Last updated: July 27, 2025

Introduction

Cimetidine, a histamine H2-receptor antagonist, emerged as a pivotal therapy for peptic ulcer disease, gastroesophageal reflux disease (GERD), and Zollinger-Ellison syndrome in the 1980s. Despite its longstanding clinical use, recent market dynamics, patent status, and emerging treatment alternatives significantly influence its market trajectory and pricing. This analysis provides a comprehensive assessment of the current market landscape, future price projections, and strategic considerations pertinent to stakeholders involved in cimetidine's manufacturing, distribution, and utilization.

Market Overview

Historical Context and Therapeutic Role

Cimetidine was among the first H2-receptor antagonists introduced globally, revolutionizing acid suppression therapy. Its patent expiration in the late 1990s paved the way for generic manufacturing, fostering widespread availability. Currently, cimetidine remains prescribed for long-term management of acid-related disorders, albeit facing declining use due to the advent of proton pump inhibitors (PPIs) like omeprazole and esomeprazole, which demonstrate superior efficacy and safety profiles [1].

Current Market Dynamics

The global demand for cimetidine has plateaued, driven primarily by its off-patent status, leading to a saturation of generic manufacturers. As per recent industry reports, the global market for H2-receptor antagonists is projected to decline at a compound annual growth rate (CAGR) of approximately 2% over the next five years, primarily attributable to shifts toward newer therapies [2]. Nonetheless, cimetidine retains niche indications (e.g., anti-androgenic properties, treatment in patients intolerant to PPIs), conserving its relevance in specific clinical settings.

Geographical Market Segmentation

- North America: Dominates in volume due to established healthcare infrastructure but exhibits a declining trend owing to PPI dominance and shifts toward newer therapies.

- Europe: Demonstrates stabilizing demand, driven by aging populations and chronic disease management.

- Asia-Pacific: Represents a burgeoning market, with increasing healthcare access and prevalent gastrointestinal disorders, yet competition from local generics influences pricing strategies.

Key Market Players

The market is highly fragmented, with several generic pharmaceutical companies manufacturing cimetidine. Major global players include Teva Pharmaceuticals, Sandoz, and Sun Pharmaceutical Industries, among others. These companies compete primarily on price, distribution reach, and supply chain efficiency.

Pricing Landscape

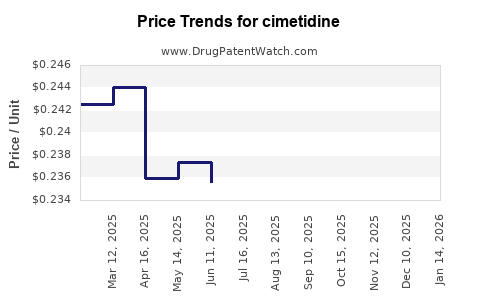

Historical Pricing Trends

Historically, the price of cimetidine has experienced a significant decline post-generic entry, with retail prices dropping approximately 80% since patent expiry. In developed markets, the cost per standard 200 mg tablet has stabilized in the range of $0.05 to $0.10, reflecting intense price competition [3].

Current Price Points

- United States: Typical retail prices for common doses range from $0.05 to $0.08 per tablet. Insurance coverage and generic discounts frequently lower out-of-pocket costs.

- Europe: Prices are comparable, with variations based on healthcare policies and procurement contracts.

- Emerging Markets: Prices can be substantially lower owing to local manufacturing and less regulatory overhead, often below $0.02 per tablet.

Pricing Influencing Factors

- Regulatory Environment: Stringent quality standards and patent litigations in certain regions can influence manufacturing costs.

- Supply Chain Dynamics: Fluctuations in raw material costs, manufacturing capacities, and distribution logistics impact final pricing.

- Market Competition: Intense generic competition sustains low prices; however, limited supply in certain markets can lead to price stabilization or increases.

- Clinical Utility: Niche applications where newer agents are less suitable can sustain marginally higher pricing.

Future Price Projections

Market Trends and Drivers

- Declining Demand: As PPI therapies surpass H2-receptor antagonists, overall demand for cimetidine is projected to decline marginally, exerting downward pressure on prices.

