Last updated: July 27, 2025

Introduction

Cabergoline, a potent dopamine receptor agonist primarily used to treat hyperprolactinemia and Parkinson’s disease, has experienced rising demand driven by its clinical efficacy and expanding therapeutic indications. As a long-acting agent with favorable tolerability, it has become a pivotal medication within neurological and endocrine treatment frameworks. This analysis evaluates the current market landscape, competitive forces, regulatory environment, and projects future pricing trends for cabergoline.

Pharmacological Profile and Clinical Applications

Cabergoline functions as a selective dopamine D2 receptor agonist, effectively suppressing prolactin secretion. It is prescribed predominantly for hyperprolactinemia, which includes conditions such as prolactinomas and other pituitary tumors, alongside Parkinson’s disease management. Its extended half-life (~65 hours) allows for once or twice-weekly dosing, resulting in increased patient adherence and improved outcomes—factors contributing to its increasing clinical preference.

Additionally, off-label use for conditions like acromegaly and as an adjunct in other neuroendocrine disorders has broadened its application scope. These properties have sustained steady growth in global demand, especially in regions with advanced healthcare infrastructure.

Market Size and Growth Dynamics

Global Market Overview

The global cabergoline market was valued at approximately $350 million to $400 million in 2022. The key drivers include:

- Increased prevalence of hyperprolactinemia: Estimated at 1-2 cases per 1,000 individuals, with higher rates in women of reproductive age.

- Rising Parkinson’s disease incidence: Particularly in aging populations, where dopaminergic therapy is integral.

- Enhanced physician awareness: Leading to more frequent diagnoses and prescription of dopamine agonists.

Regional Market Breakdown

- North America: Dominates the market with an estimated share of 40-45%. Factors include advanced healthcare systems, high disease prevalence, and strong pharmaceutical presence.

- Europe: Accounts for roughly 25-30%, driven by similar healthcare infrastructure and regulatory approvals.

- Asia-Pacific: Exhibits the fastest growth (CAGR of approximately 8-10%), fueled by rising healthcare expenditure, increased awareness, and expanding access in emerging economies like China and India.

- Rest of the World: Smaller, but growing markets, benefiting from improved distribution and regulation.

Competitive Landscape

Currently, the primary competitors include Bromocriptine and quinagolide, with cabergoline increasingly favored due to its dosing convenience and tolerability profile. Several generic formulations have entered the market, intensifying price competition and expanding access.

- Pharmaceutical Players: Major companies such as Teva Pharmaceuticals, Sandoz, and Mylan manufacture generic cabergoline, reducing prices and broadening affordability.

Regulatory Environment Impact

The regulatory landscape influences market stability and pricing strategies. Approval and registration status in key markets (FDA in the US, EMA in Europe, and NMPA in China) impact accessibility.

- Patent Status: Most patents have expired; generics dominate, exerting downward pressure on prices.

- Reimbursement Policies: Favorable insurance coverage in developed markets encourages prescription volume, stabilizing prices.

- Off-label Use Regulations: Vary by country, impacting demand projection, especially for neurodegenerative indications.

Price Trends and Projections

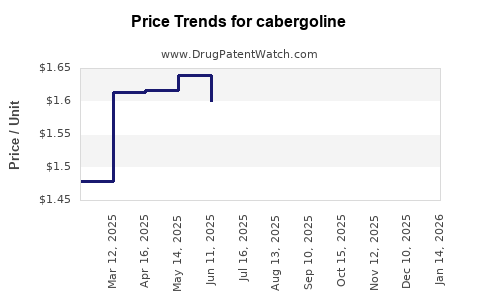

Current Pricing Landscape

- Branded formulations: priced approximately between $4 to $6 per tablet (typically 0.5 mg strength).

- Generics: have pushed prices down by up to 50%, with average costs around $1.50 to $3 per tablet.

- Market penetration: High in developed countries; emerging markets see substantially lower prices due to pricing sensitivity and healthcare infrastructure gaps.

