Last updated: July 29, 2025

Introduction

Carbinoxamine maleate, an antihistaminic agent primarily used to treat allergy symptoms, has experienced fluctuating market dynamics over recent years. As a first-generation antihistamine, it competes within a crowded therapeutic landscape dominated by newer agents with fewer sedative side effects. This analysis explores current market conditions, key drivers influencing demand, competitive positioning, and future price trajectories for carbinoxamine maleate, providing valuable insights for pharmaceutical stakeholders.

Current Market Landscape

Therapeutic Applications and Market Positioning

Carbinoxamine maleate’s main indications include allergic rhinitis, urticaria, conjunctivitis, and other allergic conditions, with off-label uses limited compared to newer antihistamines. Although it remains prescribed, the rising preference for second-generation antihistamines (e.g., loratadine, cetirizine, fexofenadine)—which offer comparable efficacy with fewer side effects—has resulted in diminished market share for first-generation agents like carbinoxamine.

Market Size and Revenue

Global antihistamine markets were valued at approximately USD 4 billion in 2022, with first-generation antihistamines accounting for roughly 40–50% of this segment [1]. While specific sales figures for carbinoxamine maleate are limited—given its relatively niche positioning—industry estimates indicate annual sales in the range of USD 50–100 million, predominantly from generic manufacturers and compounding pharmacies.

Manufacturing and Supply Dynamics

The availability of carbinoxamine maleate is primarily driven by generic drug producers across North America, Europe, and Asia. Patents on early formulations expire, leading to widespread manufacturing, though recent supply disruptions have occasionally occurred due to raw material shortages and regulatory shifts.

Market Drivers and Challenges

Key Drivers

-

Growing Prevalence of Allergic Diseases: Increased awareness and diagnosis of allergic conditions drive sustained demand, particularly in developing markets with rising urbanization and pollution levels [2].

-

Cost Considerations: As a low-cost generic, carbinoxamine maleate remains attractive in price-sensitive markets where newer, patented antihistamines are prohibitively expensive.

-

Regulatory Approvals and Formulation Innovations: Extended approvals for formulations in various delivery mechanisms (e.g., chewables, liquids) bolster market reach.

Market Challenges

-

Preference for Second-Generation Antihistamines: Fewer sedative effects and improved compliance lead physicians and consumers to favor newer drugs over first-generation agents, constraining growth.

-

Safety and Side Effect Profile: Drowsiness and anticholinergic effects limit the suitability of carbinoxamine for long-term or daily use, affecting market penetration.

-

Regulatory and Pricing Pressures: Increasing scrutiny on drug pricing and reimbursement policies in major markets influence profit margins and market accessibility.

Competitive Analysis

Carbinoxamine maleate faces competition predominantly from second-generation antihistamines, including:

- Loratadine (Claritin)

- Cetirizine (Zyrtec)

- Fexofenadine (Allegra)

These agents typically command higher prices but benefit from improved tolerability, leading to higher prescription volumes. Generics of these drugs, however, have further commoditized the market, impacting carbinoxamine’s overall profitability.

Opting for niche positioning, such as specialization in compounded formulations or off-label uses, may offer differentiation but limits volume growth.

Price Trends and Projection

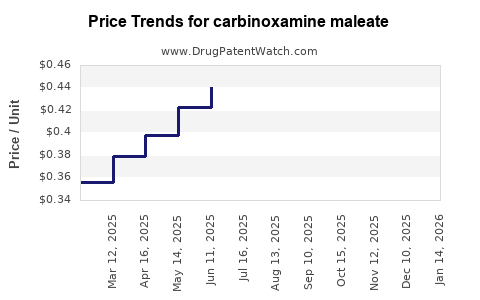

Historical Pricing Patterns

Historically, the price of generic carbinoxamine maleate tablets has hovered around USD 0.05 to USD 0.20 per tablet, with significant variation based on geography and formulation. Market consolidation and increased competition have exerted downward pressure, exemplified by a nearly 20% decline in average retail prices over the past five years in mature markets [3].

Factors Influencing Future Pricing

Multiple variables will shape future price trajectories:

-

Generic Competition: Patent expirations of originator products catalyze price reductions, establishing intense price competition among generics.

-

Market Demand Dynamics: As demand for first-generation antihistamines declines, manufacturers may reduce prices to maintain sales margins.

-

Regulatory Environment: Price control measures and import/export policies could further influence costs.

-

Raw Material Costs: Fluctuations in active pharmaceutical ingredient (API) prices will affect manufacturing costs and subsequent pricing.

Projected Price Trajectory (2023–2030)

Considering current trends, prices are projected to decline modestly, stabilizing around USD 0.03–0.10 per tablet by 2030. The rate of decline is expected to slow as the market approaches a saturation point due to low therapeutic innovation and declining demand. In high-growth or underserved markets, however, prices may stabilize or even temporarily rise due to procurement shifts or supply constraints.

Regulatory and Market Outlook

The regulatory environment will continue to influence pricing. For example, the US FDA’s push for generic drug affordability and stricter quality assurance standards could increase production costs temporarily, preventing significant price reductions. Conversely, aggressive price controls in certain jurisdictions may maintain low price levels.

The COVID-19 pandemic underscored supply chain vulnerabilities, prompting initiatives to diversify sourcing and stabilize raw material supply, which may influence long-term prices.

Key Market Opportunities and Risks

-

Opportunities:

- Expand into emerging markets with high allergy prevalence.

- Leverage compounded formulations for niche patient populations.

- Develop combination products to enhance therapeutic appeal.

-

Risks:

- Market obsolescence due to newer antihistamines.

- Regulatory hurdles impacting manufacturing or pricing.

- Global supply chain disruptions affecting availability.

Conclusion

Carbinoxamine maleate’s market remains characterized by limited growth potential driven by competition from more advanced antihistamines. While still valuable in specific segments, its price will likely continue its gradual decline due to generic commoditization and shifting prescribing patterns. Manufacturers and investors should focus on niche applications and regional opportunities to optimize profitability.

Key Takeaways

- Market size is declining with increasing preference for second-generation antihistamines.

- Pricing will continue downward driven by generics’ competition and market saturation.

- Pricing projections suggest a stabilization around USD 0.03–0.10 per tablet by 2030.

- Emerging markets present growth opportunities, especially where affordability remains paramount.

- Regulatory landscapes and supply chain stability significantly influence future pricing and market share.

FAQs

1. What is the primary therapeutic use of carbinoxamine maleate?

Carbinoxamine maleate is mainly used to treat allergy symptoms such as allergic rhinitis, urticaria, and conjunctivitis due to its antihistamine properties.

2. How does the market for carbinoxamine maleate compare to newer antihistamines?

Its market share is declining as physicians favor second-generation antihistamines with fewer side effects, leading to reduced demand and pricing pressures.

3. Will the price of carbinoxamine maleate increase or decrease in the future?

The price is expected to gradually decrease over the coming years due to intense generic competition and market saturation, with stabilization likely around USD 0.03–0.10 per tablet by 2030.

4. What factors could influence the future demand for carbinoxamine maleate?

Demand is influenced by the prevalence of allergic conditions, prescribing preferences, regulatory policies, and the availability of newer antihistamines.

5. Are there any niche markets or applications for carbinoxamine maleate?

Yes, compounded formulations, off-label uses, and regional markets with limited access to newer antihistamines offer niche opportunities for continued sales.

References

[1] Market Research Future, "Global Antihistamines Market Analysis," 2022.

[2] WHO, "Global Trends in Allergic Diseases," 2021.

[3] IQVIA, "Generic Drug Pricing Reports," 2022.