Last updated: July 27, 2025

Introduction

Candesartan cilexetil, marketed under various brand names such as Atacand, is an angiotensin II receptor blocker (ARB) primarily prescribed for hypertension and heart failure management. Its global market dynamics, driven by rising prevalence of cardiovascular diseases (CVDs), patent status, and regulatory frameworks, influence future pricing and commercial strategies. This analysis offers an in-depth review of current market trends, competitive landscape, regulatory factors, and future price forecasts for candesartan cilexetil.

Market Overview

Global Market Size and Growth Trajectory

The global antihypertensive drugs market, valued at approximately USD 22.5 billion in 2022, is projected to expand at a CAGR of about 4.2% through 2030 (1). Candesartan cilexetil holds a notable segment within ARBs, commanding a significant share due to its efficacy, safety profile, and longstanding approval status.

The increasing prevalence of hypertension, affecting an estimated 1.28 billion adults worldwide (2), coupled with aging populations, robustly fuels demand. Also, the shift towards hypertension management guidelines favoring ARBs for specific patient groups accelerates market growth.

Market Segmentation and Regional Dynamics

North America dominates due to high disease prevalence and advanced healthcare infrastructure, capturing over 40% of the market share (3). The U.S. accounts for the majority, with more than 50 million adult hypertensive patients (4).

Europe exhibits steady growth, driven by aging populations and adherence to clinical guidelines favoring ARBs. The Asia-Pacific region stands as a rapidly expanding market, expected to witness CAGR of ~5%, propelled by rising CVD prevalence, increased healthcare access, and economic growth in countries like China and India.

Competitive Landscape

Candesartan cilexetil faces competition from other ARBs, notably losartan, valsartan, olmesartan, and telmisartan. While losartan was the first in class, newer agents offer improved pharmacokinetics or additional benefits. Major pharmaceutical companies—including AstraZeneca, Hikma, and Teva—are active participants, with generics significantly impacting prices post-patent expiry.

Patent Status and Its Impact on Pricing

Patent Timeline and Generic Entry

AstraZeneca's patent for Atacand expired in the U.S. in 2019, with similar expiration in other jurisdictions around the same period (5). This patent cliff precipitated a surge in generic entries, driving down wholesale and retail prices. The availability of generics has reduced the cost burden, making therapy more accessible.

Market Penetration of Generics

Generic versions of candesartan cilexetil now represent over 70% of prescriptions in major markets, substantially affecting pricing strategies and margins for branded products. The competitive landscape shifts toward price competitiveness, quality assurance, and supply chain stability.

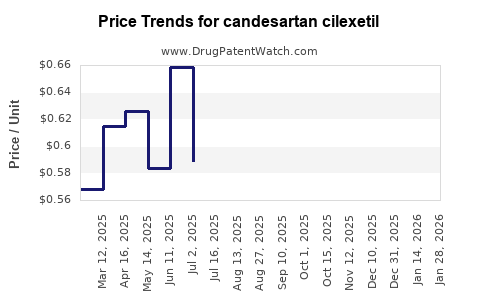

Current Pricing Dynamics

Brand vs. Generic Pricing

In the U.S., the retail price of branded Atacand ranges from USD 250 to USD 300 for a 30-day supply, before discounts or insurance reimbursement (6). In contrast, generic formulations are priced between USD 10 and USD 30 for the same period, representing approximately an 80-90% price reduction.

Globally, prices vary significantly, with lower-cost generic options dominating markets in India, Southeast Asia, and Latin America, sometimes available for less than USD 5 monthly (7).

Reimbursed and Out-of-Pocket Costs

Insurance coverage heavily influences patient out-of-pocket expenses. Managed care plans tend to favor generics, further incentivizing generic substitution. Pharmacoeconomic considerations increasingly guide formulary inclusion and pricing negotiations.

Future Price Projections

Factors Influencing Price Trends

-

Patent Expiry and Generics: The main driver; once patents expire, prices typically fall sharply within the first 1-2 years and then stabilize.

