Last updated: July 30, 2025

Introduction

Carbidopa, a pharmacological agent primarily used in combination with levodopa for the treatment of Parkinson’s disease, remains a significant player in the neurodegenerative disorder therapeutics market. As a non-prescription enhancer to levodopa, carbidopa inhibits peripheral aromatic L-amino acid decarboxylase, thereby increasing central nervous system availability of levodopa and reducing peripheral side-effects. This analysis delineates current market dynamics, anticipated growth trajectories, competitive landscape, and future pricing trends for carbidopa.

Market Overview

Global Market Size and Growth

The global Parkinson’s disease treatment market was valued at approximately USD 4.2 billion in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of around 6.2% through 2030 ([1]). Carbidopa, as part of levodopa-carbidopa combination therapies, captures a significant share within this market.

The demand for carbidopa is primarily driven by:

-

Aging Population: Increasing prevalence of Parkinson’s among individuals over 65, with the World Health Organization (WHO) estimating 6 million cases worldwide, expected to double by 2030 ([2]).

-

Advancements in Disease Management: Enhanced understanding of disease pathology stimulates biomedical innovations, maintaining steady demand for existing therapies.

-

Continued Usage of Established Formulations: Despite newer treatments, levodopa-carbidopa remains a first-line therapy owing to its efficacy, safety profile, and cost-effectiveness.

Market Drivers and Challenges

Drivers

-

Rising Prevalence: Aging demographics globally augment the need for optimized Parkinson’s treatment regimens, bolstering demand for carbidopa.

-

Generic Market Expansion: Post-patent expirations facilitate increased production of generic carbidopa formulations, expanding access and increasing volume sales.

-

Healthcare Policy Initiatives: Favorable reimbursement policies in developed markets and expanding healthcare coverage in emerging economies aid market growth.

Challenges

-

Pricing Pressures: High competition from generics can depress prices and compress profit margins.

-

Regulatory Complexity: Stringent regulations in key markets may pose hurdles for market expansion.

-

Emerging Therapies: Development of novel modalities, such as gene therapy and disease-modifying agents, could impact future demand for traditional carbidopa formulations.

Competitive Landscape

Several pharmaceutical companies hold market share in carbidopa manufacturing:

-

Elder Pharmaceutical: One of the most prominent manufacturers, offering both branded and generic formulations.

-

Sun Pharmaceutical Industries: Global reach with competitive pricing strategies.

-

Macleods Pharmaceuticals: Noted for its cost-effective production and distribution networks.

The market is characterized by high generic penetration, driven by cost-sensitive healthcare systems, especially in developing countries like India, China, and Latin America.

Pricing Dynamics and Projections

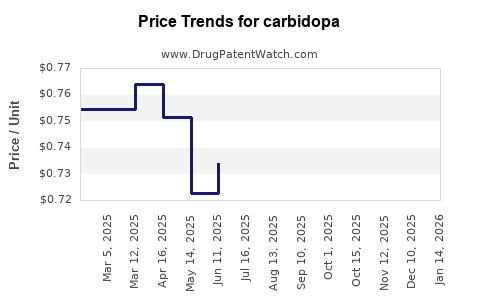

Historical Pricing Trends

In developed markets, the price of branded carbidopa drugs averaged around USD 1.50–2.00 per tablet in 2020, with generic formulations sold at approximately USD 0.50–1.00 per tablet ([3]). The entry of generics has substantially reduced the average retail price over the last decade, fostering broader accessibility.

Future Price Trends

Factors influencing future pricing include:

-

Patent Landscape: The expiration of key patents around 2015-2020 triggered price declines; subsequent patent filings for novel formulations could temporarily stabilize or elevate prices ([4]).

-

Market Penetration of Generics: Increasing approval and uptake of generics are expected to sustain downward pressure on prices, particularly in cost-sensitive markets.

-

Pricing Regulations: Price controls in countries like India and China may restrict price increases, whereas markets like the U.S. may experience variable pricing based on insurance coverage and formulary negotiations ([5]).

