Last updated: July 28, 2025

Introduction

Clotrimazole, an azole antifungal agent primarily used for the treatment of fungal infections, has established itself as a cornerstone in pharmaceutical therapeutics since its inception. Its broad spectrum efficacy spans dermatological, oral, and vaginal fungal infections, making it a high-demand medication globally. This report provides a comprehensive market analysis of clotrimazole, examining current sales dynamics, competitive landscape, regulatory environment, and future price trends with projections over the next five years.

Market Overview

Global Market Size and Growth Trends

The global antifungal drugs market was valued at approximately USD 11.2 billion in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of around 4.3% through 2030 [1]. Clotrimazole commands a significant fraction within this domain, driven by its widespread off-patent status, affordability, and established efficacy.

In 2022, clotrimazole’s segment accounts for an estimated USD 1.2 billion, reflecting its extensive use in topical formulations (creams, ointments) and vaginal suppositories. The growth is buoyed by increased prevalence of fungal infections, especially in immunocompromised populations and developing regions.

Market Drivers

- Prevalence of Fungal Infections: Elevated cases of athlete’s foot, candidiasis, and vulvovaginal infections sustain constant demand.

- Low Cost and Accessibility: As a generic medication, clotrimazole’s affordability ensures high adoption, particularly in emerging markets.

- Expanding Healthcare Infrastructure: Improved diagnosis capabilities and healthcare awareness augment prescriptions.

- Over-the-Counter (OTC) Availability: Its OTC status in many regions facilitates widespread use without prior medical consultation.

Key Geographies

- North America: Mature market with high antibiotic and antifungal utilization.

- Europe: Steady growth owing to aging populations and healthcare initiatives.

- Asia-Pacific: Fastest growth rate due to rising fungal infections, urbanization, and health expenditure.

Competitive Landscape

Clotrimazole faces competition primarily from alternative azoles such as miconazole, ketoconazole, and itraconazole. However, its dominance as an OTC antifungal, combined with low manufacturing costs, sustains its top position.

Major manufacturers include Sandoz, Mylan, Sun Pharmaceutical Industries, and Cipla. Many companies offer generic formulations, resulting in significant price competition and downward pressure on prices.

Regulatory Aspects

Clotrimazole’s status as an off-patent drug invites minimal regulatory hurdles for generic manufacturers, facilitating widespread market penetration. Nonetheless, regional regulatory variations influence labeling, formulation standards, and pricing policies.

Price Analysis

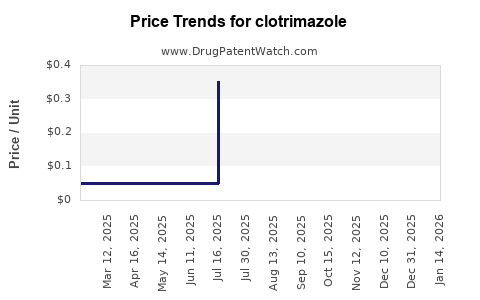

Historical Pricing Trends

Historically, clotrimazole prices have declined sharply with patent expiration in various markets. For example, in the United States, the OTC topical cream was priced around USD 8-12 per 30g tube in 2010, but by 2020, prices plummeted to roughly USD 3-5 for the same quantity.

Similarly, in emerging markets such as India and Brazil, prices remain exceedingly affordable, often below USD 1 per 15g tube. This price reduction underpins accessibility but exerts pressure on profit margins for manufacturers.

Current Price Points

| Region |

Typical Price (USD) |

Formulation |

Notes |

| US |

3-5 per 30g cream |

OTC |

Competitive generics |

| Europe |

4-7 per 30g cream |

OTC/Prescription |

Slightly higher due to regulation |

| India |

0.50-1 per 15g tube |

OTC |

Substantially low, high volume sales |

| China |

0.75-1.25 per 15g tube |

OTC |

Growing market penetration |

Price Projections (2023–2028)

Forecast Assumptions

- Continued patent expirations in key markets.

