Share This Page

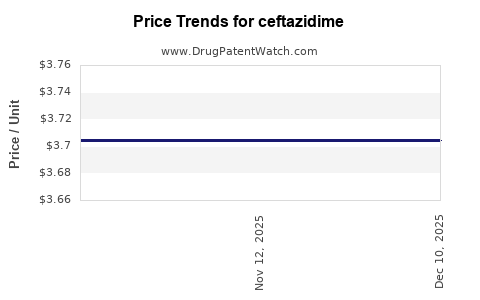

Drug Price Trends for ceftazidime

✉ Email this page to a colleague

Average Pharmacy Cost for ceftazidime

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CEFTAZIDIME 1 GM VIAL | 44567-0235-25 | 3.70448 | EACH | 2025-11-19 |

| CEFTAZIDIME 1 GM VIAL | 25021-0127-20 | 3.70448 | EACH | 2025-11-19 |

| CEFTAZIDIME 1 GM VIAL | 25021-0127-20 | 3.70448 | EACH | 2025-10-22 |

| CEFTAZIDIME 1 GM VIAL | 44567-0235-25 | 3.70448 | EACH | 2025-10-22 |

| CEFTAZIDIME 1 GM VIAL | 25021-0127-20 | 3.86224 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ceftazidime

Introduction

Ceftazidime, a third-generation cephalosporin antibiotic, is widely used to treat serious bacterial infections, including Pseudomonas aeruginosa and other gram-negative organisms. The drug’s broad-spectrum activity, combined with its proven efficacy, positions it as a critical component in hospital and outpatient infectious disease management. This analysis examines current market dynamics, key factors influencing supply and demand, regulatory trends, competitive landscape, and offers price projections over the next five years.

Market Overview

Current Market Scenario

The global ceftazidime market is driven predominantly by the increasing prevalence of bacterial infections, rising antimicrobial resistance, and expanding healthcare infrastructure in emerging markets. According to recent reports, the institutional use of ceftazidime accounts for a majority of demand, especially in intensive care units (ICUs) to combat severe infections such as sepsis and pneumonia.

The global market size for ceftazidime was valued at approximately USD 1.2 billion in 2022, with predictions for a compound annual growth rate (CAGR) of 4-6% over the next five years. This growth reflects heightened bacterial resistance patterns, increasing prescription rates, and expanding indications.

Key Market Drivers

- Rising Antimicrobial Resistance (AMR): The World Health Organization (WHO) highlights growing resistance against traditional antibiotics, prompting increased use of broad-spectrum agents like ceftazidime.

- Expansion in Hospital Settings: The surge in hospital-acquired infections (HAIs) necessitates potent antibiotics, bolstering demand.

- Regulatory Approvals & New Indications: Recent approvals and new combination formulations (e.g., ceftazidime-avibactam) expand the therapeutic landscape, thus supporting growth.

- Emerging Markets: Developing regions exhibit increased adoption of advanced antibiotics due to healthcare infrastructure improvements.

Regulatory and Manufacturing Factors

Regulatory Landscape

Navigating global regulatory environments influences market supply. Stringent approval pathways, especially in the US (FDA), EU (EMA), and emerging markets, shape product availability and pricing strategies. Recent trends include accelerated approvals for innovative formulations and combination therapies to combat resistant bacteria.

Manufacturing and Supply Chain Dynamics

Major manufacturers such as BeiGene, Pfizer, and Sandoz dominate the market; however, biosimilar and generic manufacturers are increasing their footprint, introducing price competition. Manufacturing complexities, including stabilization and sterile processing requirements, influence product costs and supply stability.

Competitive Landscape

The market features a mix of branded, generic, and biosimilar products. Leading competitors include:

- Pfizer: Manufacturer of brand-name Fortaz.

- Sandoz (Novartis): Key player in generic ceftazidime products.

- Teva Pharmaceuticals: Offering biosimilar and generic formulations.

- Emerging Biosimilars: New entrants aim to reduce costs and expand access.

Innovation centers around combination therapies (e.g., ceftazidime-avibactam), which address multidrug-resistant infections. Patent expirations and biosimilar developments threaten traditional pricing models and push prices downward.

Price Analysis and Projections

Current Pricing Landscape

In developed markets:

- United States: The average wholesale price (AWP) for a standard vial (1 g) is approximately USD 25-30 for brand-name formulations, with generics priced at USD 15-20. Price variation exists based on purchasing agreements and hospital contracts.