-

Emergence of Biosimilars and Novel Delivery Systems: Could influence price premiums or reductions depending on innovation adoption.

Projected Price Range (2023-2030):

- Developed Markets: Expect sustained generic competition resulting in stable or slightly declining prices, averaging USD 0.35–0.80 per tablet.

- Emerging Markets: Prices remain lower, around USD 0.20–0.50 per tablet, with potential increases linked to supply chain stabilization and regulatory harmonization.

Market Segmentation and Opportunities

-

By Formulation: Oral tablets dominate, with potential growth in extended-release formulations.

-

By Distribution Channel: Institutional sales (hospitals, clinics) factor heavily, alongside retail pharmacies.

-

By Geography: North America accounts for the largest share, followed by Europe, with emerging markets witnessing rapid growth.

-

Opportunities: Development of controlled-release formulations, combination therapies, and biosimilars could command premium pricing and expand market share.

Regulatory and Patent Outlook

Patent expiration timelines are pivotal. With key patents now expired, the marketplace is riddled with generics, intensifying price competition. Regulatory pathways are well established due to the drug’s long history, facilitating faster approval for new formulations or biosimilars.

Key Market Risks

- Shifts toward novel Parkinson’s therapies could diminish demand.

- Stringent regulatory frameworks could delay product entry or renewability of simplified formulations.

- Price erosion due to aggressive generic competition remains an ongoing challenge.

Conclusion and Forward Outlook

The carbidopa market will remain steady driven by its established efficacy, broad brand recognition, and widespread usage in Parkinson’s treatment. Price projections indicate a continued trend towards affordability, especially in emerging economies, with marginal price improvements possible through formulation innovations. Market players should focus on diversification through novel delivery systems and biosimilars to maintain profitability amid rising generic competition.

Key Takeaways

- The global carbidopa market is firmly anchored within the Parkinson’s disease treatment landscape, with sustained demand driven by demographic trends.

- Price pressures from generic competition are expected to persist, maintaining low-cost offerings especially in emerging markets.

- Innovation in formulations and biosimilars presents growth opportunities, potentially enabling premium pricing.

- A dynamic patent landscape influences future market strategies, with opportunities for new entrants and innovation-driven differentiation.

- Stakeholders should monitor regulatory developments and emerging therapies, considering these factors in long-term planning.

FAQs

1. How does patent expiration impact carbidopa pricing?

Patent expirations enable generic manufacturers to produce cost-effective alternatives, sharply reducing prices. This influx of generics drives overall market prices downward unless new formulations or delivery methods introduce premium segments.

2. What are the primary markets for carbidopa?

North America and Europe dominate due to high Parkinson’s prevalence and advanced healthcare systems. However, emerging economies like India and China are experiencing rapid growth due to increasing diagnosis rates and expanding healthcare infrastructure.

3. Are biosimilars a significant factor in the future carbidopa market?

While biosimilars are more prominent in injectable biologics, their potential influence on small-molecule drugs like carbidopa is limited. However, innovative delivery systems (e.g., extended-release formulations) may serve as the competitive differentiators.

4. How might new Parkinson’s treatments affect carbidopa demand?

Emerging therapies with disease-modifying potential could reduce reliance on symptomatic treatments like levodopa-carbidopa combinations, thereby impacting future demand trajectories.

5. What strategies can companies adopt to stay competitive?

Investing in formulation innovations, expanding into emerging markets, and developing combination therapies or novel delivery systems can sustain revenue streams amidst price pressures.

References

[1] Market Research Future. "Global Parkinson’s Disease Therapeutics Market." 2022.

[2] WHO. "Parkinson’s Disease Fact Sheet." 2021.

[3] IQVIA. "Pharmaceutical Pricing and Market Trends." 2022.

[4] U.S. Patent and Trademark Office. "Patent Expirations in Neurodegenerative Disease Therapies." 2021.

[5] OECD. "Pharmaceutical Price Regulation and Market Dynamics." 2022.

This market analysis aims to inform strategic decision-making for pharmaceutical stakeholders, healthcare providers, and investors involved in or considering entry into the carbidopa segment.