- Manufacturing and Supply: Overcapacity among generic producers may perpetuate low prices, with prices potentially stabilizing or declining slightly in mature markets.

- Potential Off-Patent Opportunities: Given the long patent expiry, the absence of new patents limits significant price hikes, except in cases involving formulation innovations or combination therapies.

Price Forecasts (2023–2028)

- In mature markets (e.g., North America, Western Europe), prices are expected to hover around $0.04–$0.07 per tablet, with negligible increases unless supply constraints occur.

- In emerging markets, prices could decline further to $0.01–$0.03 per tablet, driven by increased local production and intense price competition.

- Specialty indications or niche markets may see marginal price increases, particularly if supply disruptions occur or if formulations with extended-release properties are developed.

Influence of Regulatory and Industry Factors

- Regulatory changes in some jurisdictions, such as stricter manufacturing standards or quality assurance protocols, could temporarily elevate production costs and prices.

- Global health emergencies or supply chain disruptions (e.g., pandemics) may lead to short-term price fluctuations owing to supply shortages.

Strategic Insights

- Market position: Given the intense competition and declining demand, manufacturers should focus on cost efficiency and supply chain optimization.

- Differentiation: Developing formulations with improved administration or stability might command slight premium pricing in niche markets.

- Emerging markets: Opportunities exist in lower-cost manufacturing and distribution, particularly amid expanding healthcare coverage.

Key Challenges and Opportunities

- Challenges: Reduced profitability margins due to price erosion, competition from newer therapies, and regulatory hurdles.

- Opportunities: Expansion into emerging markets, leveraging niche applications such as specific anti-androgenic uses, and potentially developing combination drugs.

Conclusion

Cimetidine's market and pricing landscape remains predominantly driven by its status as a generic drug in a mature phase of its lifecycle. While demand continues, it is set against the backdrop of declining utilization in favor of newer agents. Price stability persists in key markets, with potential slight declines foreseen in the next five years, particularly in regions with intense generic competition and low-cost manufacturing capabilities. Stakeholders should consider these factors within their strategic planning, emphasizing cost-effectiveness and market diversification.

Key Takeaways

- Market maturity: The global cimetidine market is mature, with demand primarily maintaining niche applications and specific regional needs.

- Pricing trend: Prices are stabilized or declining slightly due to generic competition, with unit costs in developed countries around $0.04–$0.07 per tablet.

- Growth prospects: Limited growth potential in developed markets; emerging markets offer expansion opportunities, especially with lower manufacturing costs.

- Competitive positioning: Manufacturers should focus on supply chain efficiency, niche indications, and emerging markets to sustain profitability.

- Regulatory impacts: Stringent quality standards and supply chain disruptions could influence short-term prices, necessitating proactive industry adaptation.

FAQs

1. What are the primary factors influencing cimetidine’s market decline?

The advent of proton pump inhibitors, which offer superior efficacy and safety, coupled with the patent expiration of cimetidine and resultant generic competition, have led to a decline in demand and usage.

2. How do price variations differ between developed and emerging markets?

Developed markets maintain relatively higher, stable prices ($0.04–$0.07 per tablet), while emerging markets often see prices as low as $0.01–$0.03 due to local manufacturing and less regulatory overhead.

3. Is there potential for cimetidine to regain market share?

Unlikely in the broad gastroesophageal or ulcerative treatment space; however, niche indications or formulation innovations could sustain or slightly grow demand.

4. How do supply chain issues impact cimetidine pricing?

Disruptions can cause short-term price increases or shortages in certain regions, especially if manufacturing capacity is limited or raw material costs rise.

5. What strategic approaches should manufacturers pursue to optimize profits?

Focus on cost-efficient manufacturing, tap into emerging markets, develop specialized formulations, and explore niche applications to maintain margins amid price pressures.

Sources:

- World Health Organization. "Gastrointestinal medicines," 2022.

- Global Industry Analysts. "H2 receptor antagonists Market Report," 2022.

- IMS Health Data. "Pharmaceutical Pricing Trends," 2022.