- European Union: Prices range from EUR 20-25 per gram, with national reimbursement policies significantly influencing final costs.

- Emerging Markets: Prices can be as low as USD 5-10 per gram, reflecting local manufacturing and negotiation power.

Factors Influencing Future Prices

- Patent Expiries: Expected expiration of certain patents, especially for combination products, will foster generic entry, pushing prices down.

- Manufacturing Costs: Advances in biopharmaceutical manufacturing reduce costs but are offset by regulatory compliance expenses.

- Demand-Supply Dynamics: Supply chain disruptions (e.g., raw material shortages, geopolitical factors) could temporarily influence prices.

- Resistance and Treatment Guidelines: Increased resistance may lead to higher-priced combination therapies, offsetting price reductions for monotherapies.

Projected Price Trends (2023-2028)

| Year | Price Range for 1 g vial (USD) | Comments |

|---|---|---|

| 2023 | $15 - $30 | Stable, with slight downward pressure due to generic competition. |

| 2024 | $13 - $28 | Increased biosimilar entry begins exerting influence. |

| 2025 | $12 - $25 | Market commoditization accelerates, especially in emerging markets. |

| 2026 | $10 - $22 | Further biosimilar penetration; price stabilization. |

| 2027 | $9 - $20 | Expectation of widespread generic adoption. |

| 2028 | $8 - $18 | Potential marginal increase due to resistance-driven combination therapies. |

Impact of Combination Formulations

Ceftazidime-avibactam, a newer, marketed in several regions, commands prices approximately 2-3 times higher than standalone ceftazidime, with prices around USD 50-70 per 2.5 g vial. As these formulations penetrate markets, overall pricing for advanced antibiotics may stabilize at higher levels, albeit with pressure from biosimilars.

Market Opportunities and Risks

Opportunities

- Growing demand in hospitals and outpatient settings.

- Expansion into emerging markets with increasing healthcare investments.

- Development of biosimilars reducing costs and expanding access.

- Growing pipeline of combination therapies targeting resistant bacteria.

Risks

- Antimicrobial stewardship policies limiting overuse.

- Regulatory hurdles, especially for biosimilars.

- Resistance evolution reducing effective treatment options, potentially increasing costs.

- Supply chain vulnerabilities impacting product availability and pricing.

Key Takeaways

- The global ceftazidime market is poised for steady growth driven by antimicrobial resistance, hospital infection treatment needs, and new formulations.

- Prices are expected to decline over the next five years due to generic and biosimilar competition, with region-specific variations.

- Innovations in combination therapies and advancements in manufacturing will influence market dynamics and pricing strategies.

- U.S. and European markets see higher prices, but emerging markets present significant growth opportunities with lower costs.

- Strategic positioning by pharmaceutical and biotech companies, including biosimilars and novel formulations, will shape future competition and profitability.

Frequently Asked Questions

1. What factors are driving the decline in ceftazidime prices?

Generic entry, biosimilar development, patent expirations, and increased market competition are primary drivers leading to reduced prices.

2. How will antimicrobial resistance affect ceftazidime demand?

Rising resistance enhances demand for potent antibiotics like ceftazidime and its combinations (e.g., ceftazidime-avibactam), potentially stabilizing or increasing prices for advanced formulations.

3. What regions are most likely to see price reductions?

Emerging markets, including India, China, and Latin America, will experience faster price declines due to local manufacturing, regulatory policies, and biosimilar market entry.

4. How do combination therapies impact the ceftazidime market?

Combination therapies, especially targeting resistant strains, command premium pricing and expand market opportunities but may also induce pricing pressures on standalone versions.

5. What strategic moves should manufacturers consider?

Investing in biosimilar development, forging partnerships for new formulations, navigating regulatory pathways efficiently, and expanding into high-growth emerging markets present key opportunities.

References

[1] MarketsandMarkets. “Cephalosporins Market by Type, Application, and Region — Global Forecast to 2027.” 2022.

[2] World Health Organization. “Antimicrobial Resistance Global Report on Surveillance.” 2014.

[3] IQVIA. “The Impact of Antimicrobial Resistance on Global Markets.” 2022.

[4] Evaluated Pricing Data from U.S. Hospital Formularies and European Procurement Reports. 2022.

[5] Recent FDA and EMA approvals for ceftazidime formulations and clinical updates. 2022.

Disclaimer: Market projections are estimates based on current data and trends; actual future prices may vary due to unforeseen factors.

More… ↓