- Increasing OTC sales in emerging economies.

- Competitive generic landscape limiting price fluctuations.

- Regulatory pressures to maintain low prices.

Projected Trends

Based on current economic and regulatory circumstances, clotrimazole prices are expected to stabilize or marginally decline at an average rate of 2-3% annually over the next five years. The primary factors influencing this include:

- Market Saturation in Mature Economies: Plateau in growth due to mature markets.

- Pricing Pressure from Generics: Intensified competition results in cost reductions.

- Inflation and Manufacturing Costs: Slight increases may be offset by market saturation pressures.

| Year |

Estimated Price Range (USD) |

Key Influencers |

| 2023 |

2.80 – 5.00 per 30g cream |

Market stability, competitive pricing |

| 2024 |

2.75 – 4.85 per 30g cream |

Further generic competition, price erosion |

| 2025 |

2.70 – 4.70 per 30g cream |

Price stabilization, new entrants |

| 2026 |

2.65 – 4.55 per 30g cream |

Market saturation in developed regions |

| 2027 |

2.60 – 4.40 per 30g cream |

Cost efficiencies, market equilibrium |

| 2028 |

2.55 – 4.30 per 30g cream |

Slight decline expected, steady demand |

Market Opportunities and Challenges

Opportunities

- Expansion in Emerging Markets: Rising healthcare spendings and increased awareness foster higher adoption.

- Development of Combination Therapies: Combining clotrimazole with corticosteroids or antibacterial agents can open new therapeutic avenues.

- Digital Prescriptions and OTC Distribution: Leverage e-commerce platforms for wider access.

Challenges

- Market Saturation: Limited room for premium pricing as generics dominate.

- Regulatory Hurdles: Stringent regulation in certain regions may delay market entry.

- Competition from Alternative Antifungals: The advent of new oral agents or topical formulations can influence market share.

Conclusion

Clotrimazole remains a vital, affordable antifungal agent, with a stable yet slowly declining price trajectory driven by patent expirations, generic proliferation, and global demand. The overall market outlook suggests steady growth fueled by emerging market expansion and increasing fungal infection prevalence. Manufacturers and investors should focus on leveraging the drug’s broad accessibility, expanded distribution channels, and potential combination formulations to optimize growth.

Key Takeaways

- The global clotrimazole market is projected to grow modestly at a CAGR of 3-4% through 2030, with solid demand in both developed and emerging regions.

- Price trends indicate a gradual decline of approximately 2-3% annually, primarily due to increased generic competition and market saturation.

- Significant opportunities exist in emerging markets with rising healthcare awareness, offering prospects for volume-driven growth.

- Price sensitivity and regulatory hurdles in certain regions necessitate strategic planning for market entry and expansion.

- Continuous innovation and combination therapies may provide additional avenues for growth and differentiation.

FAQs

-

What are the main factors influencing clotrimazole pricing?

The primary drivers include patent expiration leading to increased generic competition, regional regulatory policies, healthcare infrastructure, and market competition.

-

How is the global demand for clotrimazole expected to evolve?

Demand is anticipated to grow steadily, especially in emerging markets due to increased fungal infections and accessibility initiatives.

-

Will patent protections impact future pricing of clotrimazole?

As patents expire, prices tend to decline due to generic competition. Currently, clotrimazole is off-patent in most regions, exerting downward pressure on prices.

-

Are there opportunities for premium pricing in the clotrimazole market?

Limited, given the dominance of generics. However, developing combination therapies or novel delivery systems could enable premium offerings.

-

What strategies should manufacturers adopt to maintain competitiveness?

Focus on cost efficiencies, expanding distribution channels in emerging markets, and innovating with combination formulations or improved delivery methods.

References

[1] MarketsandMarkets. “Antifungal Drugs Market by Type, Application, and Region - Global Forecast to 2030.” 2023.