Last updated: July 28, 2025

Introduction

Doxazosin Mesylate is a selective alpha-1 adrenergic receptor antagonist primarily prescribed for the treatment of hypertension and benign prostatic hyperplasia (BPH). Since its FDA approval in 1988, the drug has carved a significant niche in cardiovascular therapeutics, with ongoing developments influencing its market dynamics. This analysis explores current market trends, competitive landscape, pipeline developments, regulatory considerations, and future price projections for Doxazosin Mesylate.

Market Overview and Current Position

Market Size & Global Demand

The global demand for Doxazosin Mesylate remains robust, driven by aging populations and the prevalence of hypertension and BPH. According to data from IQVIA, in 2022, the global antihypertensive drugs market was valued at approximately USD 35 billion, with alpha-blockers constituting a significant segment. Doxazosin, owing to its proven efficacy, safety profile, and affordability, maintains a steady market share within this segment.

Manufactured Brands and Generics

Originally marketed under brand names like Cardura (Pfizer), the patent expiry of Doxazosin Mesylate has facilitated the proliferation of generic versions, significantly lowering prices and expanding accessibility. Current dominant players include Teva, Mylan, and Lupin, which supply cost-effective generic formulations worldwide.

Regulatory and Patent Landscape

Pfizer’s patent on Doxazosin Mesylate expired in most markets by 2010, opening the field for generics. Regulatory barriers primarily concern manufacturing standards across different regions, but no current patent litigations restrict production, fostering an open competitive environment.

Market Drivers

- Aging Population: The increasing prevalence of hypertension and BPH among the elderly population sustains consistent demand.

- Cost-Effectiveness of Generics: Market penetration by generics has made Doxazosin Mesylate a preferred first-line treatment in both developed and emerging markets.

- Expanded Indications: Besides hypertension and BPH, ongoing research into additional cardiovascular benefits may expand its therapeutic profile.

- Healthcare Accessibility: Growing healthcare infrastructure, especially in emerging economies, broadens patient access and increases consumption.

Competitive Landscape

Major Players

- Pfizer: Original patent holder, now mainly through generic licensing.

- Teva Pharmaceutical Industries: One of the leading manufacturers of Doxazosin Mesylate generics.

- Mylan (now part of Viatris): Significant market share in North America and Europe.

- Lupin, Sun Pharma, and Other Indian Generics Companies: Expanding presence globally, especially in Asia and Africa.

Pricing Strategies

Price competition is fierce among generics, with price erosion driven by tender awards and bulk procurement. Market share is increasingly influenced by manufacturing quality, distribution channels, and regional regulatory approvals.

Pipeline and Developmental Trends

Research & Clinical Trials

Limited ongoing clinical trials focus on Doxazosin Mesylate, primarily exploring its cardiovascular protective effects and potential repurposing for other indications. The lack of significant pipeline innovation suggests a mature market with limited near-term development activity.

Formulation Innovations

Innovations in formulation, such as once-daily extended-release pills, have been widely adopted, ensuring patient adherence and stable pharmacokinetic profiles.

Regulatory Considerations

Future market expansion depends heavily on regulatory approvals, particularly in emerging markets where healthcare infrastructure is evolving. Additionally, regulatory agencies mandate strict quality standards for generics, which reputable manufacturers meet, ensuring sustained market access.

Price Projections and Future Outlook

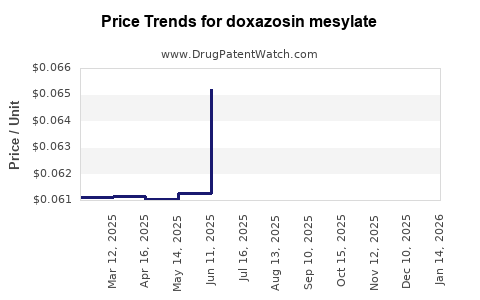

Historical Price Trends

Since patent expiry, average prices for Doxazosin Mesylate generics have declined by approximately 60-70% globally. For instance, in the U.S., the average retail price per tablet has decreased from an estimated USD 1.50 to USD 0.50 over the last decade.

Price Forecasts (2023–2030)

- Short-term (Next 2 Years): Prices are expected to stabilize due to market saturation, with minimal further erosion. Price points may hover around USD 0.45–0.55 per tablet in mature markets.

- Mid-term (3–5 Years): Slight decline anticipated to approximately USD 0.40–0.45 per tablet, driven by increased competition and price-sensitive markets in Asia and Africa.

- Long-term (5+ Years): Potential stabilization or slight increase if manufacturing costs increase or new formulations are introduced; however, significant price reductions are improbable given market saturation.

Factors Influencing Future Pricing

- Market Penetration: Increased adoption in low-income regions may stabilize or slightly increase prices due to supply challenges.

- Manufacturing Costs: Raw material prices, regulatory compliance costs, and packaging influence final consumer prices.

- Regulatory Changes: Policies promoting generic competition or price controls can impact pricing trajectories.

- Emerging Alternatives: The advent of novel antihypertensives or combination therapies could affect demand, indirectly influencing prices.

Market Risks and Opportunities

- Risks: Market saturation, stringent regulatory environments, price competition, and the potential for cheaper formulations from emerging manufacturers.

- Opportunities: Expansion into developing markets, formulation improvements for better compliance, and exploring new therapeutic indications.

Conclusion

Doxazosin Mesylate operates within a mature, highly competitive market characterized by stabilized and declining generic prices. While immediate price reductions are limited, long-term outlooks suggest stable demand with moderate pricing pressures. Manufacturers should focus on operational efficiencies, strategic market entry, and formulation improvements to sustain profitability amidst inherent commoditization.

Key Takeaways

- The patent expiry of Doxazosin Mesylate has fostered a highly competitive, predominantly generic market.

- Market demand remains steady due to aging populations and the drug’s proven efficacy.

- Prices have declined significantly since patent expiry, with further stabilization expected.

- Development activity is limited, emphasizing market maturity rather than innovation-driven growth.

- Strategic focus should be on expanding access in emerging markets and ensuring manufacturing quality to maintain competitiveness.

FAQs

1. What is the current market price of Doxazosin Mesylate?

The retail price varies globally, but in mature markets like the U.S., generic Doxazosin Mesylate typically costs around USD 0.50 per tablet.

2. Which regions offer the highest growth potential for Doxazosin Mesylate?

Emerging markets in Asia, Africa, and Latin America represent significant growth opportunities due to expanding healthcare infrastructure and increasing prevalence of hypertension and BPH.

3. Are there any new formulations or delivery methods under development?

Most developments focus on extended-release formulations to enhance adherence, with minimal innovation beyond current generics.

4. How does price competition affect profit margins for manufacturers?

Intense competition among generic manufacturers leads to price erosion, squeezing profit margins, and incentivizing cost efficiencies and manufacturing innovations.

5. What regulatory challenges could impact future market access?

Strict quality standards, approval delays, and regional approval variances may restrict supply and influence pricing strategies in different territories.

References

- IQVIA. (2022). Global Market Data on Antihypertensive Drugs.

- U.S. Food and Drug Administration (FDA). (2010). Patent Expiration and Generic Entry Data.

- Pfizer Inc. (Original marketing approval and labeling of Cardura).

- MarketLine. (2022). Pharmaceutical Industry Reports.

- GlobalData. (2022). Forecasts for Cardiovascular Pharmaceuticals.