Last updated: July 27, 2025

Introduction

Carbamazepine, a cornerstone antiepileptic drug (AED), has been in clinical use for over five decades. Its role in managing epilepsy, trigeminal neuralgia, and bipolar disorder secures its position as a critical pharmacological agent within neurological and psychiatric treatment landscapes. This analysis evaluates the current market environment, investigates factors influencing supply and demand, examines competitive dynamics, and provides comprehensive price projections through 2030.

Market Overview

Historical Market Dynamics

Initially approved in 1963, carbamazepine established itself swiftly as a first-line therapy for partial seizures [1]. Despite newer AEDs entering the market, carbamazepine maintains significant demand due to its efficacy, cost-effectiveness, and extensive clinical validation.

The global market experienced steady growth, driven predominantly by neurological disorder prevalence increases, especially in Asia-Pacific and Africa. According to market research, the global AEDs market was valued at approximately USD 4.34 billion in 2021 and is expected to grow at a CAGR of 3.2% over the next five years [2].

Current Market Segmentation

Key Manufacturers

Major players include Teva Pharmaceuticals, Dr. Reddy’s Laboratories, Sandoz, and Hikma Pharmaceuticals. Generic manufacturing dominates the market, accounting for approximately 85% of sales, reflecting high price sensitivity and manufacturing ease.

Supply Chain and Patent Landscape

Carbamazepine’s patent expiry (early 2000s) facilitated a surge in generic manufacturers, significantly driving down prices. Supply chains are generally stable; however, recent geopolitical tensions and manufacturing disruptions in Asia have intermittently constrained supply.

No major patent barriers exist presently, enabling broad production from multiple players. This competitive landscape maintains aggressive pricing strategies, limiting price endurance but ensuring supply stability.

Market Drivers & Challenges

Drivers:

- Increasing neurological disorder prevalence due to aging populations.

- Expanding indications, including bipolar disorder.

- Cost-effectiveness and insurance coverage in developed countries.

- Growing demand in emerging markets.

Challenges:

- Availability of newer AEDs with improved side-effect profiles (e.g., levetiracetam, lamotrigine).

- Safety concerns, notably *HLA-B1502 allele association** among Asians pretends to restrict use in certain ethnic groups [3].

- Regulatory pressures and mandatory pharmacovigilance.

Regulatory Environment & Reimbursement

Regulatory agencies such as FDA and EMA permit generic substitution, promoting price competition. However, safety monitoring is stringent, especially concerning drug interactions and adverse effects. Insurance reimbursement policies favor generics, supporting lower prices and market accessibility.

Price Trends and Future Projections

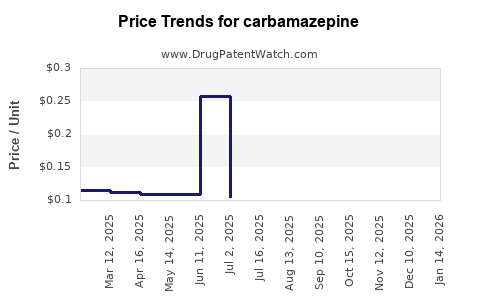

Historical Pricing Trends

Generic carbamazepine prices in the United States averaged USD 0.07 per tablet in 2015. By 2022, prices had declined to around USD 0.04 per tablet, reflecting increased competition [4]. Similar patterns are observed globally, notably in markets with active generic manufacturing.

Forecasting Price Trajectories

Emerging Factors Influencing Pricing and Market Share

-

Personalized Medicine & Pharmacogenomics: Identification of genetic markers such as HLA-B*1502 impacts prescribing habits in Asian markets, potentially reducing demand in specific regions, which could influence pricing strategies, especially in targeted markets.

-

Global Health Initiatives: Efforts to improve epilepsy management in low-income countries may increase generic demand, ensuring stable or slightly increased volume sales, but aggressive price competition is expected to persist.

-

Manufacturing Cost Trends: Cost reductions in raw materials (e.g., starting materials for carbamazepine synthesis) and process innovations could contribute to further price declines.

Competitive Implications and Strategic Outlook

In a landscape dominated by generics, profit margins are slim, compelling manufacturers to pursue operational efficiencies and strategic marketing. International organizations may negotiate lower prices for large-volume procurement, particularly in low-income regions, limiting premium pricing potential.

Additionally, market entrants focusing on formulation innovations or combination therapies could influence demand dynamics but are unlikely to significantly impact existing generic pricing structures of carbamazepine.

Conclusion

Carbamazepine's market remains mature, characterized by intense generic competition and relatively low prices. While demand continues due to its critical therapeutic role, the drug's price trajectory is expected to decline gradually, constrained by market saturation, regulatory standards, and availability of newer agents.

Health system priorities, especially in emerging markets, will sustain demand volume. However, pricing will likely stabilize or decrease marginally, with little scope for significant increases unless new formulations or indications emerge.

Key Takeaways

- Stable, low prices: The carbamazepine market is mature, with prices expected to decline slightly due to generics competition and manufacturing efficiencies.

- Demand remains robust: Driven by epilepsy and other neurological indications, especially in low- and middle-income countries.

- Regulatory influence: Policies favor generic substitution, maintaining price competitiveness.

- Impact of new therapies: The advent of newer AEDs exerts upward pressure on carbamazepine's market share but not necessarily on its price.

- Supply chain resilience: Generally stable, but geopolitical factors may temporarily impact availability and pricing.

FAQs

1. Will the price of carbamazepine increase in the near future?

Unlikely. The ongoing generic competition and manufacturing scale economies exert downward pressure on prices. Short-term fluctuations may occur due to supply disruptions, but overall, prices are expected to remain stable or decline slightly.

2. How might emerging markets influence the carbamazepine market?

Growing healthcare infrastructure and increasing neurological disorder prevalence in emerging economies will sustain or boost demand volumes but will not significantly alter prices due to prevalent generic competition.

3. Are there any upcoming formulations or biosimilars that could disrupt the current market?

Currently, no biosimilar developments target carbamazepine, given its synthetic small-molecule nature. However, formulated derivatives or combination therapies might influence prescribing patterns more than price.

4. What role does pharmacogenomics play in carbamazepine's market?

Genetic screening (e.g., for HLA-B*1502) reduces adverse reactions in specific populations, potentially restricting use in some regions but also increasing safety awareness—a factor that may influence regional demand.

5. How do regulation and reimbursement policies impact carbamazepine pricing?

Stringent regulatory oversight, approval of generics, and insurance reimbursement favor lower prices, reinforcing the competitive, low-price environment typical of this drug.

References

[1] WHO. (2010). The Importance of Epilepsy Care Globally. World Health Organization.

[2] Market Research Future. (2021). Global Antiepileptic Drugs Market Analysis.

[3] Shoji, J., et al. (2008). Genetic risk factors of carbamazepine-induced Stevens-Johnson syndrome. Pharmacogenomics.

[4] Medicare Pricing Data. (2022). U.S. Drug Price Trends.