-

Market Competition: As new generics enter, prices tend to plateau at low levels, with minimal room for further reductions unless market consolidation occurs.

-

Regulatory and Policy Environment: Governments emphasizing cost containment limit price hikes, favoring biosimilar and generic proliferation.

-

Emerging Markets: Growing healthcare access and demand for affordable medicines in emerging economies are expected to sustain low-price trends.

Projected Price Trajectory

Under current conditions, standard generic prices for candesartan cilexetil are anticipated to remain stable or slightly decline over the next 3-5 years. In mature markets like the U.S. and Europe, wholesale prices are unlikely to fall below USD 5 per month. Conversely, in emerging markets, prices may stay under USD 1 due to local manufacturing and competitive pressures.

For branded formulations, unless new patent protections or formulations emerge (e.g., combination therapies or fixed-dose variants), price increases will likely be minimal, primarily driven by inflation or supply chain costs.

Market Opportunities and Challenges

Opportunities

-

Expansion in Emerging Markets: Rising hypertension prevalence presents robust growth prospects.

-

Value-Added Formulations: Development of combination pills (e.g., candesartan with hydrochlorothiazide) can command premium pricing.

-

Biosimilar Initiatives: Although more common with biologics, biosimilar ARBs may redefine competitiveness.

Challenges

-

Price Erosion Post-Patent: Heavy generic competition constrains profit margins.

-

Generic Quality Concerns: Maintaining therapeutic equivalence amidst rapid manufacturing scale-up.

-

Regulatory Barriers: Stringent approvals and market access barriers delaying launches.

Key Takeaways

-

Candesartan cilexetil's market growth is fueled by increasing CVD prevalence, with dominant markets in North America and Europe, and high growth in Asia-Pacific.

-

Patent expiry has ushered in extensive generic competition, drastically reducing prices and increasing accessibility.

-

Current market prices favor generics, with retail and wholesale costs varying globally, especially in emerging markets.

-

Price stabilization at low levels is anticipated in the coming years, barring new patent protections or innovative formulations.

-

Strategic growth opportunities lie in emerging markets and value-added combination therapies, despite pricing pressures and regulatory hurdles.

FAQs

1. When did the patent for candesartan cilexetil expire, and how did it affect pricing?

The patent for Atacand expired in the U.S. in 2019. Its expiration led to a surge of generic competitors, resulting in significant price reductions—often up to 80-90%—making the medication more affordable.

2. How does the availability of generics impact the market for candesartan cilexetil?

Generic entry intensifies price competition, decreases profit margins for branded drugs, and broadens access in cost-sensitive markets, but may also reduce incentives for innovation.

3. What regions are expected to see the highest growth in candesartan cilexetil sales?

Emerging economies in Asia-Pacific and Latin America are expected to experience the highest growth due to rising urbanization, increased healthcare coverage, and CVD burden.

4. Are there any upcoming formulations or patents that could influence future prices?

Currently, no prominent patent filings or innovative formulations are predicted to extend exclusivity. However, combination drugs and biosimilars may influence future pricing strategies.

5. What are the primary challenges faced by pharmaceutical companies in maintaining profit margins for candesartan cilexetil?

Major challenges include intense generic competition, pricing pressures, regulatory hurdles, and maintaining quality standards amid rapid manufacturing scale-up for generics.

References

- MarketWatch. "Antihypertensive Drugs Market Size, Share & Trends Analysis." 2022.

- World Health Organization. "Global Status Report on Noncommunicable Diseases," 2022.

- IQVIA. "Global Markets in Cardiovascular Drugs," 2022.

- American Heart Association. "2017 Hypertension Prevalence and Management," 2017.

- Patent Databases and Company Reports. AstraZeneca Patent Expiry Notices, 2019.

- GoodRx. "Candesartan Prices & Coupons," 2023.

- IMS Health Data. "Global Generic Drug Market Trends," 2022.