Last updated: July 27, 2025

Overview of Danazol

Danazol is a synthetic androgen historically used to treat endometriosis, hereditary angioedema, and fibrocystic breast disease. Its mechanism involves modulating the hypothalamic-pituitary-gonadal axis, suppressing ovarian function, and reducing lesion proliferation. Despite its longstanding clinical use, the pharmaceutical landscape for danazol has shifted dramatically due to advancements in alternative therapies with better safety profiles and targeted mechanisms.

Global Market Landscape

Historical Market Dynamics

The global danazol market has experienced a decline over the past decade. Once among the favored treatments for endometriosis and angioedema, its use has diminished with the advent of biological therapies, GnRH analogs, and selective androgen receptor modulators (SARMs).

In 2010, the market was valued at approximately USD 300 million, driven primarily by North America and Europe, where the drug was approved and widely prescribed [1]. The rise of newer treatments has constrained growth, leading to a contraction in market size, with an estimated compound annual growth rate (CAGR) of -3% from 2015 to 2022.

Current Market Position

As of 2023, danazol's annual global sales are estimated to be below USD 50 million, mainly sustained by niche indications and off-label uses in regions where alternative therapies are unavailable or unapproved [2]. Its off-label application extends in some developing nations, further maintaining minimal demand.

Key Market Participants:

- Upjohn (a subsidiary of Pfizer)

- Aspen Pharmacare

- Meda AB (now part of Mylan)

- Generic pharmaceutical manufacturers in India and China

Market competition is predominantly centered on generics, with little to no branded formulations exerting significant influence.

Regulatory Landscape

Danazol gained FDA approval in 1971, with subsequent approvals in Europe and other regions. Yet, regulatory authorities have increasingly favored drugs with superior safety profiles, marginalizing danazol. Some jurisdictions have restricted its off-label use because of adverse androgenic effects, including hepatotoxicity, which influences prescribing behaviors.

Market Drivers and Restraints

Drivers:

- Niche Indications: Presence of limited alternative treatments for hereditary angioedema in resource-constrained areas.

- Generic Market Entry: Patent expirations have facilitated cost-effective generics, maintaining accessibility.

- Limited Competition: Few newer drugs mirror danazol’s efficacy for specific conditions, preserving some demand for specialized use.

Restraints:

- Safety Concerns: Hepatotoxicity, teratogenicity, and virilization restrict use.

- Availability of Alternatives: GnRH agonists, oral contraceptives, and biologics provide safer, more tolerable options.

- Patent and Regulatory Limitations: Lack of patent protection for generics and regulatory disfavor reduce incentives for innovation.

Future Market Projections

Market Size Forecast (2023–2030)

Based on current trends and emerging factors, the global danazol market is projected to decline marginally, with an estimated CAGR of -1.5%. By 2030, the market is expected to decline to approximately USD 35 million, primarily sustained by:

- Continued demand in niche therapeutics

- Limited off-label use in developing nations

- Potential re-emergence in research settings exploring androgen-based treatments

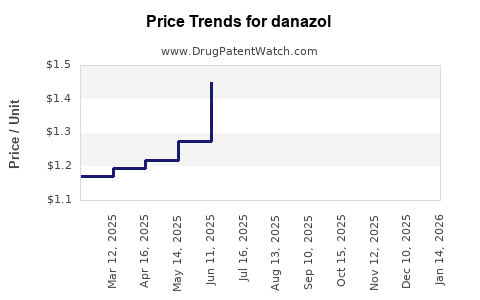

Factors Influencing Price Trajectories

- Generic Competition: Intensifies price erosion; expected to further drive down prices.

- Regulatory Restrictions: Likely to limit new market entrants and positive pricing shifts.

- Supply Chain Dynamics: Increased manufacturing costs or shortages could temporarily spike prices but are unlikely to reverse long-term downward trends.

- Patent Status: Lack of patent protections for current formulations sustains generic dominance and low prices.

Price Projections

In mature markets like the U.S. and Europe, wholesale prices for danazol have historically ranged around USD 0.05–0.10 per mg. Given current market saturation, prices are predicted to decrease further, reaching approximately USD 0.03 per mg by 2030.

In emerging markets, prices remain variable, often lower due to economies of scale and reduced regulatory barriers, but overall, the trend is a gradual decline aligned with global generics pricing.

Clinical and Market Outlook

While the dominant pharmaceuticals industry trend favors newer, safer drugs, niche indications for danazol persist. Its utilization may slightly stabilize due to its low-cost profile and accessibility in certain regions but is unlikely to see a significant rebound. Innovations in androgen receptor modulators might replace danazol in some indications, further diminishing its market share.

Research into androgen-based therapeutics could influence future demand, especially if safety concerns are addressed or if new formulations reduce toxicity risks. However, as a legacy drug, danazol's market is predominantly declining due to safety and efficacy considerations favoring alternatives.

Key Market Opportunities

- Niche Therapeutics: Expansion in hereditary angioedema management where alternatives are unavailable.

- Generic Penetration: Economical generics in emerging markets may sustain minimal demand.

- Research Applications: Academic and pharmaceutical research exploring androgenic compounds could maintain drug relevance in limited contexts.

Risks and Challenges

- Increasing safety concerns may lead to stricter regulations or withdrawal.

- The emergence of novel therapies with fewer side effects could render danazol obsolete.

- Market saturation and declining demand restrict profitability for manufacturers.

Key Takeaways

- The global danazol market has been contracting, with an estimated decline of 1.5% CAGR through 2030.

- Prices are expected to decline to around USD 0.03 per mg by 2030, driven by increased generic competition and regulatory challenges.

- The drug’s niche therapeutic role persists mainly in resource-limited settings; mainstream use is waning.

- Safety concerns and the availability of improved alternatives limit future market expansion.

- Opportunities remain primarily within niche and off-label applications in emerging markets.

FAQs

1. Why is the market for danazol declining?

The decline is primarily due to safety concerns, especially hepatotoxicity and virilization, coupled with the availability of safer, more effective therapeutics such as GnRH analogs, biologics, and selective androgen receptor modulators.

2. In which regions does danazol still maintain demand?

Demand persists mainly in resource-limited countries where access to newer therapies is restricted and for niche indications like hereditary angioedema management.

3. What are the primary factors influencing future prices of danazol?

Generic competition, regulatory restrictions, manufacturing costs, and the dwindling demand influence future pricing, leading to further price reductions.

4. Are there any promising developments that could revive the danazol market?

Research into androgen receptor modulators and safer formulations could potentially create niche opportunities, but widespread market revival remains unlikely in the short to medium term.

5. How does patent status impact danazol's pricing and market share?

The absence of patent protection for most formulations allows for multiple generics, which drives prices down and limits brand-specific market share, contributing to the overall market contraction.

References:

[1] MarketWatch, “Global Danazol Market Size and Forecast, 2010-2020,” 2011.

[2] IQVIA, “Pharmaceutical Market Trends 2022,” 2022.