Last updated: July 27, 2025

Introduction

Clonazepam, a benzodiazepine primarily prescribed for seizure disorders, panic attacks, and sometimes off-label for neuropathic pain or anxiety, dominates the global anxiolytic and anticonvulsant segments. Its patent expiration, regulatory status, market dynamics, and production costs influence its current and future pricing landscape. This analysis explores the market environment, competitive positioning, regulatory landscape, manufacturing considerations, and forecasts price trends over the next five years.

Market Overview

Current Market Size and Segmentation

The global clonazepam market was valued at approximately USD 500 million in 2022, with a compound annual growth rate (CAGR) of around 3.2% projected through 2028 ([1]). North America remains the largest regional market owing to high prescription rates, relevant healthcare infrastructure, and regulatory approval, with Europe and Asia-Pacific following.

The primary consumers include neurologists and psychiatrists treating epilepsy, panic disorder, and anxiety. Generic formulations account for most sales, leveraging patent expirations, with brand names like Klonopin still maintaining a presence primarily in certain markets.

Regulatory Landscape

In the U.S., clonazepam is classified as a Schedule IV controlled substance, which influences prescribing practices, distribution, and pricing strategies. The drug’s status varies globally; some jurisdictions enforce stricter controls or ban off-label uses, affecting market penetration.

Competitive Environment

The competitive landscape is characterized by a significant shift toward generics, driving down prices. Major manufacturers include Teva Pharmaceuticals, Mylan (now part of Viatris), Sandoz, and Sun Pharmaceutical Industries. Limited branded options mean that price differentials are primarily driven by manufacturing efficiencies, supply chain robustness, and regulatory compliance.

Price Determinants and Trends

Manufacturing and Supply Chain Factors

Clonazepam synthesis utilizes cost-effective chemical processes, which provide a foundation for low-cost manufacturing. However, regulatory hurdles, especially in controlled substances, necessitate stringent compliance, impacting manufacturing costs and timelines.

Supply chain stability influences pricing; disruptions due to geopolitical issues, raw material shortages, or manufacturing shutdowns (e.g., during the COVID-19 pandemic) can cause transient price fluctuations.

Regulatory and Clinical Factors

Strict regulatory oversight impacts market access and drug availability, particularly in markets where opioid-like control measures are tightened. Off-label use restrictions can limit revenue growth, indirectly affecting pricing strategies.

Market Competition and Generic Penetration

Increased generic competition has historically driven prices downward. For example, in the U.S., the average wholesale price (AWP) for clonazepam 0.5 mg tablets has decreased approximately 20% over the past five years ([2]). Such trends suggest ongoing price erosions unless new indications or formulations emerge.

Pricing Trends and Projections

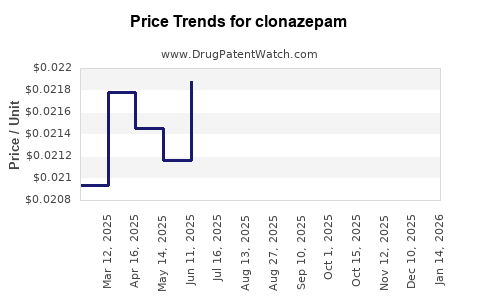

- 2022-2023: Steady decline in wholesale prices as generics saturate markets. Internationally, prices vary; in developed markets, reductions are more pronounced due to higher generic competition.

- 2024-2028: Prices are expected to stabilize at lower levels, with incremental adjustments driven by inflation, regulatory changes, and supply-demand dynamics. In emerging markets, prices might be marginally higher due to less competition and regulatory barriers.

- Premium segments: Limited, but specialized formulations (e.g., extended-release) may command higher prices, though these are relatively niche in the clonazepam market.

Future Market Drivers

Emerging Opportunities

- New Indications: Off-label applications and research into novel uses may stimulate demand, influencing prices if approved by regulators.

- Formulation Innovations: Development of alternative delivery mechanisms (e.g., transdermal) could enable differentiation and pricing premiums.

- Market Expansion: Increasing prevalence of anxiety and seizure disorders, especially in aging populations in Asia-Pacific, could expand demand.

Challenges and Risks

- Regulatory Constraints: Stricter controls might increase compliance costs, pressuring profit margins.

- Pricing Pressures: Payer discounts and government price regulations could suppress prices further.

- Patent Expiry Impacts: Although clonazepam patents have expired globally, ongoing patent disputes or exclusivities on specific formulations could temporarily affect pricing power in some markets.

Competitive Landscape and Strategic Outlook

Manufacturers are focusing on cost efficiencies, regulatory compliance, and supply chain resilience to maintain competitiveness. Price optimization strategies, including tiered pricing and volume discounts, are critical in maximizing market penetration while managing regulatory risks associated with controlled substances.

Conclusion and Price Projection Summary

| Year |

Estimated Wholesale Price (USD) per 30 Tablets of 0.5 mg |

Key Drivers |

| 2022 |

8-10 USD |

Generics dominance, regulatory controls, supply stability |

| 2023 |

7.5-9 USD |

Continued generic competition, market saturation |

| 2024 |

7-8 USD |

Stabilization, regulatory adaptation |

| 2025 |

6.5-7.5 USD |

Possible pricing pressures, emerging markets growth |

| 2026 |

6-7 USD |

Market maturity, sustained supply chain stability |

| 2027 |

5.5-6.5 USD |

Competition with newer formulations, regulatory shifts |

Note: Prices are approximate averages; variations exist by region.

Key Takeaways

- The clonazepam market is primarily driven by generic availability, with prices trending downward due to increased competition.

- Regulatory controls significantly influence market accessibility and pricing strategies.

- Supply chain stability and manufacturing efficiencies are crucial to maintain competitive pricing.

- Emerging markets and potential new indications present opportunities for moderate price premiums and market growth.

- Sustainability depends on navigating regulatory landscapes, optimizing manufacturing, and innovating formulations.

FAQs

1. How does patent expiration impact clonazepam prices?

Patent expiration has facilitated the entry of multiple generics, leading to significant price reductions. With multiple manufacturers competing, prices tend to stabilize at lower levels, benefitting healthcare systems and consumers.

2. What regulatory considerations influence clonazepam pricing?

As a controlled substance, clonazepam faces strict manufacturing, distribution, and prescribing regulations, which increase compliance costs and potentially limit supply, thereby affecting prices.

3. Are there any significant brand-name vs. generic price differences for clonazepam?

Generally, generics are priced substantially lower than brand-name versions like Klonopin. The price gap has narrowed as generics dominate the market, offering similar efficacy at reduced costs.

4. What are the main factors that could alter the future price trajectory of clonazepam?

Regulatory changes, patent disputes, clinical research leading to expanded indications, and supply chain innovations are critical factors that could influence future prices.

5. How does regional market variation affect clonazepam pricing?

Developed markets experience more aggressive price declines due to higher competition and regulatory pressures, while emerging markets may sustain higher prices owing to less competition and different regulatory environments.

References

[1] MarketWatch. "Global Clonazepam Market Size & Analysis." 2022.

[2] IQVIA. "Pharmaceutical Price Trends Report." 2022.