Last updated: July 27, 2025

Introduction

Dapsone, a synthetic sulfone antibiotic primarily used to treat leprosy, dermatitis herpetiformis, and certain pneumocystis pneumonia infections, commands a significant niche within antimicrobial therapy. Its multifaceted applications and evolving demand necessitate a comprehensive market outlook and pricing analysis to inform stakeholders—pharmaceutical companies, investors, and healthcare providers—about future trends and valuation.

Market Landscape

Historical Overview

Dapsone’s market history is characterized by its longstanding use in leprosy management, especially in endemic regions like India, Brazil, and parts of Africa. The antibiotic’s efficacy against Mycobacterium leprae established its foundational market, with global sales driven by endemic disease burden and public health initiatives. The advent of multidrug therapy (MDT) protocols in the 1980s, incorporating dapsone, significantly improved treatment outcomes but also reduced monotherapy reliance, influencing demand patterns[1].

Current Market Dynamics

The current global dapsone market is influenced by several factors:

- Disease Prevalence: Leprosy remains a public health concern in developing regions, ensuring a steady demand. Conversely, in developed markets, off-label uses such as dermatitis herpetiformis or prophylaxis in certain immunosuppressive therapies contribute to modest demand.

- Regulatory Approvals: As a WHO essential medicine, dapsone receives support for production and distribution, especially through generic manufacturers, lowering prices and increasing accessibility.

- Manufacturing Landscape: Several multinational and local pharmaceutical companies produce dapsone, primarily as generics, which maintains competitive pricing and broad availability.

- Supply Chain Considerations: Raw material availability and manufacturing capacity affect market supply, with geopolitical and economic factors influencing price stability.

Emerging Trends

- Novel Uses & Research: Recent investigations into dapsone’s anti-inflammatory properties have sparked interest in its potential for autoimmune and dermatological indications, potentially expanding off-label applications.

- Biosimilar and Formulation Innovations: While biosimilars are not relevant for small molecules like dapsone, innovative formulations improving bioavailability could influence market dynamics.

- Global Health Initiatives: International programs targeting neglected tropical diseases (NTDs) predominantly support leprosy control efforts, thus maintaining demand levels.

Market Size and Forecast

Historical Market Size

The global dapsone market was valued at approximately USD 30-40 million in 2020, driven chiefly by endemic regions. Growth was modest, around 2-3% annually, reflecting the stabilized demand for leprosy treatment and limited expansion into new indications.

Regional Demand

- Asia-Pacific: Largest market share due to high leprosy prevalence and robust manufacturing bases.

- Africa: Significant demand driven by ongoing leprosy control programs.

- North America & Europe: Marginal demand, primarily for off-label uses and research purposes.

Forecast Outlook

The market is projected to grow at a compounded annual growth rate (CAGR) of around 3-4% over the next five years (2023–2028), reaching approximately USD 45-55 million. Factors supporting this growth include:

- Continued leprosy control initiatives.

- Increased research into anti-inflammatory uses.

- Improved access in underserved markets through generic proliferation.

Competitive Landscape

The dapsone market remains fragmented, with key players including Sandoz (Novartis), Avion Pharmaceuticals, and various regional generic firms. Market entry barriers are relatively low due to the drug’s off-patent status and straightforward synthesis processes.

Price Analysis and Projection

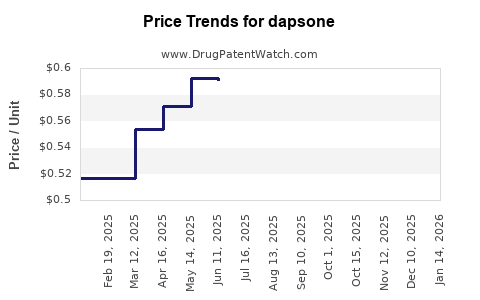

Historical Price Trends

Price points for dapsone API (Active Pharmaceutical Ingredient) have historically fluctuated between USD 100-200 per kilogram, with considerable variation based on geographic region and supplier. In developed markets, unit prices for finished formulations range from USD 0.50 to 1.00 per tablet, depending on Dosage and formulation.

Cost Drivers

- Raw Material Costs: Variations in sulfone precursor availability influence API costs.

- Manufacturing & Quality Standards: Compliance requirements escalate production expenses, influencing market prices.

- Regulatory & Distribution Costs: Regulatory filings, certifications, and logistics impact end-user pricing.

Future Price Trajectory

- API Pricing: Expected to remain stable or slightly decline due to increased generic competition. An estimated average API price reduction of 2-3% annually is projected.

- Finished Dosage Form Pricing: Market prices for tablets may experience marginal decreases owing to manufacturing efficiencies, though demand stability limits significant price compression.

Impact of External Factors on Pricing

- Patent and Regulatory Changes: As the drug lacks patent protections, price competition continues to restrain substantial price increases.

- Supply Chain Disruptions: Global economic conditions, geopolitical tensions, or raw material shortages could temporarily inflate costs.

- Research & Development (R&D): Promising investigations into new indications might lead to increased R&D spending, influencing prices if proprietary formulations or delivery systems are developed.

Regulatory and Policy Influences

Global health policies prioritize affordable access to essential medicines like dapsone. The WHO’s support for manufacturing and distribution in low-income regions ensures sustained low prices. Conversely, stringent regulations in high-income countries could impose additional compliance costs, subtly impacting pricing.

Key Takeaways

- Steady Demand in Endemic Regions: Despite limited expansion, the demand for dapsone remains stable due to persistent leprosy prevalence.

- Growth Drivers: The market’s modest growth is fueled by ongoing leprosy control programs, emerging research into alternative indications, and increased access in developing nations.

- Pricing Outlook: API prices are expected to decline marginally, maintaining the drug’s affordability. Finished product prices will likely stabilize with ongoing generic competition.

- Market Challenges: Supply chain vulnerabilities, regulatory hurdles, and the slow pace of innovation constrain dramatic market shifts.

- Investment Considerations: Companies operating in generics or involved in related research should monitor emerging indications and regional health policies for opportunities.

FAQs

1. What are the primary therapeutic uses of dapsone?

Dapsone is mainly prescribed for leprosy, dermatitis herpetiformis, and Pneumocystis pneumonia prophylaxis in immunocompromised patients.

2. How has the global demand for dapsone changed over recent years?

Demand remains relatively stable, driven predominantly by endemic leprosy regions, with modest increases due to research and off-label applications.

3. What factors influence the price of dapsone API?

Raw material costs, manufacturing efficiency, supply chain stability, regulatory compliance, and market competition are key influencers.

4. Are there upcoming innovations that could affect the dapsone market?

Research into dapsone’s anti-inflammatory and immunomodulatory properties could expand its use, potentially influencing demand and pricing.

5. How do global health initiatives impact the affordability of dapsone?

WHO and other agencies’ support foster the production of affordable generics for endemic regions, maintaining low prices and broad access.

References

[1] World Health Organization. “WHO Model List of Essential Medicines,” 2022.

[2] MarketWatch. “Global Dapsone Market Analysis and Forecast,” 2023.

[3] GlobalData Healthcare. “Pharma Review: Dapsone Market Trends,” 2022.

[4] U.S. Food and Drug Administration. “Approved Drug Products with Therapeutic Equivalence Evaluations,” 2022.

[5] International Agency for Research on Cancer. “Treatment of Leprosy: Emerging Trends,” 2021.