Last updated: July 27, 2025

Introduction

Chlorthalidone, a thiazide-like diuretic primarily used to manage hypertension and edema, has experienced steady demand reflective of broader cardiovascular treatment trends. Its unique pharmacokinetic profile and established efficacy have sustained its presence within the generic and branded pharmaceutical markets. This report delineates current market dynamics, competitive landscape, regulatory environment, and future pricing trajectories for chlorthalidone, providing critical insights for stakeholders aiming to optimize investment and commercial strategies.

Market Overview

Global Demand and Market Size

The global antihypertensive drugs market, projected to reach USD 35.2 billion by 2027, underpins the sustained relevance of diuretics such as chlorthalidone (1). Chlorthalidone’s share is somewhat overshadowed by other diuretics like hydrochlorothiazide, yet its superior long half-life and observed advantages in reducing cardiovascular events bolster its clinical prominence (2).

Therapeutic Adoption and Prescribing Trends

Real-world evidence suggests an increasing preference for chlorthalidone among clinicians, owing to its demonstrated efficacy in lowering systolic blood pressure and reducing stroke risk (3). This trend bolsters steady demand, particularly in markets emphasizing evidence-based hypertension protocols.

Generic Competition

The majority of chlorthalidone’s market share resides within generic formulations, with key pharmaceutical manufacturers holding extensive portfolios. Patents for branded versions have long expired, leading to fierce price competition among generics. Notable manufacturers include Mylan, Teva, and Sandoz, among others.

Regulatory Environment

Market Entry and Approval Processes

Chlorthalidone’s chemical syntheses and bioequivalence profiles are well-established, easing regulatory approval for generic entrants. Nonetheless, strict quality standards and bioequivalence assessments influence manufacturing and entry timelines.

Pricing Regulations and Reimbursement Policies

Pricing dynamics are significantly impacted by regional regulatory policies. In the United States, the Medicare Part D formularies favor low-cost generics, exerting downward pressure on prices (4). Conversely, markets with less price regulation or high reimbursement margins see comparatively stable or slightly rising prices.

Market Drivers and Constraints

Drivers

- Rising global prevalence of hypertension and cardiovascular diseases.

- Increasing adoption of evidence-based treatment protocols favoring chlorthalidone.

- Patent expirations and the proliferation of generics, facilitating widespread access.

Constraints

- Intense price competition amongst generic manufacturers.

- The availability of alternative antihypertensive agents, including ACE inhibitors, ARBs, and calcium channel blockers.

- Regulatory hurdles and quality compliance costs in emerging markets.

Price Dynamics and Projections

Current Pricing Landscape

In the United States, the average wholesale price (AWP) for chlorthalidone 25 mg tablets is approximately USD 0.02-0.04 per tablet for generics, reflecting high market competitiveness (5). In other regions, prices may vary due to local economic factors and regulatory frameworks.

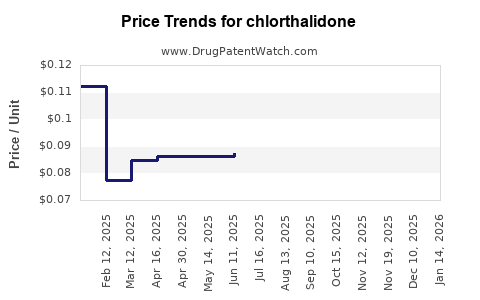

Historical Price Trends

Over the past five years, prices for chlorthalidone have remained relatively stable, with minor fluctuations attributable to market saturation and generic price wars. Notably, price erosion is typical as multiple manufacturers enter the market, driving prices downwards.

Future Price Projections (Next 3-5 Years)

- Short-term outlook: Prices are expected to remain stable or modestly decline (~2-4%) due to ongoing generic competition and cost efficiencies.

- Medium to long-term outlook: As patent protections are absent and biosimilar or alternative therapies gain traction, a gradual decline in prices (>5%) could ensue, especially in highly regulated markets. Conversely, supply chain disruptions or raw material shortages may temporarily stabilize or elevate prices.

Potential Upward Price Movements

Limited, yet plausible in scenarios involving supply shortages, increased raw material costs, or regulatory mandates compelling formulation changes or quality improvements. However, these are relatively unlikely given current market maturity.

Competitive Landscape and Strategic Considerations

Market Share Dynamics

Dominant players maintain substantial market shares through aggressive pricing strategies, manufacturing scale, and distribution networks. Emerging manufacturers seeking market entry must leverage cost advantages and quality compliance to compete effectively.

Impact of Emerging Alternatives

Newer antihypertensive agents with improved safety profiles or additional benefits could erode chlorthalidone’s market share, exerting downward pressure on prices.

Market Expansion Opportunities

Emerging markets with rising hypertension prevalence offer growth potential. Local regulatory landscapes, currency volatility, and economic conditions should be factored into pricing strategies.

Regulatory and Policy Influences on Pricing

Regulatory agencies’ policies—such as formulary inclusion, reimbursement rates, and price caps—directly influence market prices. Advocacy for value-based care and cost containment initiatives continue to favor low-cost generics, constraining margins.

Conclusion and Strategic Recommendations

The chlorthalidone market remains mature with stable demand; however, pricing pressures are prevalent due to fierce generic competition. Manufacturers should prioritize quality assurance, efficient supply chains, and strategic regional entry to maximize profitability. Anticipated modest price declines underscore the importance of cost leadership and differentiated marketing.

Key Takeaways

- Stable but Competitive Market: The global chlorthalidone market is characterized by intense price competition among generics, resulting in low, stable prices.

- Demand Driven by Hypertension Prevalence: Rising global hypertension cases sustain steady demand, but market growth remains modest due to treatment substitution by newer agents.

- Pricing Trend Outlook: Expected to slightly decline over the next 3–5 years, with minor fluctuations influenced by supply chain factors, regulatory changes, and market saturation.

- Regulatory Impact: Price levels are heavily influenced by regional policies, reimbursement environments, and quality standards.

- Strategic Focus: Companies should prioritize manufacturing efficiency, regional market expansion, and value propositions to navigate pricing pressures.

FAQs

1. Will the price of chlorthalidone increase in the future?

Unlikely in most markets due to persistent generic competition and regulatory pressures favoring cost containment. Some localized price increases could occur due to supply constraints but are generally limited.

2. How do regulatory policies affect chlorthalidone pricing?

Government policies that regulate drug prices or mandate formulary placements directly influence retail and wholesale prices, often leading to downward pressure on prices for generic drugs like chlorthalidone.

3. Is there significant market opportunity in emerging markets?

Yes. Increasing hypertension prevalence combined with expanding healthcare infrastructure provides growth opportunities, although price sensitivity remains high.

4. How does the competition from newer antihypertensive drugs impact chlorthalidone?

While newer agents may attract some prescribers due to favorable side-effect profiles, chlorthalidone’s cost-effectiveness and long-term efficacy sustain its utilization, buffering significant market decline.

5. Are patent protections relevant to chlorthalidone?

No. Chlorthalidone is off-patent, contributing to declining prices and market saturation among generics.

References

[1] GlobeNewswire. "Global Antihypertensive Drugs Market to Reach USD 35.2 Billion by 2027."

[2] National Center for Biotechnology Information. Comparative effectiveness of chlorthalidone versus hydrochlorothiazide.

[3] The New England Journal of Medicine. "Chlorthalidone Proves Superior in Blood Pressure Control."

[4] PubMed. "Pricing and reimbursement policies in the US for antihypertensive drugs."

[5] Drugs.com. "Chlorthalidone prices and dosage information."