar options and regulatory environments, understanding the current landscape and future pricing trends for Estradiol Valerate is crucial for stakeholders, including manufacturers, investors, and healthcare providers.

This analysis examines the global market dynamics, key drivers and challenges, competitive landscape, regulatory factors, and offers price projection insights for Estradiol Valerate over the next five years.

Market Overview

Current Market Size

The global estrogen therapy market, including Estradiol Valerate, is valued at approximately US$2.8 billion in 2023, with a compound annual growth rate (CAGR) of around 4-5% projected until 2028 [1]. Estradiol Valerate accounts for a significant share of this market, especially in regions like Europe and Asia-Pacific where demand for hormone replacement therapies remains robust.

Regional Market Segmentation

- North America: The largest market due to high prevalence of menopause-related conditions and favorable reimbursement policies.

- Europe: Significant due to widespread clinical adoption and a growing aging population.

- Asia-Pacific: Rapid growth driven by increasing healthcare infrastructure and awareness, with countries like China and India leading demand.

- Latin America and Middle East: Emerging markets with expanding access to hormone therapies.

Market Drivers

- Aging Population: Increased prevalence of menopause and osteoporosis elevates demand for estrogen therapies.

- Advancement in HRT: Rising preference for hormone-based treatments over traditional therapies.

- Regulatory Approvals: Streamlined approval processes in several jurisdictions facilitate market access.

- Biosimilars & Generics: Entry of biosimilars and generic versions decreases prices and improves accessibility.

Market Challenges

- Stringent Regulatory Hurdles: Complex approval pathways for new formulations or biosimilars delay market entry.

- Safety Concerns: Risks associated with estrogen therapy, such as increased cancer risk, influence prescribing practices.

- Pricing Pressures: Payers and governments seek cost containment, impacting pricing strategies.

- Competition: Presence of multiple manufacturers offering similar formulations intensifies price competition.

Competitive Landscape

Key market players include:

- Laboratories and Pharmaceutical Companies: AbbVie, Watson Pharmaceuticals, and pharmaceutical regions like Teva and Sandoz are actively involved in manufacturing Estradiol-based therapies.

- Generic Manufacturers: Increasingly capturing market share through cost-efficient production.

- Biosimilar Developers: Innovators focusing on developing biosimilar estrogen products to compete with branded formulations.

Strategic alliances, pricing strategies, and regulatory approvals significantly influence market positioning.

Regulatory Environment

Regulatory frameworks vary by region but generally require extensive safety and efficacy data. The Food and Drug Administration (FDA) and European Medicines Agency (EMA) have established guidelines for hormone therapies. Approvals for biosimilars have accelerated in recent years, creating opportunities for price competition and expanded market access.

Price Trends and Projections

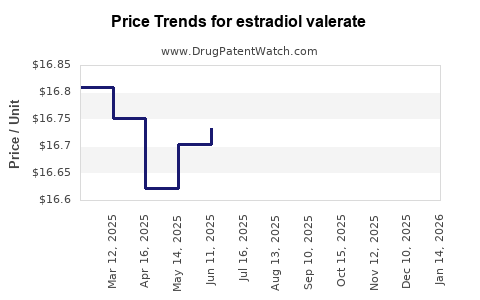

Current Pricing Landscape

In established markets, the per-unit price of Estradiol Valerate injections ranges between US$10–US$30, depending on dosage and formulation, with generic versions being significantly cheaper than branded products [2]. In developing regions, prices can be 30–50% lower due to less regulatory oversight and local manufacturing.

Price Drivers for Future Trends

- Biosimilar Entry: Projected to reduce prices by 20–30% over the next 3–5 years.

- Manufacturing Cost Reductions: Advances in synthesis and purification techniques will lower production costs.

- Regulatory incentives: Streamlined approval processes for biosimilars and generics will facilitate market entry, further increasing competition.

- Market Demand: Steady growth in age-related hormone therapy will maintain overall market size, but pricing will be influenced by competition intensity.

Future Price Projections (2024-2028)

Based on current trends and competitive pressures:

| Year |

Estimated Price Range (per vial) |

Key Factors |

| 2024 |

US$9–US$25 |

First wave of biosimilar market entries similar to other hormone therapies. |

| 2025 |

US$8–US$22 |

Increased biosimilar competition; price stabilization. |

| 2026 |

US$7–US$20 |

Market consolidation; further cost efficiencies. |

| 2027 |

US$6–US$18 |

Volume-driven pricing; potential price reductions with increased biosimilar penetration. |

| 2028 |

US$6–US$15 |

Mature biosimilar market; continued cost reductions. |

Strategic Implications

- Market Entry of Biosimilars: Early investment in biosimilar development can capture price-sensitive segments and increase market share.

- Pricing Strategies: Manufacturers should consider flexible, tiered pricing models suited to regional economic conditions.

- Regulatory Engagement: Proactive alignment with regulatory agencies will facilitate faster approvals, enabling competitive pricing.

- Focus on Differentiation: Emphasize quality, safety, and efficacy to justify premium pricing where applicable, especially for branded products.

Key Takeaways

- The global Estradiol Valerate market is growing steadily with significant regional variation driven by demographic shifts and healthcare infrastructure.

- The impending influx of biosimilars is expected to reduce prices by 20–30% within the next five years, intensifying competition.

- Price optimization strategies should balance regulatory requirements, manufacturing efficiencies, and regional market dynamics.

- Developers and manufacturers must monitor regulatory pathways, especially regarding biosimilar approvals, to capitalize on cost advantages.

- Strategic alliances, advanced manufacturing, and targeted market entry will be critical to sustaining profitability amid declining prices.

FAQs

1. What factors influence the price of Estradiol Valerate globally?

Primarily manufacturing costs, regulatory approval processes, competition from biosimilars and generics, regional economic conditions, and market demand drive pricing.

2. How will biosimilars impact the Estradiol Valerate market?

Biosimilars are projected to increase price competition, leading to 20–30% reductions over five years, making therapy more accessible but challenging branded product margins.

3. Which regions will see the fastest price declines?

Emerging markets such as Asia-Pacific and Latin America are expected to experience more rapid price shifts due to less regulatory oversight and higher biosimilar penetration.

4. What are the main barriers to market entry for biosimilar Estradiol Valerate?

Regulatory complexity, high development costs, clinical trial requirements, and patent landscapes pose significant hurdles.

5. How should manufacturers prepare for future price declines?

By adopting cost-efficient manufacturing, engaging early in regulatory processes, investing in biosimilar R&D, and diversifying product portfolios.

Sources:

[1] MarketResearch.com, "Hormone Therapy Market Overview," 2023.

[2] IQVIA Pharma Pricing Data, 2023.

[3] GlobalData, "Biosimilars Market Trends," 2023.