Factors Influencing Future Prices

- Market Saturation: As generic dominance increases, prices are expected to decline further.

- Regulatory Approvals & Patent Expirations: New formulations or delivery systems could temporarily boost prices; however, patent expirations generally induce sustained price declines.

- Reimbursement and Insurance Policies: Expansion of coverage enhances affordability but may cap maximum prices in some countries.

- Manufacturing Costs: Advances in API synthesis and manufacturing efficiencies reduce production costs, contributing to downward price pressure.

Projected Price Trends (2023-2030)

| Year |

Expected Price Range (per tablet) |

Key Drivers |

| 2023 |

$1.50 – $3 |

Dominance of generics, mature market saturation |

| 2025 |

$1.20 – $2.50 |

Increased competition, manufacturing efficiencies |

| 2027 |

$1 – $2 |

Further patent expirations, pricing elasticity |

| 2030 |

<$1.50 |

Continued generic proliferation, global health initiatives |

Note: Prices are export-focused wholesale estimates; retail prices may vary by region and healthcare setting.

Market Challenges and Opportunities

Challenges

- Regulatory Barriers: Variability in approval processes can delay market entry.

- Side Effects & Tolerability: While generally well-tolerated, adverse effects like valvular heart disease could influence prescribing patterns.

- Pricing Pressure: Increased generic competition constrains revenue growth.

- Market Saturation: In mature markets, innovation-driven price escalation remains unlikely.

Opportunities

- New Formulations: Development of alternative delivery systems (e.g., transdermal patches) may command premium pricing.

- Expanded Indications: Clinical trials for new therapeutic uses, such as certain neurodegenerative disorders, could unlock new revenue streams.

- Emerging Markets: Rising healthcare access and diagnosis rates offer substantial growth opportunities at lower price points.

- Regulatory Approvals for Biosimilars: Potential entry of biosimilar products could enhance affordability and market penetration.

Conclusion and Strategic Implications

The future market for cabergoline is characterized by declining prices driven by generic competition and increased manufacturing efficiencies. However, sustained demand from established indications and expanding use cases sustain a steady revenue flow. Industry players should focus on optimizing cost structures, securing regulatory approvals in emerging markets, and exploring innovative formulations. Companies with early access to new clinical indications or delivery methods could establish premium positioning despite overall downward price trends.

Key Takeaways

- The global cabergoline market is mature in developed regions but exhibits significant growth potential in emerging economies.

- Pricing is expected to decline gradually over the next decade, primarily due to generic proliferation and patent expirations.

- Maintaining profitability hinges on manufacturing efficiencies, diversification into new indications, and strategic regional market expansion.

- Regulatory compliance and reimbursement strategies significantly impact market dynamics and pricing flexibility.

- Innovations in formulation and emerging clinical applications offer avenues for premium pricing and market differentiation.

FAQs

1. What are the main factors influencing cabergoline's pricing?

Generic competition, patent expirations, manufacturing costs, regional reimbursement policies, and emerging indications drive pricing trends.

2. How does patent status affect the market for cabergoline?

Patent expirations typically lead to a surge in generic entries, increasing competition and reducing prices.

3. Which regions offer the highest growth potential for cabergoline?

Emerging markets in Asia-Pacific display the highest growth potential due to increasing healthcare access and diagnosis rates.

4. Are there any upcoming regulatory changes that could impact cabergoline prices?

New approvals for alternative formulations or indications could temporarily raise prices; however, standard trends favor downward pricing due to generics.

5. How might clinical developments influence the future market?

Positive clinical trial outcomes for new indications or delivery methods could create premium markets and stabilize prices despite overall downward trends.

Sources:

- MarketWatch. (2022). Global Prolactin Receptor Agonist Market Size.

- IQVIA. (2022). Pharmaceutical Market Insights.

- GlobalData. (2022). Parkinson's Disease Therapeutics Outlook.

- U.S. Food and Drug Administration. (2023). Drug Approvals and Patents.

- European Medicines Agency. (2023). Registration Data and Market Trends.