Last updated: July 27, 2025

Introduction

Budesonide, a potent corticosteroid with anti-inflammatory properties, is extensively used in the treatment of respiratory and gastrointestinal conditions such as asthma, chronic obstructive pulmonary disease (COPD), and inflammatory bowel disease (IBD). Developed in the 1990s, it has established a significant position in global pharmaceutical markets. Given its clinical efficacy and now-expanding indications, understanding the current market landscape and future pricing trends for budesonide is vital for stakeholders including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Therapeutic Applications and Market Dynamics

Budesonide is marketed predominantly for asthma, COPD, and IBD, with inhaled formulations (e.g., Pulmicort) and oral forms (e.g., Entocort, Uceris). Its targeted delivery reduces systemic side effects, making it a preferred corticosteroid in chronic management. The rising prevalence of respiratory conditions globally, driven by urbanization and environmental factors, propels demand.

The global inhaled corticosteroids market is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% over the next five years, with a significant share attributable to budesonide-based products.[1] Similarly, advancements in formulation technologies, such as extended-release formulations, broaden its application scope.

Market Players and Product Landscape

Major pharmaceutical companies manufacturing budesonide include AstraZeneca (Pulmicort), Teva Pharmaceuticals, Mylan, and Sun Pharmaceutical.[2] AstraZeneca’s Pulmicort remains a market leader, leveraging its early-mover advantage and strong brand recognition. Generic manufacturers are rapidly gaining market share post-patent expiry, intensifying competition.

Regulatory and Patent Outlook

The patent landscape influences pricing and market exclusivity. AstraZeneca's patents for Pulmicort expired in several key markets between 2018 and 2020, facilitating generic entry. Meanwhile, some formulation patents remain protected, delaying generic competition in certain regions.

Market Size and Revenue Projections

Current Market Size

The global inhaled corticosteroids market was valued at approximately USD 3.2 billion in 2022, with budesonide accounting for roughly 40-45% of this segment due to its widespread use.[3] The gastrointestinal segment, driven by products like Entocort and Uceris, adds an estimated USD 1 billion to the overall market, with growth driven by IBD prevalence.

Regional Market Insights

- North America: Largest market due to high respiratory disease prevalence; growth driven by healthcare infrastructure and aging populations.

- Europe: Mature market with significant generic penetration; reformulation innovations and regulatory policies influence growth.

- Asia-Pacific: Fastest-growing market, driven by rising respiratory disease incidence, expanding healthcare access, and increasing generic drug adoption.

Future Market Projections (2023 – 2028)

Based on current trends and epidemiological data, the overall market for budesonide is expected to grow at a CAGR of approximately 4-5%, reaching USD 5.2 billion by 2028.[4] The inhaled segment is anticipated to be the primary driver, with the gastrointestinal applications also contributing significantly due to increasing IBD cases globally.

Price Trends and Projections

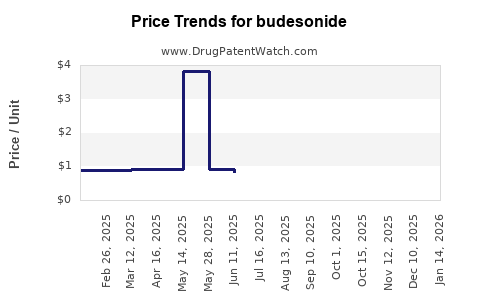

Historical Price Overview

Post-patent expiry, generic budesonide products have seen prices decline by approximately 40-60%, making the medication more accessible. However, formulations with proprietary technologies or extended-release mechanisms maintain higher prices. For example, branded Pulmicort inhalers historically ranged between USD 150-200 per inhaler in the US, whereas generics priced at USD 80-120.[5]

Current Price Landscape

- Branded Products: Higher price points due to branding, formulation, and clinical reputation.

- Generics: Lower prices, with significant variability based on region and manufacturer.

