Last updated: July 27, 2025

Introduction

Clobazam, a benzodiazepine primarily indicated for Lennox-Gastaut syndrome and other forms of epilepsy, has carved a significant niche within the neurological therapeutics market. Its distinct pharmacological profile, safety profile, and regulatory landscape influence its commercialization potential and pricing strategies. This analysis provides a comprehensive overview of the current market landscape, competitive environment, regulatory considerations, and future price projections for Clobazam, equipping stakeholders with actionable insights for investment, R&D, and strategic planning.

Market Overview

Therapeutic Indications and Clinical Use

Clobazam’s primary approved indication is Lennox-Gastaut syndrome (LGS), a severe form of childhood-onset epilepsy characterized by multiple seizure types and cognitive impairment. Its efficacy extends to adjunctive therapy for various refractory epilepsies. Due to its unique mechanism—selective modulation of GABA-A receptors—Clobazam offers anti-seizure benefits with a relatively favorable side effect profile compared to other benzodiazepines.

Current Market Size and Growth Trends

Global epilepsy therapeutics market size was valued at approximately USD 4.5 billion in 2022, with the anti-epileptic drugs segment expected to witness a CAGR of around 5% over the next five years ([1]). Clobazam's share within this segment is estimated at USD 300–400 million, driven by its FDA and EMA approvals, and expanding usage across pediatric and adult populations. The increasing prevalence of epilepsy, estimated at over 50 million globally ([2]), underpins steady market demand.

Geographic Market Distribution

North America dominates due to high prescription rates, advanced healthcare infrastructure, and regulatory acceptance. Europe accounts for a significant share, with emerging markets in Asia exhibiting rapid growth potential owing to increasing healthcare access and awareness. Regulatory approvals in countries like China, India, and Brazil are expanding Clobazam’s commercial footprint.

Competitive Landscape

Clobazam's market is influenced by drugs like diazepam, clonazepam, and newer antiepileptics such as cannabidiol (Epidiolex). Several generic formulations exist, leading to intense price competition, especially in mature markets. Key brand players include Takeda (Onfi in the US), Lundbeck, and Asahi Kasei. Patent expirations and biosimilar entries could further pressure prices.

Regulatory and Patent Environment

Regulatory Status

Clobazam’s regulatory approvals streamline market access. In the US, Onfi (Takeda) holds FDA approval, and similar approvals exist in Europe under various brand names. Regulatory pathways for generic entry are active, with patent litigation often delaying generic competition, thus allowing for premium pricing in initial years.

Patent Protection and Market Exclusivity

Takeda’s patent portfolio protected Clobazam's formulations until approximately 2024 in the US and Europe. Subsequent patent expirations are expected to foster generic market entries, significantly impacting pricing structures. Emerging markets often have less stringent patent enforcement, enabling broader generic utilization earlier.

Price Analysis and Projection

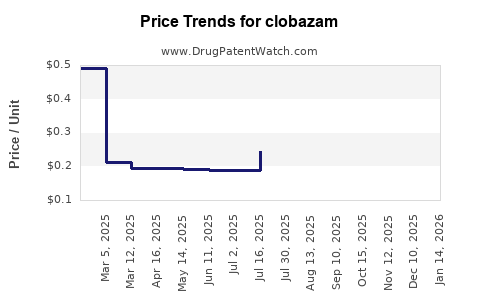

Current Pricing Dynamics

In the US, branded Clobazam (Onfi) is priced at approximately USD 20–25 per tablet (10 mg), translating to annual treatment costs near USD 7,300 for a typical pediatric dose. Generics, once introduced, could reduce prices by 50–70%, positioning the drug as a more accessible treatment option.

Influencing Factors on Price Trajectory

- Patent expiry and generic competition: A critical determinant, expected around 2024 in key markets.

- Regulatory approvals in emerging markets: Broader access could decrease prices globally.

- Market penetration and uptake: Increasing adoption in treatment-resistant epilepsy cases sustains higher prices initially.

- Healthcare reimbursement mechanisms: Insurance coverage and government policies influence net prices.

Short- and Mid-term Price Projections (Next 3–5 Years)

- Immediate post-patent expiry scenario (2024–2026): Prices could decline by 50–60%, with branded formulations remaining at a premium. New generic entrants could drive unit costs below USD 10 per tablet.

- Long-term scenario (2027 and beyond): Price stabilization at lower levels, with biosimilar and generic products dominating. Market consolidation and voluntary price reductions could further suppress costs, making Clobazam more affordable in developing countries.

Impact of Emerging Markets and Biosimilars

Biosimilars and generics in developing nations may lead to a 70–80% reduction in price over the next decade, aligning Clobazam closer to other generic benzodiazepines. Market expansion in Asia and Latin America will amplify volume-driven revenue, partially offsetting lower unit prices.

Strategic Implications

Manufacturers should prepare for increased generic competition post-2024 and consider phased pricing strategies. Innovators may focus on novel formulations or combination therapies to sustain premium pricing. For investors, timing of patent cliffs, regulatory approvals, and market penetration are critical to forecasting revenue streams.

Key Challenges and Risks

- Patent litigation delays: Late patent challenges may extend premium pricing periods.

- Regulatory barriers: Variability across markets can impede market entry and affect pricing.

- Market saturation: High adoption in existing markets leaves limited room for growth.

- Emerging alternative therapies: Advances in gene therapy or other anti-epileptics could undermine Clobazam’s market share.

Conclusion

Clobazam’s market prospects hinge on patent timelines, competitive dynamics, and expanding global healthcare access. While current high prices reflect market exclusivity and R&D investments, substantial price declines are anticipated post-patent expiry, especially with increased generic and biosimilar activity. Strategic planning, early market penetration in emerging regions, and innovation will be essential for stakeholders seeking sustained profitability.

Key Takeaways

- Clobazam commands premium prices in developed markets due to patent protection; prices are projected to decline sharply post-2024 with the advent of generics.

- Market growth is driven by increasing epilepsy prevalence and expanding therapeutic indications, particularly in pediatric populations.

- Patent expirations will catalyze a transition towards more affordable generic formulations, potentially reducing prices by up to 80% over a decade.

- Emerging markets represent significant growth opportunities with less restrictive patent enforcement, expanding access and revenue streams.

- Strategic focus should include diversification into new formulations and market expansion, especially in underserved regions.

FAQs

-

When does Clobazam’s patent protection expire, and what impact will this have on pricing?

Patent protection is expected to expire around 2024 in key markets like the US and Europe. This will likely lead to an influx of generic competitors, significantly reducing prices and lowering branded drug revenues.

-

How does the competition from generics influence current Clobazam pricing?

The entry of generics tends to decrease prices by approximately 50–70%, making treatment more affordable and expanding access, particularly in low- and middle-income countries.

-

What factors could delay the expected decline in Clobazam’s prices?

Patent litigation, regulatory delays in approving generics, and market monopolization by brand-name manufacturers could temporarily maintain higher prices.

-

Are there emerging therapeutic alternatives that threaten Clobazam’s market share?

Yes, newer anti-epileptic drugs like cannabidiol (Epidiolex) and gene therapies are emerging, which could alter treatment paradigms and impact Clobazam’s market position.

-

What strategic steps should pharmaceutical companies adopt to maximize profitability?

Firms should invest in early market penetration before patent expiry, diversify product portfolios, explore innovation in formulations, and expand into emerging markets with unmet need.

Sources:

[1] Market Research Future, "Epilepsy Therapeutics Market Trends," 2022.

[2] World Health Organization, "Epilepsy Fact Sheet," 2021.