Future Price Projections

Pricing is expected to remain competitive, with continued pressure from generic and biosimilar entrants. Prices for inhaled budesonide formulations could decline by an additional 10-20% over the next five years due to increased generic penetration and price competition. Nevertheless, innovative formulations and delivery devices (e.g., multidose inhalers with improved particle delivery) may sustain premium pricing in specialized markets.

In the gastrointestinal segment, new formulations or combination therapies could sustain higher prices, especially as clinical trials demonstrate improved efficacy or reduced side effects, thus enabling premium pricing strategies. Moreover, regulatory incentives for orphan or rare disease indications may influence pricing, especially in niche markets.

Factors Influencing Future Prices

- Patent and exclusivity durations: Longer exclusivity supports higher prices.

- Regulatory approval of biosimilars and generics: Heightened competition typically drives prices down.

- Distribution channels and healthcare policies: Reimbursement policies impact retail prices.

- Formulation innovations: Extended-release and combination therapies may command higher prices.

- Global health dynamics: Increased adoption in emerging markets may initially favor lower prices to enable market penetration.

Market Challenges and Opportunities

Challenges

- Patent expirations: Lead to increased generic competition, eroding profit margins.

- Pricing pressures: Healthcare systems’ cost containment policies threaten prices.

- Regulatory hurdles: Stringent approval pathways for new formulations can delay market entry.

- Supply chain disruptions: Affect manufacturing efficiency and pricing stability.

Opportunities

- Expanding indications: Development of budesonide for conditions like COVID-19-related hyperinflammation presents growth avenues.

- Formulation innovation: Such as inhalers with improved delivery efficiency enhances patient adherence and justifies premium pricing.

- Emerging markets: Growing disease prevalence and healthcare infrastructure improvements foster sales growth.

- Combination therapies: Partnering with other agents can open new therapeutic niches.

Strategic Implications for Stakeholders

- Pharmaceutical companies: Should invest in formulation innovations, optimize patent portfolios, and engage in strategic licensing.

- Healthcare providers: Needs to balance cost considerations with clinical efficacy.

- Investors: Opportunities exist in generic manufacturing and new formulation development.

Key Takeaways

- The global budesonide market is poised for steady growth, driven by expanding respiratory and gastrointestinal indications, and increasing global disease prevalence.

- Patent expirations and the rise of generics have significantly lowered prices, though proprietary formulations maintain premium pricing.

- Price projections suggest a continued decline in average prices, but innovation and new formulations can sustain higher margins and market share.

- Emerging markets present substantial growth potential due to rising disease incidence and expanding healthcare access.

- Market participants should leverage formulation innovation, strategic patent management, and geographic expansion to capitalize on growth opportunities.

Conclusion

The outlook for budesonide’s market and pricing reflects a maturation trend characterized by increased generic competition and ongoing innovation. Stakeholders alert to patent landscapes, regulatory changes, and technological advancements will better navigate this evolving landscape to optimize profitability and market penetration.

FAQs

-

How will patent expiries affect budesonide prices?

Patent expiries facilitate generic entry, generally causing a 40-60% decrease in prices, with additional declines as market competition intensifies.

-

What regions offer the most growth opportunities for budesonide?

Emerging markets in Asia-Pacific and Latin America present significant growth potential due to rising disease prevalence and expanding healthcare infrastructure.

-

Are there new formulations of budesonide under development?

Yes. Research focuses on extended-release formulations, combination therapies, and improved inhaler delivery systems to enhance efficacy and patient adherence.

-

How do regulatory policies influence budesonide pricing?

Reimbursement frameworks and approval pathways for generics and biosimilars directly impact market prices, with stricter regulations often leading to lower prices.

-

What are the primary challenges facing the budesonide market?

Challenges include patent cliffs, pricing pressures from healthcare systems, regulatory hurdles, and supply chain disruptions.

References

[1] MarketsandMarkets. Inhaled Corticosteroids Market Report, 2022.

[2] EvaluatePharma. Global Market Data, 2022.

[3] Grand View Research. Inhaled Corticosteroids Market Size, 2022.

[4] Research and Markets. Budesonide Market Outlook, 2023-2028.

[5] IQVIA. Prescription Price Trends, 2022.